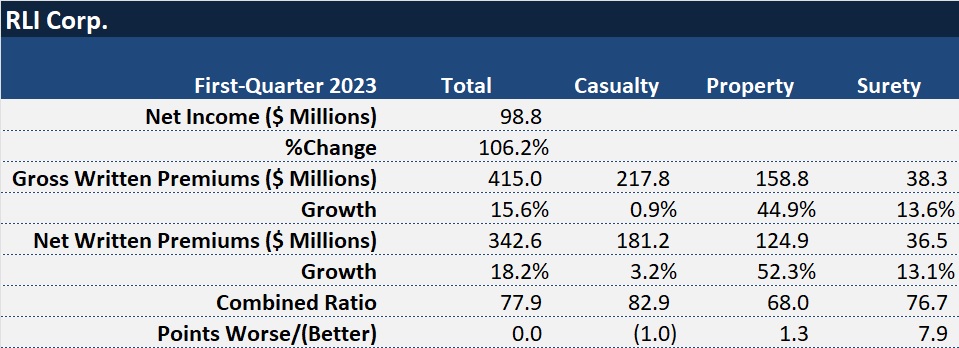

As property/casualty insurers preannounce catastrophe loss estimates that will dent first-quarter 2023 bottom lines almost daily, RLI Corp. reported a 68 property combined ratio with a 50 percent jump in property premiums.

Overall net income more than doubled.

The specialty insurance company whose tagline is “Different Works” also reported a 77.9 first-quarter 2023 combined ratio for the company overall yesterday—the same figure it posted in first-quarter 2022.

While that’s very different from overall combined ratios being reported by industry peers, the near-80 combined ratio in the first-quarter for RLI continues a string of consistent profits for the company, coming after a full-year 2022 result of 84.4 that marked a run of 27 straight years of underwriting profits.

Chief Operating Officer Jen Klobnak cited geographic differences that set RLI’s first-quarter property results apart from other carriers during an earnings conference call, with RLI’s book concentrated in the Southeast, California and Texas avoiding events in the Midwest and Northeast during the quarter. Looking at the complete picture of property, casualty and surety results, Klobnak, Chief Executive Officer Craig Kliethermes and Chief Financial Officer Todd Bryant talked about discipline and strategy and product diversity, with Kliethermes giving some colorful analogies to highlight those ideas.

“RLI believes in ‘the marshmallow test,'” he said, referring to famous social experiment in delayed gratification involving children and marshmallows. “We have the resolve to be a stable market with a consistent risk appetite through all market cycles,” the CEO said.

Later, he drew a different analogy to a famed boxer known for quick reflexes, resilience and defensive strategies. “We can be patient when required, but like the Boxer Archie Moore, we also have the proven ability to adapt and counterpunch with speed and skill,” Kliethermes said, referring to worlds longest reigning light heavyweight boxing champion. “The speed is derived from our consistent underwriting approach and strong balance sheet, which gives us the confidence to execute amid market uncertainty,” he said.

“We will continue to remain vigilant around opportunities and risks as we navigate the uncertainty and disruptions in the market,” Kliethermes said, speaking generally of disruptions in cat-exposed lines.

Klobnak provided more specifics on market conditions and areas where RLI is punching forward, such as property in the Southeast and in the personal umbrella line of business. She also described areas where the carrier bobbing and weaving away from potential trouble—exiting energy excess liability market, reducing participation on a quota share reinsurance treaty for Prime Insurance Company, and exercising caution in the public D&O market where 20 new competitors (carriers and MGAs) are crowding the market.

“We have not seen new capacity in the Florida market in quite some time, and competitors continue to manage their limits closely, which creates space for multiple carriers to participate on a risk…”

Jen Klobnak, RLI Corp.

Describing the Southeast property market, Klobnak said that “hurricane rates were up 47 percent for the quarter, which continues a string of quarterly double-digit rate increases going back to fourth-quarter 2019.”

“With rate a primary driver of premium, exposure growth has been limited. We have not seen new capacity in the Florida market in quite some time and competitors continue to manage their limits closely, which creates space for multiple carriers to participate on a risk including RLI,” she said.

While RLI’s total property premium soared 45 percent, casualty growth was flat overall. “Producing consistent profitable results stems from a willingness to pare back underperforming portions of our portfolio when needed or rebalance products to better align with our appetite,” she said.

As for public D&O, Klobnak reported a broker tally of the 20 newcomers to the market over the last months. “We believe these new entrants are late to the party and are providing brokers with more mouths to feed,” she said, noting that premium for RLI’s Executive Products Group dropped 14 percent in the quarter. “We experienced 5 percent rate decreases, but we’re able to achieve growth outside of public D&O,” she reported.

Speaking more generally, Kliethermes agreed that “rates continue to be up with even greater momentum for wind and earthquake exposures.”

“We are finding that although competition is tougher in many of our liability and surety businesses, there seems to be some reluctance for the markets to behave too irrationally,” he added, attributing the continued rationality to the fact that “reinsurers are doing a better job passing along their costs to the primary market, and creating general concern over the availability and price tag of their capacity.”

“We appreciate smart competitors and discerning capacity,” he said. “We prefer to compete in markets where measured risk-taking and discipline are more pervasive.”

During the question and answer part of the call, an analyst asked Klobnak to try explain RLI’s relative success in the property segment, where competitors are reporting high levels of catastrophe losses, wondering whether she could quantify the impacts of changes in terms and conditions, limits or deductibles in past years.

“That’s a good question. And I asked that question myself in the last week because I keep seeing these preannouncements, and I’m saying, ‘What is our impact?'”

Klobnak confirmed RLI’s concentration in Florida, Texas and California. In addition, “about 10 years ago or so, we were a little larger in the habitation space in our E&S property portfolio. We experienced a fair amount of tornado and hail losses back in the day…..We reduced our participation there because frankly we couldn’t get the terms and conditions we needed,’ she said.

Across the property book, Bryant reported that while storm losses added four points to the property segment’s loss ratio versus three points last year, attritional losses remained low and were spread across a much higher revenue base.

Adding to RLI’s bright earnings picture for the quarter, investment income advanced 51.5 percent to $27.1 million, boosting operating earnings to $75.0 million—24.1 percent above first-quarter 2022.

Realized gains were roughly $15 million, bringing overall first-quarter 2023 net income to $98.8 million, more than double the level for first-quarter 2022.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits