According to an analysis of rate filings “disposed” by state regulators— approved or allowed by regulation—in second-quarter 2024, Liberty Mutual had the highest number of rate hikes approved in the quarter.

The analysis from S&P Global Market Intelligence puts the sum of calculated premium changes for Liberty Mutual’s 117 increases at more than $600 million.

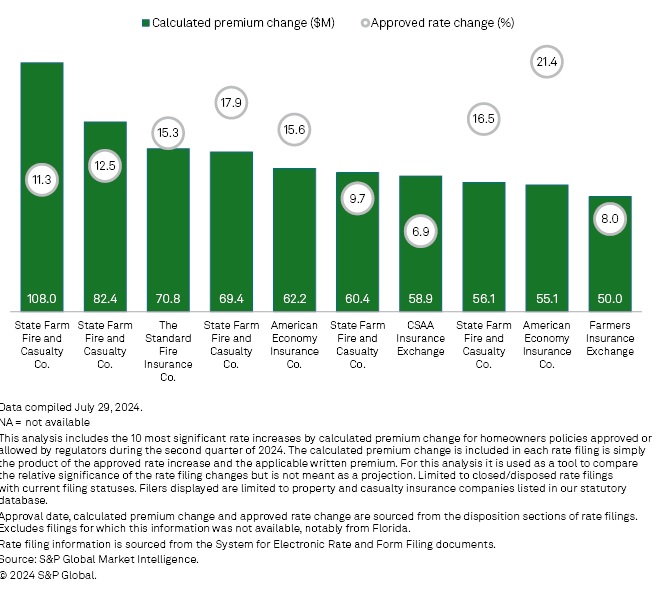

Ranking filers by the calculated dollar amounts of premium change associated with approved percentage changes, State Farm had the biggest—$108 million associated with an 11.3 percent rate increase in Minnesota impacting 600,000 policyholders. According to S&P GMI, the nation’s largest insurer, State Farm—or, in particular, the group’s State Farm Fire and Casualty Co. subsidiary—had five of the 10 biggest increases based on the calculated premium impact. The other notable State Farm changes impacted policyholders in Missouri (12.5 percent), Washington (17.9 percent), Oklahoma (9.7 percent) and Arizona (16.5 percent)

Also listed among the top 10 based on calculated premium impact, Travelers (The Standard Fire and Casualty Co.), CSAA Insurance Exchange, and Farmers Insurance raised rates in California, with Travelers recording the largest change —15.3 percent with an associated calculated premium change of $70.8 million.

Importantly, footnotes on the charts in the S&P GMI report that display the rankings by calculated premium change and by approved percentage rate change indicate that these two figures are sourced from the disposition sections of rate filings, and that this information is not available for the state of Florida. The analysis, therefore, does not include any information from Florida filings or other states that don’t have this information.

On a percentage rate change basis, American Modern Property & Casualty Insurance Co., a subsidiary of Munich Re, had the largest rate change of the second quarter—56.4 percent impacting 17,000 California policyholders—among the subset of filings reviewed by S&P GMI.

According to the report, “State Farm secures significant homeowners rate increases in Q2 2024,” a number of homeowners insurers received rate increases of 25 percent or more on books of business exceeding $20 million in the quarter. Again, Liberty Mutual led the pack, with six such approvals.

About the S&P GMI Analysis

All figures listed are based on as-reported numbers filed in the rate filings of each subsidiary in each state. The calculated premium change included in filings is simply the product of the approved rate change and applicable premium written. It is not a final projection of the additional premium the insurer may receive in the upcoming year. Changes to the insurer’s policy mix or policies in force are not factored in.

U.S. states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use as well as use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are “disposed” by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.

A link to the full analysis can be found here: State Farm secures significant homeowners rate increases in Q2 2024 | S&P Global Market Intelligence (spglobal.com)

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb