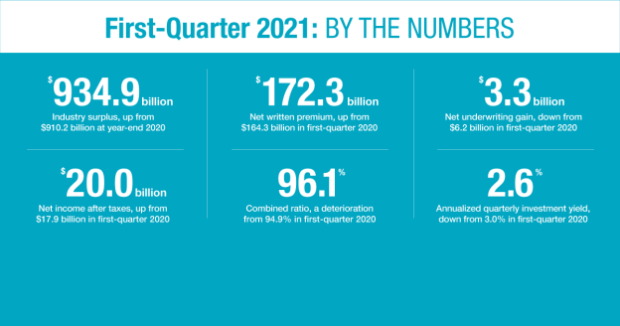

U.S. private/casualty insurers saw their net income after taxes jump to $20 billion in the 2021 first quarter, but their combined ratio worsened compared to the same period a year ago, according to a new report from Verisk-owned ISO and the American Property Casualty Insurance Association.

Net income after taxes in the 2020 first quarter was just under $18 billion.

Where did the gains come from? They stemmed in part from an increase in realized capital gains as well as a modest rise in premiums compared to the 2020 first quarter. But severe weather worsened underwriting profitability and the resulting combined ratio, according to the report.

“While the insurance industry’s net income grew significantly in the first quarter of 2021, underwriting results suffered, due in part to severe weather in Texas,” Neil Spector, president of ISO at Verisk, said in prepared remarks. “Those catastrophe losses are a stark reminder that even as we emerge from the pandemic, challenges may lie ahead. Precision underwriting, enhanced loss controls, and comprehensive risk management and resilience strategies remain critical for insurers.”

Robert Gordon, APCIA’s senior vice president of policy, research and international, noted that the industry has been through a lot in the past year, from pandemic challenges in 2020 to the 2021 Texas record freeze, extreme tornados and floods, a record heatwave in the West and wildfires. A likely above-average hurricane season is to come. With that in mind, he said that 2021 underwriting gains come with a catch.

“Reserve releases for prior years’ business accounted for virtually all Q1 underwriting gains, while slowing premium growth was unable to keep pace with spiking losses and loss expenses,” Gordon said in prepared remarks.

At the same time, the industry’s statutory surplus saw big gains with improving investments after a big drop at the end of the 2021 first quarter. Further trouble is ahead, however.

“Insurers now face significantly increasing inflationary costs, including medical care, auto repair, building materials and labor all exceeding the underlying consumer price index,” Gordon said. “Long-term pandemic liabilities are also still unclear, with continued growth in COVID variants globally and unknown medical costs for long-haul COVID victims.”

Here are further details from the report:

- Insurers’ combined ratio was 96.1 for the 2021 first quarter, compared to 94.9 in the 2020 first quarter.

- Insurers’ annualized rate of return on average policyholders’ surplus dipped to 8.7 percent in the first quarter, from 8.8 the year before.

- The insurance industry’s overall catastrophe losses and loss adjustment expenses (LLAE) were $111.1 billion in the 2021 first quarter, a 5.3 percent gain. Other underwriting expenses grew to $45.7 billion, a 1.3 percent increase, and policyholder dividends grew to $1.2 billion.

- Insurers saw a 2.3 percent growth in earned premiums in Q1, year over year, translating into $3.3 billion in net underwriting gains for the quarter. That compares to $6.2 billion in underwriting gains in the 2020 first quarter, down 46.7 percent. According to the report, the jump in catastrophe LLAE was partially offset by a decline in other LLAE and by more favorable LLAE reserve development than in 2020, which helped insurers avoid underwriting losses.

- Insurer 2021 first quarter net investment income fell to $12.8 billion, from $13.2 billion the year before. At the same time, insurers’ realized capital gains jumped to $5.2 billion from $1.1 billion, creating $18 billion in net investment gains for the 2021 first quarter. In the 2020 first quarter, that number was $14.3 billion.

- Earned premiums grew to $161.2 billion in the 2021 first quarter, a 2.3 percent underwriting gain.

- Net written premiums jumped to $172.3 billion during the quarter, versus $164.3 billion in the 2020 first quarter. The report’s authors note the 4.9 percent growth is weaker than the 6.2 percent premium increase in the 2020 first quarter, but it is still a recovery from the 1.4 percent average growth for the nine months from April 1, 2020 through Dec. 31, 2020.

- The growth in net earned premiums slowed to 2.3 percent in the 2021 first quarter from 5.4 percent in the 2020 first quarter.

- The industry surplus was $934.9 billion during the quarter, up from $910.2 billion at the end of 2020.

The full ISO/APCIA report is “Property/Casualty Insurance Results: First Quarter 2021.”

Source: ISO/APCIA

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best