After a year when insurers couldn’t hire new staff as quickly as people left their jobs, carriers are paying up to attract experienced talent—and may well need to adjust compensation for remaining staffers, researchers reported last week.

Reporting the results of the Semi-Annual U.S. Insurance Labor Market Study conducted The Jacobson Group and Ward Group, a unit of Aon, during a webinar, Jeff Rieder, a partner with Aon and head of Ward, said that 72 percent of carriers surveyed expect to increase staff in 2022—and 75 percent of the new hires will be experienced professional rather than entry level recruits.

Commenting on the reluctance for companies to build the capabilities internally, particularly in areas like product management and technology where carriers said they anticipate attracting roughly 90 percent of their new hires from a pool of experienced professionals, Rieder said an unintended consequence is the “tremendous impact” this is having on compensation levels.

“What is happening here is that we’re seeing that the overall market adjustments are increasing at significantly greater rates,” he said.

“As companies are bringing on more experienced individuals into the organization that is also causing pay inequities internally—as the ‘new incumbents’ are being hired in at higher rates than the existing incumbents. As a result, companies, as they look at their internal pay equity studies are realizing that when they bring in these new individuals that is requiring them to make market adjustments for their other individuals that are below that new hire,” he explained.

Rieder noted that historically, in years prior to the 2008 recession, it was common for insurers to target merit increases of roughly 4 percent, but that in more recent years this fell to 3 percent, and in some years to the 2.5-2.8 percent range. Then in 2020, nearly 20 percent of carriers froze pay increases. That carried on into 2021, with 6 percent of Ward’s insurance clients again freezing salaries. “What that is causing is that there are significant market adjustments needed to be made for many organizations,” he said, citing the pay inequities in comparison to new hires with experience.

Going forward, he predicted market average ranges of year-over-year pay adjustments coming in closer to 5 percent, up from the 3 percent levels that had been common in recent years.

Further straining carrier expense ratios, Rieder said that Ward is seeing an expansion of the incentive compensation to all levels of employees. Even though growing revenue levels don’t always translate into overall profitability growth, people are now expecting to be paid bonuses “at or close to target even in years that are perhaps not as favorable,” he added.

Greg Jacobson, chief executive officer of The Jacobson Group, agreed with Rieder that industry professionals “are seeing very significant increases to change jobs—probably higher than they have ever been.” Jacobson confessed, however, that he could only share anecdotal information on this point. “Most states have instituted laws that do not allow you to ask for someone prior or current compensation in order to make an offer for future compensation. And that’s not only having an impact on my lack of ability to actually know how much of an increase people are getting, but I think it’s also having putting the negotiating power in the hands of the candidate–and that is probably increasing the compensation for people who are making changes by even greater amount,” Jacobson said.

Before the compensation discussion, Jacobson and Rieder reviewed the results of their annual survey, going over the latest answers to familiar questions about planned and actual staffing and revenue changes in the industry overall, and separately for the P/C and life-health segments, as well as other questions about particular positions that carriers desire to fill and how hard it has been to do so.

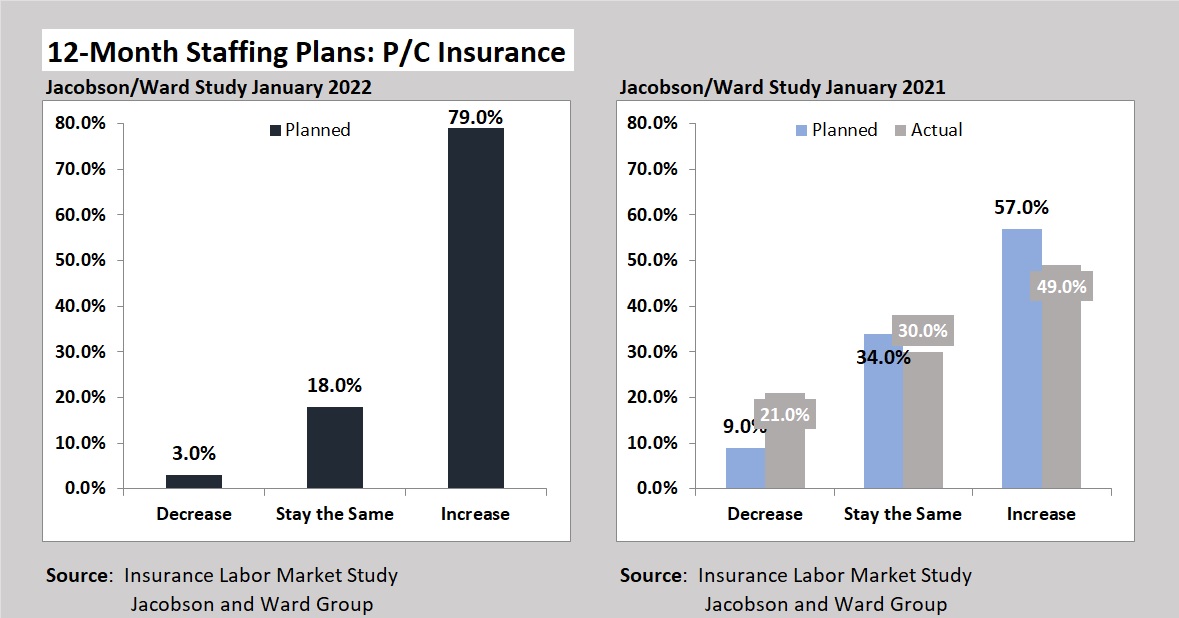

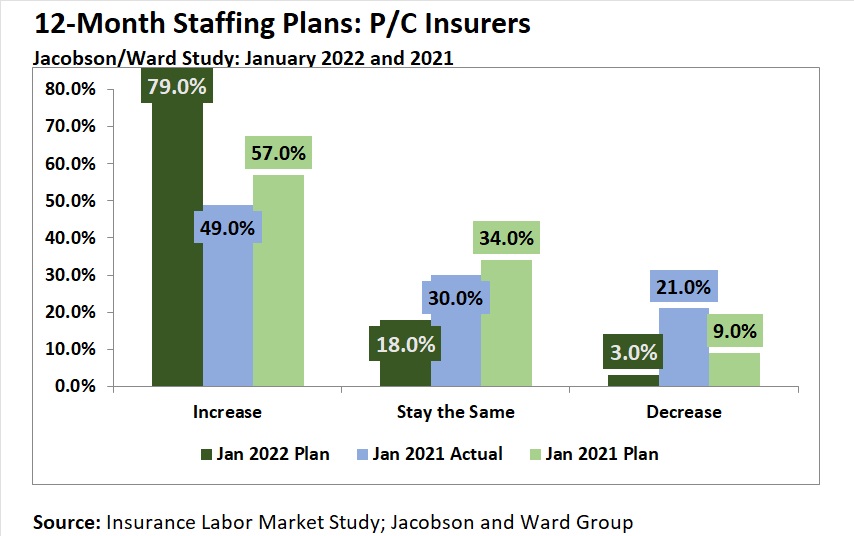

Rieder noted that the 72 percent of all insurance carriers that said they are expecting to increase employees in 2022 is a record high number for any of the 13 years that the survey has been performed, adding that a big driver came from P/C insurers: 79 percent of P/C insurers said they plan to increase staff over the next 12 months—again a record high figure.

Jacobson compared big disparities in actual staffing changes with planned ones in 2021, noting, for example that the 49 percent of companies that actually added staff fell far short of the 56 percent that intended to grow their workforces. “This is just a clear indication that what’s happened is that companies have not been able to replace the staff nearly as fast as they’ve been losing staff to retirements and to just leaving the market—and at the same time they haven’t been able to keep up with the growth plans.”

Similarly, looking at the survey results on this question for just the P/C insurers, he noted that 21 percent of P/C insurers lost staff in 2021 vs. only 9 percent that planned decreases. The results aren’t the result of a significant number of companies deciding to lay off staff, he asserted. “That just didn’t happen. It’s really those companies that were not able to keep up with the turnover from the Great Reshuffling or Resignation, whatever you want to call it,” Jacobson said.

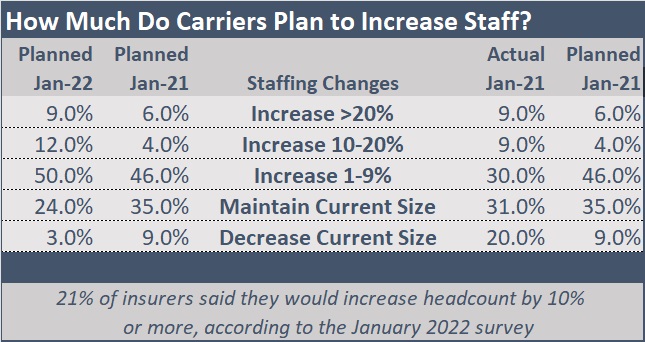

Presenting results that break down how much insurers (both P/C and L/H combined) plan to grow in 2022, Rieder highlighted the fact that 21 percent of the surveyed insurers said they expect to grow by 10 percent or more this year. “What’s interesting is while that may be the plan, whether or not they’ll be able to execute on that might also be very difficult,” Rieder said, asking Jacobson to share some of his recruiting firm’s experiences in placing candidates in recent months.

The Jacobson Group’s statistics show the search firm has to reach out to “almost double the number of people” to fill jobs. “The amount of competition and the number of phone calls people are receiving from recruiting firms or directly from companies is just dramatically higher,” Jacobson said.

As far a time to fill each position, Jacobson said while the firm tries to say within a target of three months for executive level positions, and about two months for professional level positions, more resources need to be devoted to every search in order to achieve those goals.

Rieder, sharing metrics for the broader financial services sector that includes insurance, said that two weeks more are required now compared to placements made prior to the onset of COVID-19 shutdowns: 46 days to fill entry level positions, compared to 39 pre-pandemic; 73 days now to fill positions for experienced professionals vs. 62 pre-pandemic ; 97 days now for executives, compared to 83 days before.

Claims Staff in High Demand

Survey respondents reporting their own experiences in recruiting for 11 different functions on a scale of 1-10 (10 is most difficult) are finding technology, actuarial and analytics positions most difficult to fill. Noting that positions rated 5 or higher are considered difficult to fill, Jacobson noted that there were none rated below a 5 in this study.

“This is the most difficult place we’ve ever been in in terms of recruiting difficulty,” Jacobson said, noting the average difficulty across all the positions came in at 6.2, eclipsing a previous high of 5.8.

“I can’t recall ever seeing kind of frustration from companies to fill positions, or this type of hunger for labor at any point in the history of doing the study—but even going back to my 25-years plus in the industry,” Rieder said. Jacobson agreed. “Absolutely, this is the most competitive environment I’ve seen in the 30-plus years I’ve been in the business.”

Other survey highlights included findings that:

- The most wanted category of professionals is claims for P/C personal lines companies.

- The most in-demand professionals at P/C commercial lines insurance companies are those with technology or underwriting experience.

- Demand for temporary staff is reaching an all-time high; 19 percent of carriers plan to increase their use of temporary employees in 2022, which compares to an average of roughly 10 percent over the last decade.

- The vast majority of insurers intend to offer flexible working arrangements as offices reopen. Eighty-nine percent plan to offer a hybrid work model and 45 percent plan to provide fully remote options.

“Despite all the advances in technology, there is still that need to have the front office-type activities,” Rieder said, focusing on the sharp spike in the need for claims professionals. Claims is not only the most in-demand function to staff up for P/C personal lines companies but it is also the second most in-demand across all P/C companies. Speculating on the reasons, Rieder noted that claims frequency was suppressed in 2020, and although it rebounded in 2021, carriers were reluctant to add positions that were vacated or just open. They are now finding that they need to fill those positions to be able to meet their customer service levels.

Rieder also noted that with 82 percent of carriers expecting to grow revenue—expanding their products, overall footprints and policy counts—they need to grow staff in underwriting and in sales and marketing functions, in addition to claims.

With respect to technology staff, Rieder noted that while demand remains high, “there has also been a modest growth in companies that are using managed service agreements for some of their core technology operations.”

Not a member? Signup today to access the content of the next magazine.

He said, “I won’t call it a significant trend, but it is a trend that we’re seeing where some of those activities are being outsourced and offshored for many organizations, and historically when we saw those happening [it was] at companies that wrote $10 billion or more in premiums. Now we’re seeing companies that are smaller, even those that are only a billion in premiums, beginning to offshore some of those activities.”

What About Pay Equity?

Toward the end of the webinar, a viewer asked Rieder how carriers should go about addressing pay equity within their organizations.

Rieder said carriers with good performance management systems are best able to deal with the issues that arise when a new hire comes in at a higher pay rate than many current staffers. In many cases, “it isn’t higher than everybody. In cases where that individual is coming in with at least similar experience or background as a current incumbent, if that current incumbent is performing at or above expectations, [carriers] are [raising] pay to increase it to at least the incoming incumbent’s position”—or moving to that level over, perhaps, a two-year period.

“In cases where the individuals are performing below expectations or not as strong performers, companies are consciously making a decision not to address that because [current] performance may not warrant the additional pay.

“But you do run into issues that if you do not have a very well-defined performance management system that has clearly documented that that individual is an underperformer,” he said.

“It’s a challenge,” he concluded. “I can tell you we face that—I think every business has faced a similar situation where you see new incumbents coming in at higher rates.”

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard