Although ACE, FM Global and The Hartford got high marks from risk managers of businesses buying commercial insurance coverage, collectively insurance brokers ranked higher than carriers in a buyers’ satisfaction survey released late last year.

According to the inaugural J.D. Power and RIMS 2014 Large Commercial Insurance Report, the customer service index for brokers (based on a 1,000‐point scale) is 854. In contrast, satisfaction with property insurers scored an index of 821, followed by auto at 811.

Workers compensation insurers came in lowest among the three groups, garnering an overall average score of only 746.

What sets high-scoring insurers and brokers apart from low ones?

The report notes that the insurer scores for property, workers comp, and auto are each based on the combined index scores of five customer experience factors: interaction; program offerings; price; billing and payment; and claims.

The broker index is based four customer experience factors: ease of contacting; reasonableness of fees; advice and guidance in selecting program offerings; and timeliness of resolving contact.

The importance of the five insurer factors varies by product line, an executive summary of the report says. For example, the “billing and payment” factor—essentially tracking the ease and accuracy of financial transactions—is the lowest-scoring factor in the auto and workers compensation indices, where factor scores are 725 for comp and 793 for auto.

With property insurers scoring best on “billing and payment”—at 808—there’s an 83-point difference between the highest and lowest of these scores for the three lines of business.

The “claims” factor is a slightly different story, where the gap in scores between the lines of business is narrower. In judging the competency and efficiency of insurer claims management, there is a 64-point gap between auto insurers achieving the highest satisfaction level (798) and workers comp with the lowest (734).

Across product lines, “interaction” is the second-most impactful factor driving overall customer satisfaction, accounting for nearly one-fourth of the overall model used in each of the product line indices, according to J.D. Power and RIMS (the risk management society).

Even though most customers interact via their broker for service related to their property, workers comp and auto insurance coverages, study findings did not reveal any strong relationship between a customer’s overall impression of their insurer and their broker interactions. “This suggests that commercial customers perceive their insurers and brokers as separate and distinct from each other,” the report says.

In contrast, findings of a separate J.D. Power 2014 U.S. Small Business Commercial Insurance Study show that the overall customer experience with an insurer is driven, in part, by agent or broker experiences.

The 2014 Large Commercial Insurance Report is based on surveys of nearly 1,000 risk managers from organizations with $100 million or more in annual revenue in more than 20 industry sectors that have purchased a commercial property, workers compensation, or auto policy with a profiled insurer or broker.

Although J.D. Power and RIMS did not reveal individual insurer scores in a summary released to the media yesterday, the organizations did provide a list of the insurers included in the survey for each of the three lines:

Property Insurance

- AEGIS

- ACE Limited

- American International Group (AIG)

- Allianz AG

- Chubb

- FM Global

- Liberty Mutual

- Lloyd’s of London

- Oil Insurance Limited

- Swiss Re

- Travelers

- XL Group

- Zurich Insurance Group

Workers Compensation Insurance

- ACE Limited

- American International Group (AIG)

- AmTrust North America

- Berkshire Hathaway Group

- Chubb

- CNA Insurance

- The Hartford

- Liberty Mutual

- Old Republic International

- Travelers

- W.R. Berkley Corporation

- Zurich Insurance Group

Auto Insurance

- ACE Limited

- American International Group (AIG)

- Auto-Owners Insurance

- Chubb

- The Hartford

- Liberty Mutual

- Nationwide

- Old Republic International

- Travelers

- Zurich Insurance Group

In addition to the comparison between the J.D. Power studies on small business insurance and large commercial insurance, an executive summary of the report also contrasts the average scores for commercial lines insurers and personal lines insurers. While average scores based on the surveys of large business risk managers and personal lines consumers are similar for the auto line—811 vs. 810—the range between top-performing and worst-performing personal auto insurers is wider than for commercial lines. Personal auto scores range from 715 to 860 (a 145-point gap) while large business commercial auto insurer scores extend from a low of 724 to a high of 836 (a 112-point gap).

On property, there’s a 142-gap for the homeowners line, ranging from 697 to 839, while property insurers scores based on business risk manager responses fit within a 107-point band, extending from 753 to 860.

While workers comp insurers got the worst scores overall, there seems to be less distinction between carriers for this line than for any other large commercial line. Less that 100 points separate the scores of the best and worst-ranked insurers (scored 807 and 711, respectively).

Wednesday’s report is based on the J.D. Power 2014 Large Business Commercial Study, a syndicated benchmark study that is scheduled to release in February 2015. The full report promises to dive deeper into insurer‐ and broker‐level performance in the large commercial market, highlighting best practices that are critical to satisfying large business insurance risk professionals.

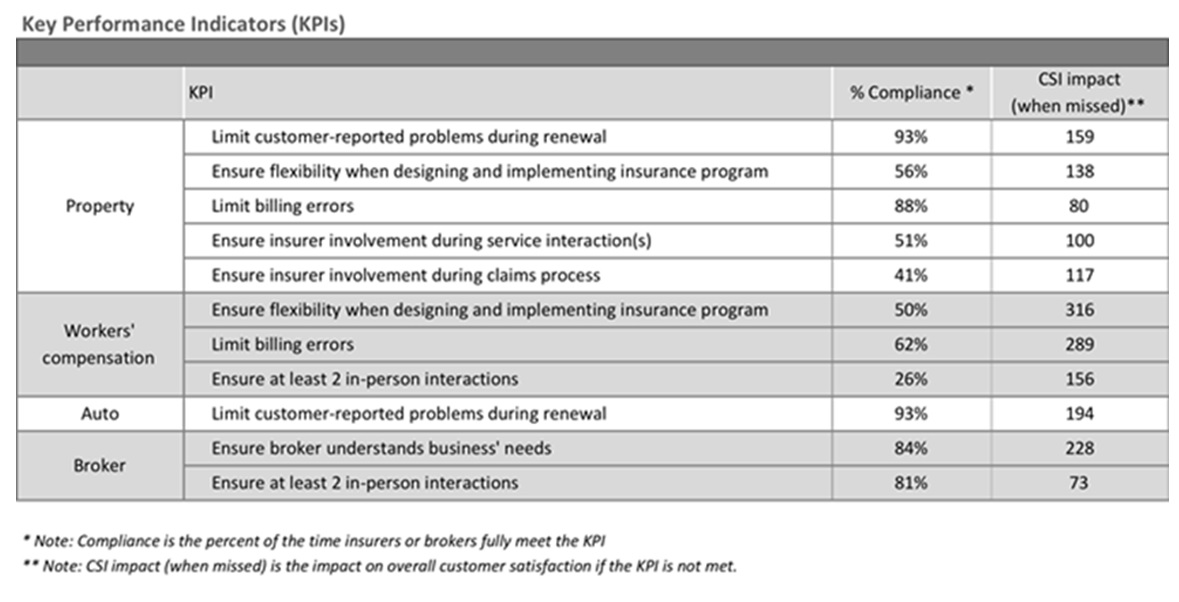

For now, J.D. Power and RIMS note that risk managers are significantly more satisfied when 11 key performance indicators (KPIs) are met by their insurers and brokers. The graphic below summarizes the impact of these KPIs on customer satisfaction indexes when insurers and brokers fall short of insurance buyers’ expectations.

The detailed report set to be released next year also promises to break down satisfaction measures by buyer industry segment—financial services, health care, telecom, etc. A preview included in this week’s report reveals, for example, shows that financial services industry customers tend to stay with their property insurance carriers longer than with their workers compensation insurance carriers, and that while these buyers say that price is the key reason (47 percent) for choosing their comp carrier, it’s a less important factor in choosing a property insurer (16 percent) where coverage is deemed more important.

Source: J.D. Power, RIMS

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers