Sixty-two percent of carrier professionals recently surveyed said their companies have already adopted artificial intelligence and machine learning initiatives, but a high percentage of those adopters said they have talent-related concerns around the initiatives.

LexisNexis Risk Solutions published the survey results in late December in a white paper titled “Hype or Reality: The State of Artificial Intelligence and Machine Learning in the Insurance Industry.” The paper summarizes responses of 300 insurance carrier professionals from data science, analytics, actuarial, technology, underwriting, product management and claims disciplines to questions about how they use AI and ML and what obstacles they face in implementing AI and ML strategies.

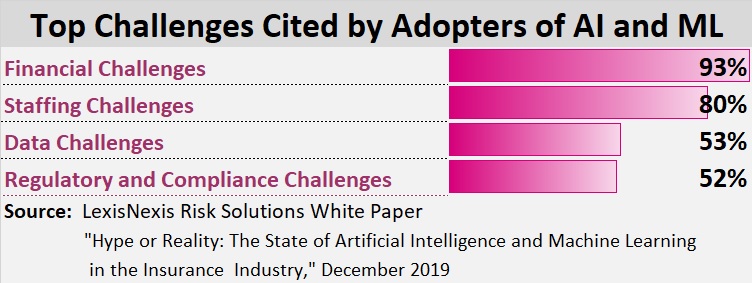

Focusing on the 62 percent whose companies are already AI and ML adopters, 80 percent listed staffing concerns as a key challenge. And among adopters with staffing concerns, 78 percent said they were worried about the ability of non-technology staff to understand algorithms, applications and outcomes. Concerns about technology staff bubbled up as well, with 70 percent citing a concern about technology staff’s understanding of algorithms and the ability to monitor AI and ML projects as a challenge.

LexisNexis says the carriers best-positioned to deal with these challenges are hiring “knowledge managers” that speak tech and non-tech languages. “There is a growing need for people who can understand the inputs, outputs, usage and value of the applications—and explain them to the business functions,” the white paper states, stressing the need for knowledge managers to bridge the non-tech and tech worlds and to help position carriers as they acquire new talent and reskill existing staff.

Survey numbers support the idea that carriers feel pressure to hire the right staff, with just under half of all respondents—49 percent of adopters and non-adopters—reporting that AI and ML have impacted current staffing plans, and two-thirds expect an impact within three years.

As carriers staff up, LexisNexis advises carriers about aligning their data science functions within their organizations.

- If a carrier’s adoption of AI and ML is primarily a technology play, then align data scientists with the core technology team.

- If business objectives are the primary driver, then align them with business functions.

- Data wranglers, or people who can help search for solutions or datasets within the organization, are most effective when aligned with an organization’s broader objectives.

Noting that carriers are competing with the Amazons and Googles of the world as they seek to onboard data scientists, the white paper mentions the need to pay attention to attract and retain data scientists financially and with cultural fits, responding to expectations about remote and flexible work schedules, for example.

For purposes of the study, LexisNexis Risk Solutions uses the following definitions:

- Artificial Intelligence is any technique that enables computers to mimic human intelligence, using logic, if-then rules, decision trees and ML (including Deep Learning).

- Machine Learning, a subset of AI, includes algorithms that can learn from data without relying on rules-based programming.

- Deep Learning, a subset of ML, is composed of algorithms that permit software to perform tasks, such as image recognition. Deep Learning happens by exposing multi-layered neural networks to vast amounts of data.

Benefits and More Challenges

Among the headline findings presented in the survey, LexisNexis reported that 75 percent of the respondents agreed that AI and ML are not hype and will provide carriers with competitive advantages.

With the 300 respondents coming from the ranks of the top 100 U.S. insurers in the auto, home, life and commercial markets, the white paper reveals that 68 percent of adopters write auto insurance and 60 percent write commercial insurance. While it is true that most adopters come from large carriers, there is significant adoption by smaller carriers, LexisNexis found. In fact, 51 percent of respondents from the top 50-100 carriers said their companies have already adopted AI and ML strategies.

Among the 50 largest carriers, the adoption percentage is 82 percent for the top 20 and 62 percent for carriers ranked 21st through 50th by size.

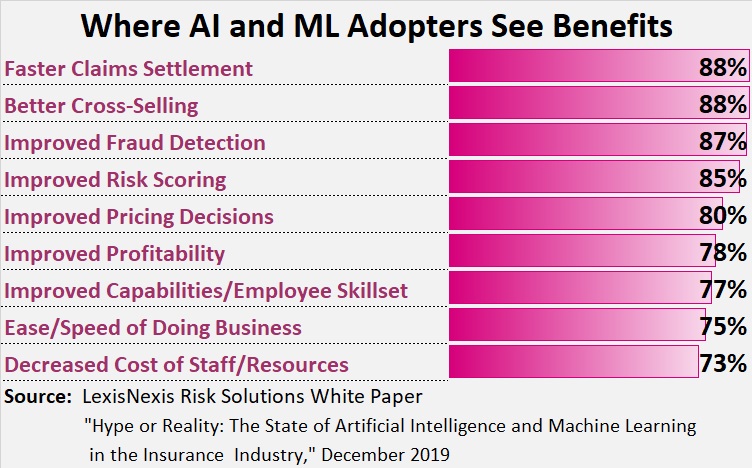

The adopters are already seeing benefits from these AI and ML investments, according to the survey results, with the benefit of faster claims settlement—identified by 88 percent of adopters—topping the list. Nine benefits are listed in the report, with decreased cost of staff ranked lowest (identified by 73 percent of adopters).

The white paper also includes survey findings specific to individual carrier functions, listing out activities for which adopters use AI and ML within marketing, underwriting and claims departments.

When asked broadly about overall carrier challenges of implementing AI and ML initiatives, only financial concerns topped staffing concerns—with a whopping 93 percent of adopters citing financial concerns including the cost of implementation, uncertainty around ROI and competing priorities.

Data challenges ranking as top concerns by adopters included the ability to manage larger volumes of data and to ensure data security.

Adopters with compliance concerns worry about increased scrutiny and about the inability of external regulators and internal compliance professionals to understand AI and ML, which in turn might mean carrier efforts to implement AI and ML strategies are blocked.

This underscores the need for knowledge managers, LexisNexis advises. “For example, knowledge managers can help ensure that internal compliance and legal teams understand black-box inputs and outputs,” the report says.

The white paper also warns carriers to guard against using new data sources that “are a proxy for sensitive or prohibited data,” as carriers seek out emerging data sources to better understand risk and serve customers.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next