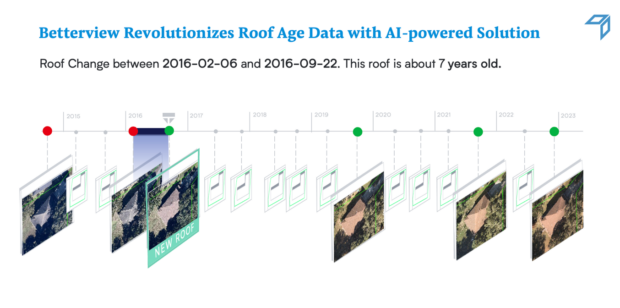

California-based insurtech and property intelligence company, Betterview, announced new technology that uses artificial intelligence (AI) and computer vision to analyze high resolution aerial imagery to precisely determine roof age.

Property insurers typically rely on outdated data when estimating roof age.

It’s estimated that $1 billion in premium leakage every year occurs as a result of inaccurate roof age data. Older roofs may be linked to a variety of risk factors including structural failures, damage from hazards like wind and hail, as well as a higher likelihood of a complete collapse.

“Traditional roof age estimates tend to come from two sources,” says Jason Janofsky, chief technology officer at Betterview. “The first is homeowner-supplied roof age (HOSRA), which is generally underestimated by five to even fifteen years. The other source is permit data, which again gives an incomplete and outdated picture of roof age. Insurers need a reliable source and we decided there needed to be a better way.”

Combining property insights, such as roof conditions and peril scores, with AI boosts property intelligence, according to Betterview co-founder and chief operations officer Dave Tobias.

“Roof age has a huge impact on potential future losses,” he added.

The technology supplements data and processes insurers already use to evaluate roof age to improve risk selection and pricing, while reducing premium leakage and potential future losses.

Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says

Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next