InsurTechs are changing the face of insurance, Capgemini and Efma said, announcing results of a consumer survey last month in which nearly one-third of respondent said they now rely on InsurTechs.

But while the actual figure—31.4 percent of more than 8,000 consumers surveyed worldwide—represents customers who said they rely on InsurTechs either exclusively or in combination with incumbent relationships to access insurance services, other survey results—in particular, an answer to a question about trust—point to the value of incumbent insurers working together with insurers.

Nearly 40 percent of the customers surveyed—39.8 percent to be exact—say they trust their insurers, compared to only 26.3 percent who trust InsurTechs, Capgemini and Efma said in the 2017 World Insurance Report, published in mid-September.

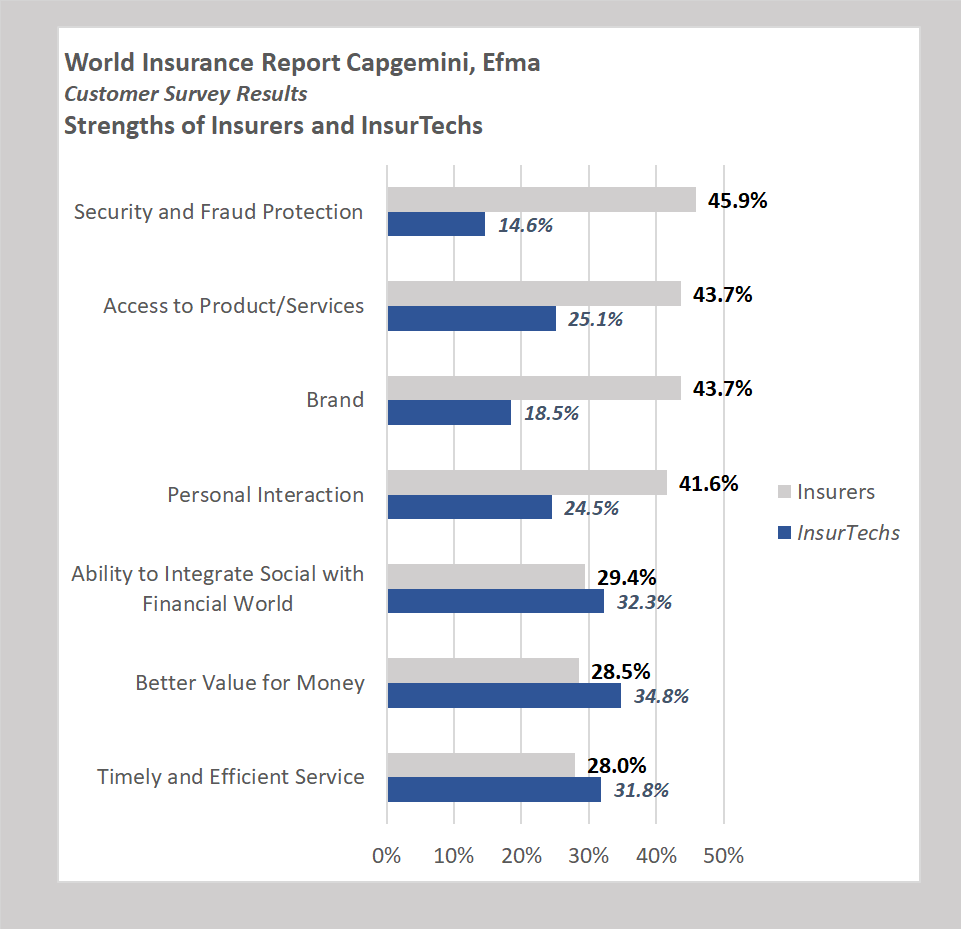

In addition to their customer trust advantage, insurance firms got higher marks for security and fraud protection (according to 45.9 percent of respondents), brand recognition (43.7 percent) and personal interaction (41.6 percent).

InsurTechs, on the other hand, offer better value for the money (34.6 percent) than incumbents, they are better able to integrate social networking with the financial world (32.3 percent) and they provide timely and efficient service (31.8 percent).

In fact, in a statement announcement the report, Capgemini and Efma define InsurTech as “the application of technology to spur savings and efficiency within traditional insurance industry models. “InsurTech explores innovations such as customized policies, social insurance, and using data from mobile devices to dynamically price premiums,” they say.

Given the complementary strengths of InsurTechs and traditional insurers, the two are natural partners, the report authors assert. Jack Dugan, Executive Vice President and Head of Insurance for Capgemini, said, “Increasingly, partnerships are being viewed as a welcome development in the ongoing effort to address the InsurTech movement. InsurTechs can help incumbents overcome roadblocks such as aging systems and paper-based processes. Meanwhile, incumbents can help InsurTechs face newcomer challenges like high customer-acquisition costs and a lack of risk management experience.”

Insurers agree that InsurTechs shouldn’t be viewed as competitors but that there is a solid case for collaboration instead, the report notes, presenting the results of a separate survey of 100 senior executives to support the idea. Of the executives interviewed from insurance firms in 15 markets, a strong majority—75 percent—said that developing InsurTech capabilities would help them better meet customers’ evolving demands. And more than half—52.7 percent—agreed that having InsurTech capabilities would help them quickly design personalized products.

Executives interviewed were also asked to how insurers should prioritize investments in six emerging technologies.

- 82.8 percent, identified advanced analytics as an important technology, and 85 percent said they felt insurers were already investing in analytics

- 72.4 percent selected connected devices (connected ecosystems and wearables). But here, only half said insurers are already investing in connected systems, with about 36.4 percent expecting the insurance industry to invest in this type of technology in the next one-to-three years.

- 69 percent put artificial intelligence on their lists of important emerging technologies, but here again, executives believed industry investments are still to come. Only 36.4 percent said the insurance industry is already investing in AI, while another 45.5 percent said investments will happen in the next three years.

As for the other technologies that Capgemini and Efma asked about, the executives estimated that 79 percent of insurers are already investing in robotic process automation, with just over 63 percent identifying RPA as important.

Blockchain and drones were cited as the least important of the six emerging technologies.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec