Notable announcements on insurance company financial strength ratings last week included AM Best’s upgrade of Crum & Forster Insurance Group, and various rating agency announcements about a potential post-deal upgrade for Aspen Group.

***

Crum & Forster Upgraded

AM Best has upgraded the financial strength rating of the members of Crum & Forster Insurance Group to “A+” (superior) from “A” (excellent). Best also upgraded the group’s long-term issuer credit ratings to “aa-” (superior) from “a+” (excellent). The outlook of the ratings is stable.

A key driver of the action is improvement in the group’s business profile assessment, the rating announcement said, noting that C&F “has enhanced its scale and diversification materially in recent years through organic growth.”

“Throughout this growth stage, the group has maintained solid underwriting performance measures with reducing volatility in most recent years.”

C&F is a collection of specialty operations that wrote $5.7 billion of gross premiums in 2024 with a combined ratio of 95.0 (IFRS 4). Through the first six months of 2025, C&F’s gross written premiums grew 6.0 percent to $2.9 billion, and its combined ratio landed at 86.9, according to a financial report from C&F’s ultimate parent, Fairfax Financial Holdings Limited.

Related article: How a Decentralized Structure Opens Career Paths at C&F

In addition to the favorable business profile, Best said C&F’s ratings also further reflect implicit and explicit support provided by Fairfax. AM Best also assesses the balance sheet strength of C&F as very strong and enterprise risk management as appropriate.

Concurrently, AM Best has affirmed the FSR of “A” (excellent) and the Long-Term ICR of “a+” (excellent) of Monitor Life Insurance Company of New York. Among other factors, the ratings reflect the financial support and strategic importance to its parent, United States Fire Insurance Company, part of C&F.

Moody’s, AM Best, S&P Reviewing Aspen

Following last week’s announcement by Sompo Holdings, Inc. that a wholly owned subsidiary of Sompo International Holdings Ltd. entered into a definitive merger agreement to acquire Aspen Insurance Holdings, Limited for $3.5 billion, Moody’s Ratings placed the A3 insurance financial strength ratings of Aspen’s main insurance operating entities—Aspen Bermuda Limited and Aspen Insurance UK Limited—on review for upgrade.

Related Article: Sompo to Acquire Aspen for $3.5 Billion to Expand Global Access

Moody’s also put the Baa2 senior unsecured debt rating of Aspen Insurance Holdings Limited, the top holding company of Aspen Group on review for upgrade.

Moody’s said the review for upgrade reflects its expectation that Aspen’s credit profile will benefit from the proposed ownership by Sompo and its integration into Sompo International, as Sompo executes its strategy to expand its operations outside of Japan.

Moody’s expects to conclude its review when the proposed acquisition is completed, assessing the extent to which Aspen will be integrated into Sompo International, its strategic importance to Sompo and its expectation of support that could result in uplift to Aspen’s standalone ratings. If the deal is completed, and there is sufficient evidence of both its strategic importance and Sompo’s support, the rating could be upgraded.

In its announcement, Moody’s pointed to the strategic benefits of additional scale and market presence in the global specialty insurance and reinsurance markets that Sompo gains from Aspen, noting that Aspen wrote $4.6 billion of gross premiums in 2024. Added to Sompo International’s business, the combination would create a specialty insurance and reinsurance group with more than $21 billion of gross premiums written on a pro-forma basis, and a top 10 position by premium volume in global reinsurance. Aspen also brings a strong position in the Lloyd’s market and Aspen Capital Markets, one of the leading third-party capital platforms, with nearly $2.2 billion of assets under management, Moody’s said.

On its own, Aspen’s current A3 IFSRs reflect the group’s resilient franchise and good market position, supported by its growing alternative reinsurance capital management platform, a geographically diverse portfolio in both insurance and reinsurance, a conservative investment portfolio, and robust regulatory capital which. After having undergone a multi-year transformation program, Aspen’s capital position is now less sensitive to catastrophe losses and inflationary trends, Moody’s said, noting, however, that growing exposure to long-tail insurance lines tempers that strength.

Separately, AM Best put financial strength ratings of “A” (excellent) for several Aspen insurance operations and the “A+” (superior) financial strength ratings of Sompo Japan Insurance Inc. and its subsidiaries under review with positive implications.

AM Best’s announcement about Aspen Insurance UK Limited, Aspen Bermuda Limited, Aspen American Insurance Company and Aspen Specialty Insurance Company also referred to the long-term issuer credit ratings of “a” for the insurers, and the long-term ICR of “bbb” (good) of Aspen Insurance Holdings Limited.

Best said that the “under review with positive implications” status reflects the potential financial and operation benefits that Aspen may derive from being part of a significantly larger insurance organization with greater financial strength.

As for the “A+” FSR and “aa-” long-term ICR of the Sompo Japan insurers, and the long-term ICR of “a-” (excellent) of Sompo International Holdings Ltd., AM Best, like Moody’s, said its review anticipates potential material benefits in Sompo group’s business profile following the acquisition of Aspen—more geographic diversification and greater presence in the global property/casualty insurance and reinsurance markets, owing to Aspen’s diversified underwriting portfolio and expertise in specialty lines.

Separately, two days after the deal announcement, S&P Global Ratings published a statement about Sompo Holdings group, which did not constitute a rating action, stating its belief that Sompo can absorb the financial burden of buying out Aspen Insurance and still maintain a very strong capitalization.

“Despite the associated financial burden, we assess that the group will be able to maintain capital at a level above the 99.95 percent confidence level of our capital model,” S&P said, adding that the group can further strengthen its capital by accumulating profits and reducing risk through the sale of strategic equity holdings. “We also believe that the Sompo group’s financial leverage is relatively low, and we see no factors that may hamper debt repayment following the acquisition,” the S&P Global Rating statement said.

S&P also said that it believes the Sompo group’s willingness to make further strategic investments is high. In fact, the group will need to make “further outlays of this kind” to achieve medium-term growth targets,” S&P’s statement on Sompo said.

Like the other rating agencies, S&P also took note of the potential for the Aspen deal to strengthen Sompo’s competitiveness by expanding the scale and scope of its overseas insurance business, including Lloyd’s business and Aspen Capital Markets. In addition, S&P noted the prospect of improved operational efficiency through integration of Aspen with Sompo International Holding Ltd., the group’s subsidiary responsible for overseas operations

S&P’s current rating for Sompo Japan Insurance Inc. is “A+” with a stable outlook.

Yesterday, S&P put the “A-” financial strength ratings and issuer credit ratings of Aspen’s core subsidiaries on CreditWatch Positive, reflect the possibility that ratings could go up by at least one notch.

Aspen could benefit from potential support from a higher-rated group once the deal is done, but “it is still too early to comment on how Aspen will be integrated into Sompo considering the limited information at this stage,” S&P said. While it is known that the acquisition will be conducted through Sompo International Holdings Ltd., “at this stage it is not clear how Aspen’s entities will be integrated into the group apart from plans to achieve about $200 million of cost and capital synergies by 2030,” S&P said.

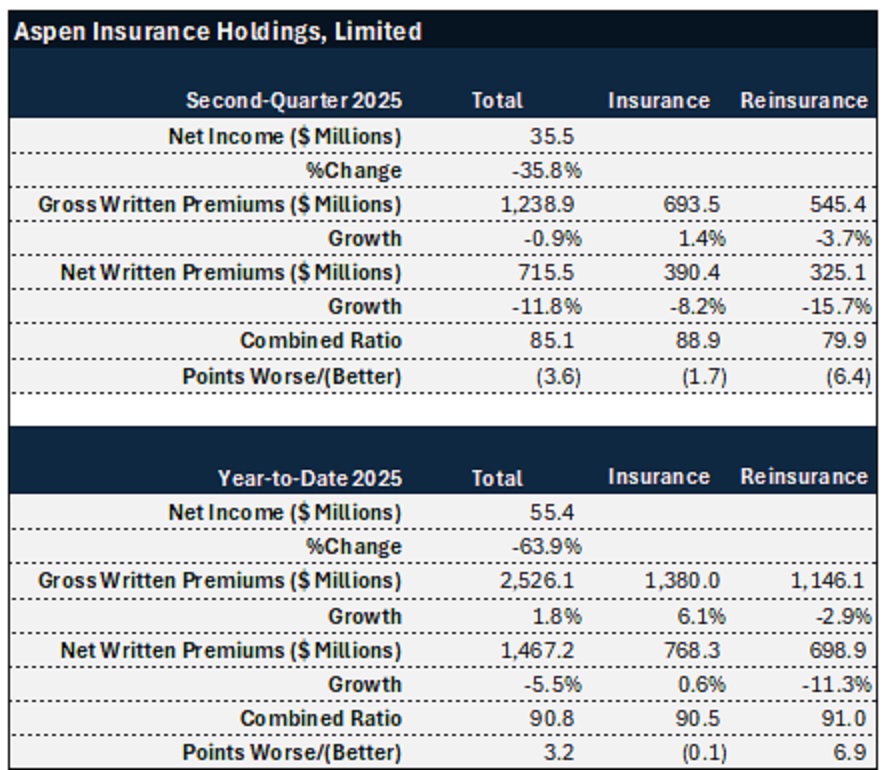

S&P made note of the fact that Aspen continued to report solid underwriting performance in first-half 2025, with a net combined ratio of 90.8 (reported), despite incurring losses from California wildfires in the first quarter of 2025.

The CreditWatch also applies to S&P’s “BBB” long-term issuer credit rating on Aspen Insurance Holdings, and its issue ratings on the holding company’s senior debt and preference shares.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  The Future of HR Is AI

The Future of HR Is AI  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best