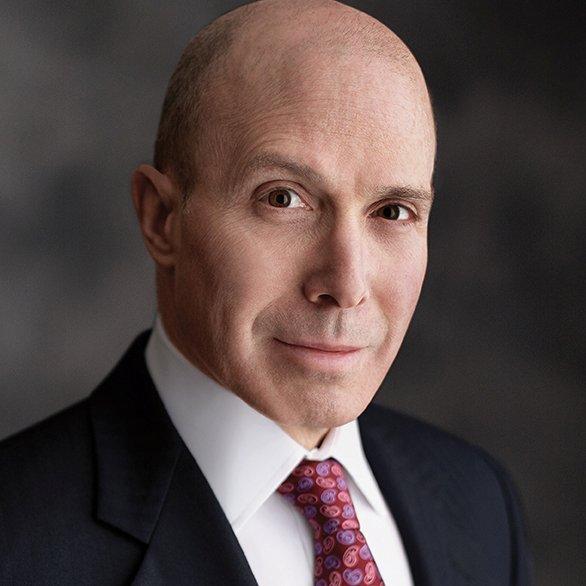

Ace Ltd. Chief Executive Officer Evan Greenberg said it would be a mistake to start celebrating his agreement to buy Chubb Corp. for more than $28 billion, because the real test will be to integrate the insurers.

“That execution takes time and, you know, when you run the cycle, it takes you two years to get all of the mop-up done,” Greenberg told analysts in a conference call Wednesday. “You have to be relentless. You can’t lose your focus.”

Greenberg is seeking to keep the loyalty of customers and insurance brokers while retaining the best employees after promising investors that the deal will help cut costs. He acknowledged the cultural differences between his insurer, which began in Bermuda in the 1980s, and Warren, New Jersey-based Chubb, which traces its roots to the 1880s.

He said in July that a gathering of executives from the two companies began like an event for teenagers in which boys and girls separated to opposite sides of the room. It then became more cohesive once alcohol was served, he said. Wednesday he said he was encouraged by the prospects that staff will get along once the deal is completed, which is scheduled to happen next year.

“Each one of us comes to the table and has sniffed the other one out,” he said, citing a culture of underwriting discipline at both companies. “I think we find that the similarities are gratifying.”

Greenberg, 60, has also purchased businesses in Brazil, Thailand and Mexico in recent years and expanded into niches like U.S. crop insurance. He said Wednesday that integrating other companies requires a long-term commitment.

“It’s a long march,” he said. “And you’ve got to lead them from the beginning ’til the very end.”

Ace climbed 2.3 percent to $113.58 at 4 p.m. in New York. The Zurich-based company has slipped about 1.1 percent this year, beating the 5.5 percent drop of the Bloomberg World Insurance Index.

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit