A large group of creditors of MF Global Holdings Ltd.’s bankrupt brokerage unit will soon receive their first payout, as $518.7 million of checks start to be mailed out on Friday, the third anniversary of the company’s Chapter 11 filing.

James Giddens, the trustee liquidating the MF Global Inc. brokerage unit, on Thursday said the payout to unsecured general creditors will cover 39 percent of claims he has deemed valid.

He said another $32.3 million will be distributed to some “priority” claimants, covering all of their valid claims.

Giddens is keeping roughly $300 million in reserve for unresolved unsecured and priority claims, and said he expects another significant distribution by next June.

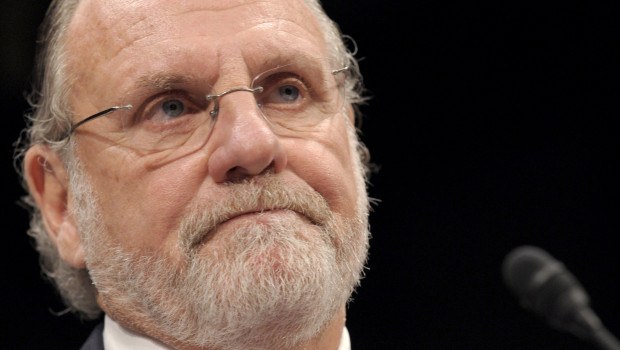

Once run by former Goldman Sachs co-chairman and New Jersey governor Jon Corzine, MF Global collapsed amid worries about Corzine’s $6.3 billion bet on European sovereign debt, and the use of customer money to cover liquidity shortfalls.

The overall, $551 million payout is nearly twice the $295 million sum that Giddens had on Aug. 26 projected distributing. U.S. Bankruptcy Judge Martin Glenn in Manhattan authorized the higher payout earlier this month.

Giddens previously distributed $6.7 billion to satisfy all valid claims of the nearly 26,500 former commodities and securities customers of the brokerage unit.

It often takes years after a bankruptcy for customers and creditors to recoup all or some of their money.

Corzine and other former MF Global officials remain subject to other lawsuits by investors, customers and regulators. A committee representing the parent is pursuing a $1 billion lawsuit against former auditor PricewaterhouseCoopers.

The cases are In re: MF Global Inc., U.S. Bankruptcy Court, Southern District of New York, No. 11-02790; and In re: MF Global Holdings Ltd. in the same court, No. 11-15059.

(Reporting by Jonathan Stempel in New York; Editing by Marguerita Choy)

10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?