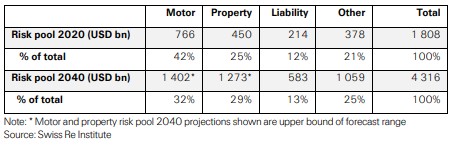

Global property/casualty premiums are expected to more than double to $4.3 trillion in 2040 from $1.8 trillion in 2020 – growth driven by economic development, urbanization and climate change, according to Swiss Re’s latest sigma study.

The study revealed that substantial growth is expected over the next 20 years for property and liability lines. However, motor’s share of P/C premiums is expected to drop by approximately 25%, as automation makes cars safer and pushes down claims and premiums, explained Jerome Haegeli, Swiss Re’s group chief economist during a media briefing to discuss the report.

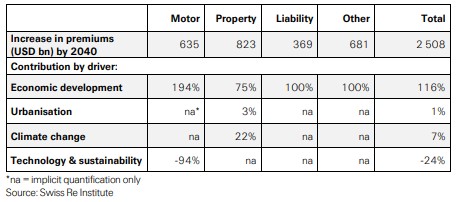

Indeed, Haegeli said technology is likely to drive almost a $600 billion drop in motor premiums by 2040.

“[A]s safety technology further permeates car fleets, accident frequency and claims cost per vehicle will decline, and premium growth will slow,” which will have a dampening effect on premium growth, said the report, titled “More risk: the changing nature of P&C insurance opportunities to 2040.”

Property insurance is forecast to grow by 5.3% annually with global insurance premiums rising to $1.3 trillion in 2040 from $450 billion in 2020, said Swiss Re, noting that economic development will remain the key driver of rising property premiums, contributing 75%, or up to $616 billion of new premiums.

“Climate-related risks are expected to result in a 22% increase in global property premiums, or up to $183 billion, over the next 20 years as weather-related catastrophes will likely become both more intense and frequent,” continued the report.

During his presentation, Haegeli drilled down into the drivers of P/C growth: economic development and climate change/urbanization.

Economic development is the most important driver for the P/C market growth across all lines of business, he said. “But to put a number on it, economic development is going to add, plus $2.9 trillion in terms of new premiums by 2040.”

On the other hand, climate risk will add about $183 billion in terms of new premiums, while urbanization, which is more important for emerging markets, will add around $24 billion of new premiums by 2040, Haegeli affirmed.

The share of property premiums will rise to an estimated 29% of P/C premiums in 2040 from 25% in 2020, while liability will rise to 13% in 2040 from 12% in 2020, the report continued.

Liability Growth

Addressing the growth expected on the liability side of the business, Swiss Re forecast that premiums would rise by 4.7% annually on average to $583 billion until 2040 from $214 billion in 2020. “We see long-term growth potential in liability insurance from climate change effects, artificial intelligence, and social/legal changes. In the short- and mid-term, social inflation will drive up the frequency of large verdicts/settlements, especially in the U.S.,” said the sigma report.

As the more volatile property and liability segments are gaining in significance, the share of motor insurance – traditionally a lower-risk and high-volume mainstay segment of P/C – will shrink due to safety improvements from automation and smart technology and a drop in associated claims, it continued.

“While the share in the P/C risk pool is expected to shrink to 32% of sector premiums by 2040 from 42% in 2020, motor will remain the largest line of business, with premiums forecast to almost double up to $1.4 trillion by 2040 from $766 billion in 2020,” the report confirmed.

“With the global portfolio shifting from lower risk motor insurance to higher risk lines, P/C insurance business will become more volatile,” said Gianfranco Lot, head Globals Reinsurance at Swiss Re, in a statement accompanying the report.

“At the same time, risk modeling will become more complex, which will lead to higher capital requirements and an increased demand for reinsurance. In this fundamentally different risk environment, reinsurers will play a crucial role in keeping risks insurable,” Lot added.

As the title of the sigma report suggests, Haegeli noted, there will be more risks ahead with the changing nature of P/C insurance, “but with more risks, there will also be more opportunities.”

*This story ran previously in our sister publication Insurance Journal.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers