Earlier this month, AM Best provided its initial tally of year-to-date financial results for U.S. property/casualty insurers, reporting a $34.9 billion net underwriting gain through the first nine months of 2025.

According to Best’s Special Report, titled, “First Look: Nine-Month 2025 US Property/Casualty Financial Results,” the result is a big improvement from a roughly $3.7 billion underwriting profit for the first nine-months of 2024.

Like an earlier report from Fitch Ratings, AM Best tallied an aggregate combined ratio of 94.0 through the first three quarters of 2025, and net written premium growth of just over 5 percent.

Related article: What to Expect in 2026: U.S. P/C Results More Like 2024

“A 7 percent increase in net premiums earned was aided by muted catastrophe losses during the third quarter of 2025, resulting in incurred losses and loss adjustment expenses (LAE) remaining relatively flat with the prior-year nine-month period,” AM Best said in its report.

AM Best estimates that catastrophe losses accounted for 8.0 points on the nine-month 2025 combined ratio, down from an estimated 8.7 points in the prior year.

Both AM Best and Fitch estimate that $18.0 billion of favorable loss reserve development factored into the 2025 industry results.

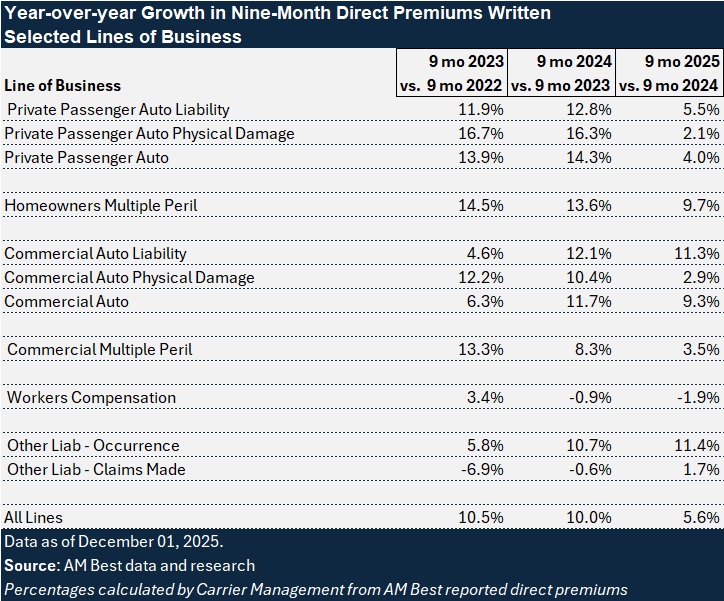

Along with tables showing loss ratio and expense ratio contributions to the combined ratio improvement (which came mostly from the loss ratio decline), as well as investment and other income contributors to a 6.8 percent jump in surplus and to an an overall decline in net income, the AM Best report also includes a line-by-line summary of nine-month direct written premiums for 2025 and the comparable periods in 2022, 2023, and 2024.

Below, Carrier Management has excerpted some of the information from the direct written premium report, revealing changes in premium growth for a handful of major lines.

Among the select lines, only commercial auto liability and other liability-occurrence direct premiums remained in double-digit-growth territory for the first nine months of 2025. In contrast, private passenger auto liability growth came in at 5.5 percent, dropping from double-digit nine-month growth rates that were twice as high in 2024 and 2023. Auto physical damage growth is down to between 2 and 3 percent for personal and commercial vehicles, while commercial multiple peril growth collapsed to 3.5 percent.

Overall, the report shows direct premium growth of 5.6 percent for the first nine months of 2025 compared to the first nine months of 2024. Last year’s comparable growth rate was 10 percent.

Returning to net results, AM Best reported that a 5.9 percent increase in net investment income, together with the nine-month 2025 underwriting gain, boosted pretax operating income by 52 percent to $102.4 billion for the first nine months of 2025.

Net income was $100.9 billion, declining 23 percent from $131.5 billion for the first nine months of 2024. AM Best attributed the decline to an 80 percent reduction in net realized capital gains, driven primarily by a combined $60.5 billion decline at three Berkshire Hathaway companies.

Industry surplus increased 6.8 percent from the end of 2024 to $1.2 trillion.

The data in the AM Best report are based nine-month 2025 interim period statutory statement received as of Dec. 1, 2025. These companies account for an roughly 98 percent of total industry net premiums written and 98 percent of policyholder surplus.

The Future of HR Is AI

The Future of HR Is AI  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits