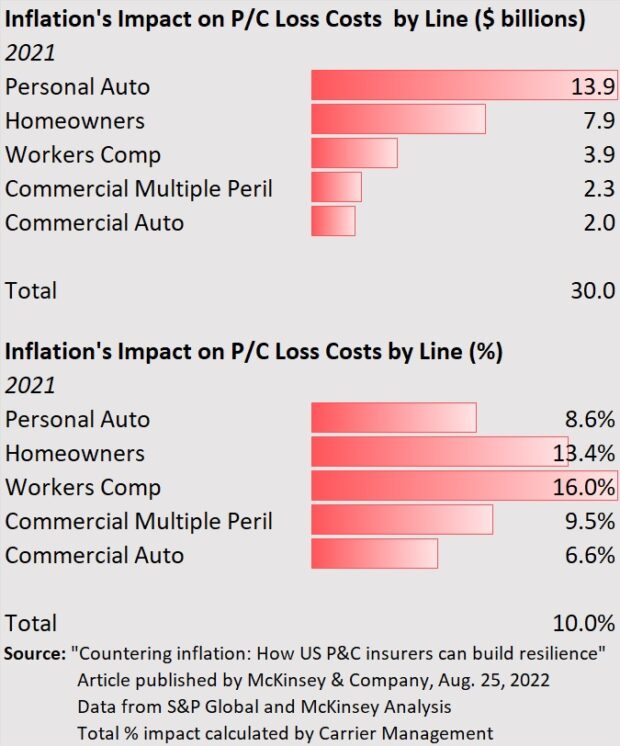

Experts at McKinsey & Company estimate that inflation pushed loss costs for property/casualty insurers up roughly $30 billion last year, with nearly three-quarters of that figure coming through personal lines.

In an article titled, Countering inflation: How U.S. P&C insurers can build resilience, McKinsey partners Kia Javanmardian, Sebastian Kohls and Fritz Nauck, together with senior expert Gavin McPhail, stress the role of insurance executives in directing a coordinated response to inflation’s potential jolts to profitability, with leaders orchestrating actions across pricing, underwriting, claims and other functions—essentially following a “resilience playbook” that will respond as different inflation scenarios play out.

Focusing on the amount an insurer must pay to cover claims, its loss costs, the authors estimated that rising prices drove an almost $22 billion increase in personal lines loss costs in 2021, over and above historical loss trends. For three commercial lines—workers comp, commercial multiple peril and commercial auto—the 2021 impact of cost inflation was roughly $8 billion, they estimated. While the dollar impacts for the longer-tail commercial lines are smaller than for personal lines, a chart showing the percentage impact on each line reveals a 16 percent impact for workers comp.

Neither set of figures—the dollar or the percentage impacts on loss costs—gauge the further impacts of inflation in 2022. The authors explained that they used the latest full-year data available for their analysis, adding that once 2022 is in the books, the impacts will be much bigger.

Explaining the high impact of inflation on personal auto for both years, they note jumps in prices of motor vehicle parts and equipment between June 2021 and June 2022, and supply chain disruptions impacting the physical damage coverage part.

“Under these circumstances, short- and long-term strategies for insurers revolve around savvy pricing, expense management discipline and claims operational excellence,” they write. While advising insurers to keep their eyes on general inflation, wage inflation and interest rates, the authors stressed that claims cost inflation needs to garner the most attention in the months and years ahead.

“To manage such costs effectively, insurers will need to focus on increasing claims productivity and automation and improving or repairing managed-care network utilization and negotiated pricing while also balancing cycle time improvements with claims accuracy,” they write.

The article also sets forth nine possible future-state scenarios, combining possible levels of cost inflation in energy, food and commodity markets globally with potential responses from the U.S. Federal Reserve and other government agencies and businesses around the world. Among the nine scenarios, they highlight three as most relevant for insurers in the months and years ahead: stabilization of prices with the Fed staying on its current path; continued price disruption in global markets with the Fed forced to hike policy rates above 4 percent; and persistently elevated inflation (and U.S. stagflation).

For P/C insurers, the scenario in the middle—the continued price disruption scenario—is worse than the less likely scenario in which inflation remains at persistently high levels, the McKinsey experts write. Both the most optimistic (stabilization) and the pessimistic (stagflation) scenarios would mean short-term disruption in underwriting profits. But the middle scenario in which energy, food and commodity prices continue to rise—and then adapt—could result in a severe hard market, they say.

Under that second scenario, disruptions in global commodity markets will drive up claim costs while moderate general inflation could prevent insurers from increasing premiums for customers. Reacting to profit struggles, insurers may restrict underwriting capacity and apply stringent underwriting standards in a very hard market.

Suggesting that the insurers that find profits in this scenario will be those that maintain expense discipline, superior underwriting, pricing discipline and focus on pockets of the market, the authors call on executives to pull together a “resilience playbook,” mapping out responses to any of the scenarios that ultimately play out.

The article provides specific advice for chief underwriting and product officers, for chief claims officers and for chief financial officers. In the section on underwriting leadership, for example, the McKinsey team describes the need for pricing granularity and raise the idea of reducing policy calendar exposure from 12 months to six months or less.

“Now may be a good time to accelerate innovative loss prevention capabilities through in-home Internet of Things applications, automotive telematics (such as vehicle tracking) and workplace monitoring,” they advise in the section devoted to chief claims officer responses.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report