Long after leaving American International Group Inc., members of the Greenberg family are expanding financial ties through companies they now oversee.

Evan Greenberg’s Chubb Ltd., previously known as Ace Ltd., has paid more than $650 million in commissions over the past decade to companies tied to his father, Maurice “Hank” Greenberg. That includes $60 million last year to Starr International Co., according to a regulatory filing Monday. Evan Greenberg’s companies have also invested more than $50 million with Aquiline Capital Partners, the private-equity firm run by his brother Jeff, 64.

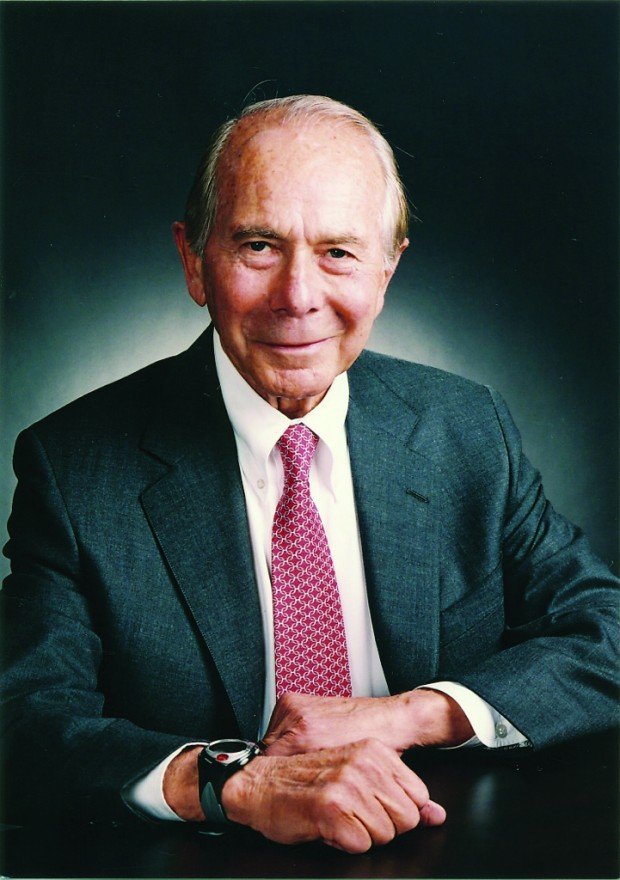

The Greenbergs have long been regarded as titans of the insurance industry. The 90-year-old father built AIG into the world’s largest insurer and promoted Jeff and Evan Greenberg, 61, to senior roles there before they went on to lead other industry giants. Chubb is now the largest of the Greenberg-led companies, and also has publicly traded stock, meaning it files an annual proxy statement that provides a window into related-party transactions. Chubb Ltd., which was formed when Ace acquired Chubb Corp. this year for more than $29 billion, said the arrangements are appropriate.

‘Not Involved’

“We have entered into these contracts because we judge them to be good for our business,” Chubb said in the filing Monday. “Our CEO is not involved in negotiating the terms of these agreements.”

Jeff Greenberg was once viewed as a possible successor to his father as the head of AIG, but instead left for insurance broker Marsh & McLennan Cos. Both departed their jobs amid probes by Eliot Spitzer, then the attorney general of New York, into suspected abuses in the insurance industry, such as bid rigging and accounting lapses.

Marsh & McLennan agreed in 2005 to pay $850 million to settle a Spitzer suit that accused the broker of colluding with insurers including AIG. In 2006, AIG settled with regulators. Jeff Greenberg said in 2004 that he took “strong and immediate action” to respond to Spitzer’s allegations against his company. Hank Greenberg has denied wrongdoing at AIG and said that the company made a mistake in settling the legal case.

Evan Greenberg joined Ace in 2001, a year after Hank Greenberg said he would eventually run AIG. The son built Ace through a series of acquisitions, led by the Chubb deal. Ace began a relationship in 2006 with the Starr business that serves as an agent, writing policies and contracts tied to property coverage and inland-marine business, a category that can include transportation-related risks. The commissions were about $45.5 million in 2006 and reached more than $80 million some years.

Private Equity

The first investment that Ace disclosed in Aquiline was about $3 million in 2011, a sum that includes management fees and other fund expenses. The 2015 investments were $8.6 million in one Aquiline fund and $8.5 million in a second. Evan Greenberg’s company received $4.4 million in distributions from the funds last year.

Jeff Greenberg’s firm has invested about $1.9 billion since 2005 in 32 middle-market financial services firms in North America and Europe, according to the company’s website. Aquiline has exited investments including Conning Holdings Corp., the asset manager that was sold last year to Taiwan’s Cathay Financial Holding Co.

A spokesman for Aquiline declined to comment. Hank Greenberg didn’t respond to a message left with an assistant.

Other related-party transactions include payments between Ace and Starr for technical services through subcontract or consultant relationships. Last year, Evan Greenberg’s company paid about $477,000.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec