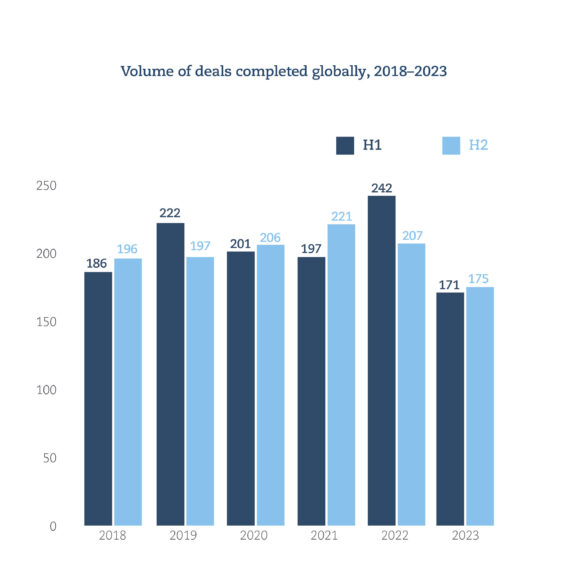

The number of worldwide mergers and acquisitions in the insurance sector in 2023 dropped to 346 in 2023, down from 449 in the previous year, according to a new report from Clyde & Co.

But the global law firm believes “deal activity has reached the bottom of this current cycle and will start to increase through 2024, with Europe leading the way.”

Recapping 2023

According to Clyde & Co.’s Insurance Growth Report, year-on-year activity between 2022 and 2023 was down worldwide. Each of the four regions dropped between 37.5 percent (Middle East and Africa) and 13.3 percent (Asia Pacific).

“As the global economy continues to feel the impacts of high inflation, funding for transactions for many insurance businesses has been challenging to find,” said Peter Hodgins, a Clyde & Co partner in Dubai, in a press release. “Meanwhile, with over half of the global population expected to be called to the polls in 2024, as well as a number of escalating regional conflicts, heightened geopolitical risks have become a persistent concern. In the face of this market uncertainty, deal-makers have remained in wait-and-see mode, with a negative impact on overall transaction volume in 2023.”

The Americas remained the most active region for M&A in 2023, but the gap between the Americas and Europe narrowed significantly — down to just 55 deals from 106 in 2022. Clyde & Co reports that “the downward trend exhibited by Europe and the Americas in the first half of the year was reversed in the second half, as the number of deals increased.”

Europe led the revival with a 22.9 percent increase; deals in the Americas increased by 5.1 percent. Meanwhile, the opposite was true for the Asia Pacific and Middle East and Africa regions, which saw 20.7 percent and 33.3 percent decreases in activity in the final six months of 2023.

M&A Outlook

Clyde & Co reports that in the United States, larger broking players are looking to make acquisitions in both the MGA and broking spaces, while cross-border transactions by intermediaries are also on the move. Elsewhere, international interest in the GCC region is returning, with international brokers looking to acquire businesses in the UAE and Saudi Arabia.

“With financial markets potentially looking more volatile this year, growth in carriers’ investment portfolios is by no means certain,” Hodgins said. “Continuing high interest rates will also impact the cost of debt funding for acquisitions and contribute to increased claims costs and higher operational costs. However, in the face of macroeconomic and geopolitical uncertainty, insurers are increasingly viewing the current trading environment as ‘the new normal,’ and we expect them to become less cautious with regards to M&A over the coming 12 months.”

Eva-Maria Barbosa, a Clyde & Co Partner in Munich, said that M&A activity is coming back to the European insurance market as leading global carriers look to acquire specific business lines, particularly those high-volume but relatively low premium contracts that can be sold as embedded or affinity products.

“Companies finding it challenging to achieve healthy margins on commercial business are looking for reliable cash flow in the personal lines space,” she explained.

Trends to Watch

As insurance businesses continue to pursue alternatives to growth beyond a merger or acquisition, the revolution in digital assets and the use of cryptocurrencies present a significant opportunity for insurers, with a range of coverages already being written to cover the risks of trading in digital assets, Clyde & Co reported.

“Digital assets are on a very fast trajectory globally, and we’re seeing great demand for them and the underlying technology,” said Liam Hennessy, Clyde & Co partner, Brisbane. “On the commercial side, it presents a massive opportunity, and some major Lloyd’s insurers are starting to underwrite D&O, corporate crime, and professional indemnity risks on behalf of asset managers who are advising clients on diversifying their portfolios with exposure to this asset class. Even more exciting, we are seeing insurers adopt blockchain technology in their own businesses, for example, in loyalty programs, information storage and parametric smart contracts for simple claims.”

Hodgins also shared that while geopolitical risks may cause insurance businesses to either rein in expansion plans or pull back from lines of business or territories impacted by conflict, there is “an important role to be played by insurers as businesses get to grips with evolving geopolitical risks. The Middle East has already seen significant events such as the Israel-Hamas conflict and tensions around the Red Sea driving up demand for cover of political risks and products like trade credit insurance as clients’ exposure increases.”

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation