Thanks largely to Hurricanes Harvey, Irma and Maria, commercial insurance buyers will face a market correction in 2018, Willis Towers Watson asserts in its 2018 Marketplace Realities report.

In other words, rate increases are likely on the way as insurers continue to tally their losses from the fall’s massive hurricane events and plot recovery from those historic hits.

“There seems to be a growing consensus that the total [losses] will exceed $100 billion,” Willis Towers Watson said in its report. “That’s a serious blow to the industry [and] it’s hard to imagine that such a blow will not impact rates.”

“The long soft market for commercial property insurance could be over, at least temporarily,” the report added.

What’s more, the need for commercial insurance rate hikes could lead to a domino impact on many other lines, Willis Towers Watson said.

The Willis Towers Report suggests that insurers who book heavy losses will face pressure to make up for the shortfall in non-property premiums, which means other lines may also see rate hikes beyond commercial insurers.

“Many industry observers have pointed out that the profitability of property insurance (even while rates have been declining, relatively modest catastrophic losses have meant profits for many) has masked loss deterioration in other lines of business,” the report said. “With that mask gone, some will see increases in other lines.”

Competition could keep this pressure in check, Willis Towers Watson said, but at the least, rate decreases could be at a temporary end.

With all the hurricane-related losses, rate hikes may come, in part, from insurers who seek to pass along rates they could see from reinsurers, Willis Towers Watson noted.

“Reinsurers have seen rates tumble for an extended period and now face another blow. They could well be on the hook for a large portion of the losses that most expect will exceed $100 billion,” the report explained. “This should certainly put the brakes on reinsurance price reductions and likely reverse them leading to increases.”

It remains unknown whether those expected increases will hold, but Willis Towers Watson said this will still add another pressure element on insurers “to raise their own rates.”

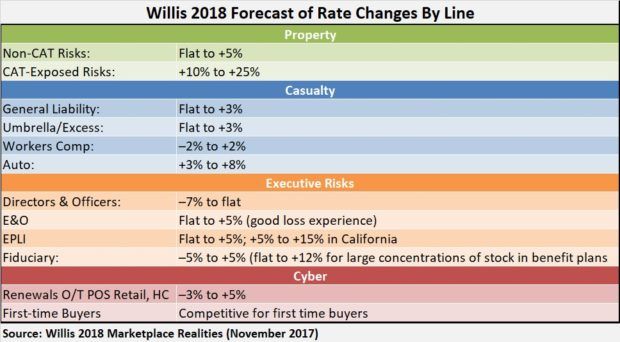

Willis Towers Watson said it expects non-cat property risks to rise an average 5 percent in 2018, with cat-exposed risks jumping 10 percent to 20 percent on average. Cat-exposed risks with losses, on the other hand, could rise as much as 25 percent, the report predicted.

Casualty general liability and umbrella risks, however, will see rates range from flat to 3 percent higher compared to 2017, Willis Towers Watson said. Excess risks will stay flat, and workers compensation will see a range of negative 2 percent to positive 2 percent rate changes. Auto will see rate hikes of 3 percent to 8 percent, and international will drop from 5 percent to 10 percent, according to the report.

Source: Willis Towers Watson

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation