While nearly 70 percent of risk managers surveyed are “very satisfied” with their casualty insurance programs, more than one-fifth report some gaps in coverage that they are unable to fill, a recent survey finds.

Roxanne Mitchell, executive vice president and chief casualty officer for Aspen Insurance, reported the results of a survey of buyers and brokers during the Advisen Casualty Insights conference earlier this year.

Advisen, a research and analytics firm, partnered with Aspen to survey over 400 casualty insurance buyers and brokers in February, finding that 21 percent of risk managers and 28 percent of brokers had exposures for which they could not find adequate coverage at an affordable price.

Characterizing the percentages as “a material portion of survey respondents,” Mitchell suggested there are “opportunities for innovation and growth for creative and enterprising underwriters.”

Where are the opportunities?

Among the exposures cited most often as problematic to cover by the respondents were catastrophe perils, New York construction, adult entertainment, ski areas, sexual misconduct for religious organizations, patent infringement and cyber, she said.

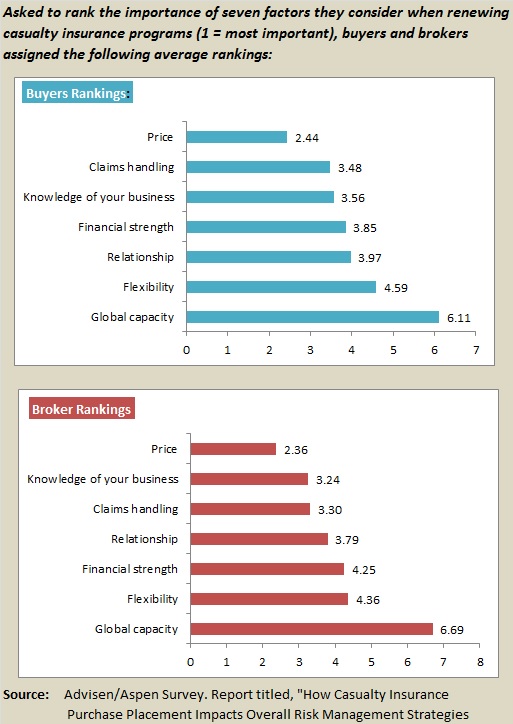

That’s good information for carriers hoping to win commercial casualty insurance customers with a benefit beyond a good price. Asked to rank seven factors influencing their renewal decisions (1 as most important and 7 as least important), both buyers and brokers selected price as most important. The average price ranking for buyers was 2.44 and for brokers it was 2.36.

On the other end of the spectrum, risk managers and brokers care least about global capacity. That factor got a 6.11 average ranking from the buyers and 6.69 from the brokers.

Remaining factor rankings are set forth below:

The positive headline news of the survey is that risk managers are overwhelming satisfied with their casualty insurance programs, Mitchell reported. Asked to characterize how satisfied they were “considering price, capacity and breadth of coverage,” only 2 percent said they were “dissatisfied.” Sixty-nine percent said they were “very satisfied,” and 30 percent said they were “somewhat satisfied.”

“Intuitively, one might assume that an insured’s level of satisfaction is related to their experience with large or complex claims,” but when risk management respondents were asked if they had a large casualty claim in the last five years, many of the 40 percent who said yes also said they were happy with their programs, Mitchell revealed.

“Having experienced a claim is not strongly correlated with satisfaction or dissatisfaction with an insurance program,” she said. “Of the insureds that had large complex claims, 71 percent said they were ‘very satisfied’ with their program, 29 percent said ‘somewhat satisfied.’ No one said they were dissatisfied.”

Advisen’s report summarizing the survey results said similar percentages were reported for buyers that did not have any large complex claims in the past five years. Among those buyers, 67 percent were “very satisfied,” while 30 percent were “somewhat satisfied.”

There was even more good news from the survey respondents who have global exposures. “Eighty-five present of risk managers who have global exposures are satisfied that their global casualty achieves all their risk management objectives. “That was my eye-opener among all the statistics we collected,” Mitchell said, expressing surprise that the percentage was so high.

The survey, which also asked brokers what carriers could be doing better when handling claims (garnering answers such as better communication), asked buyers who they relied on to compared coverages (mainly brokers), and asked both to identify emerging exposures that concern them (psychological claims, health effects of nanotechnology, drones and fracking were cited), included a section allowing for comments.

Here, “the most compelling [responses] dealt with relationships,” with buyers giving carriers high marks, Mitchell said. Other responses—from brokers—indicated that analytics are playing a larger part in the casualty underwriting arena, Mitchell reported.

The full report titled, “How Casualty Insurance Purchase/Placement Impacts Risk Management Strategies,” is available here.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage