The commercial automobile insurance segment is headed for its ninth straight year of underwriting losses when the books close at year-end 2019, analysts at Fitch Ratings predict in a new report.

In fact, a decade of underwriting losses may be in the cards in 2020 for the industry overall, although a handful of top writers, including market leader Progressive, are managing to record underwriting profits and grow their top lines at the same time, Fitch says.

According to the new report, “U.S. Commercial Auto Insurance Market Update—Recovery in Results Still Slow to Emerge,” the latest recorded industry full-year combined ratio for the line was 107.9 in 2018, only three points below the 2017 high for the decade of 111.1. Combined ratios in excess of 100 started to emerge back in 2011, making 2018 the eighth consecutive year of underwriting losses.

“Underwriting results are likely to improve further in 2019, but a return to a market combined ratio below 100 is likely out of reach in 2019 or 2020,” the report says, noting that insurers have been taking aggressive actions to repair the damage of the recent string of losses.

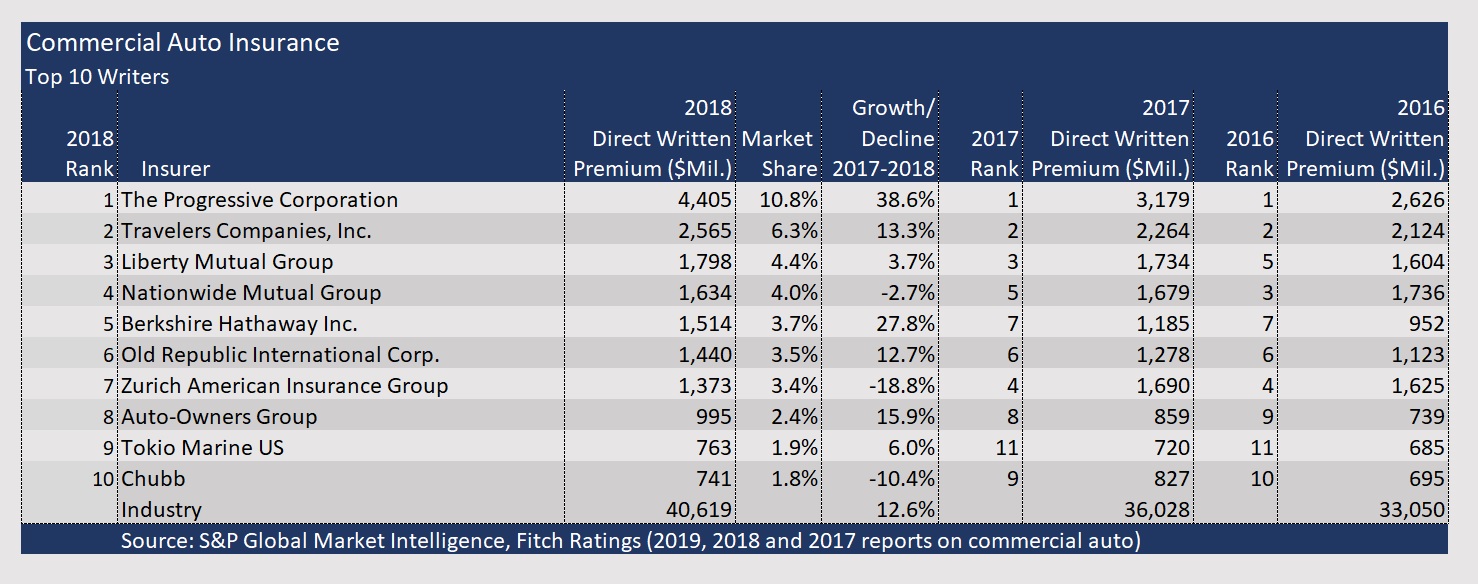

Only four of the top 15 writers of commercial auto managed to dodge persistent loss trends, including Progressive. Fitch calculated the five-year average combined ratio for each of the top 15 writers, finding that Progressive comes in at 87. Progressive also recorded nearly 39 percent growth in direct written premiums in 2018 and has more than doubled the size of its direct written premiums since 2015 (based on figures in the latest Fitch report and three prior reports).

Another industry sprinter, Berkshire Hathaway, recording 28 percent growth in direct premiums in 2018, is among the small group of leading commercial auto writers with average five-year combined ratios under 100. Others with average sub-100 combined ratios for the past five years are Old Republic, ranked one spot below Berkshire with the sixth largest volume of premiums, and 10th-ranked Chubb Limited.

At the other end of the profit spectrum, American International Group, the only one of the top 15 insurers to report declining premiums in the last five years, also had a five-year average combined ratio of 133. AIG reduced exposure in several segments in an effort to restore profitability. With premium drops of more than 20 percent each in 2016 and 2017, and another 3 percent premium decline in 2018, AIG now ranks 15th among the top commercial auto writers, according to Fitch’s summary of statutory data.

Other companies with commercial auto underwriting results that are notably worse than the industry in the last five years include State Farm (five-year average combined ratio of 124), Zurich (122), Liberty Mutual and Amtrust (both at 120). State Farm, now ranked 13th in overall direct written premium volume and market share for commercial auto, first appeared on Fitch’s list of the top 15 carriers in 2017. (The chart accompanying this article displays the top 10 carriers, excerpted from Fitch’s full list.)

State Farm and Cincinnati Insurance Group, which ranked 12th by direct premium volume for the line in 2018, replaced The Hartford and W.R. Berkley Group among the top writers in 2017.

Overall, across the industry, Fitch said that aggressive pricing actions have made commercial auto the fastest-growing major segment in U.S. commercial lines in the last five years. In fact, commercial auto renewal rates have climbed for 31 consecutive quarters (or since third-quarter 2011), with an 8.8 percent jump recorded in first-quarter 2019, the Fitch report notes, citing pricing information from The Council of Insurance Agents & Brokers’ (CIAB) Commercial Market Pricing Survey.

Fitch’s latest report notes that the price increases helped to fuel a 12.6 percent increase in industrywide direct written premiums in 2018, and comparable information in prior reports reveals that direct premiums have increased nearly 30 percent since 2015. But persistent claims severity and adverse reserve developments are crushing the other side of the ledger.

For the industry, commercial auto liability adverse development totaled greater than 7 percent of annual earned premiums for each of the last four years, according to the Fitch report. In addition, Fitch Ratings’ analysis of liability payments on closed claims from industry statutory data show the cost of paid claims rose by nearly 8 percent in 2018 and 47 percent from 2009 to 2018.

Overall, Fitch estimates that industry statutory commercial auto liability reserves may be deficient by 3-5 percent at year-end 2018, or roughly $1.1 billion to $1.8 billion.

The Fitch commercial auto update report includes graphs showing industrywide net written premium volumes and combined ratios for each of the last 10 years, net and direct written premium growth for each year since 2014, 10 years of average closed claims, and commercial auto liability loss development by accident and calendar year for the same 10 years.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec