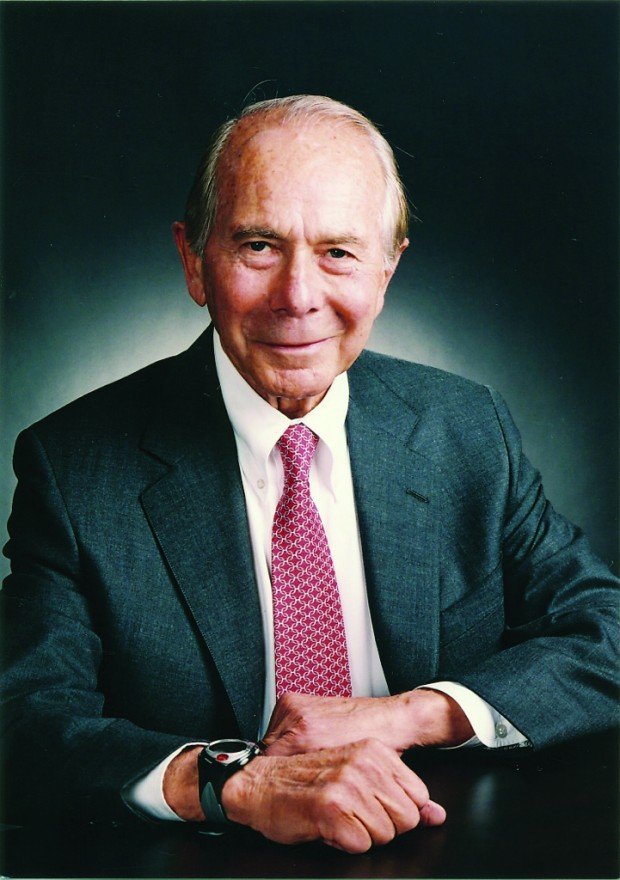

Former American International Group Inc. Chief Executive Officer Maurice “Hank” Greenberg said he’s filed another request to dismiss an eight-year-old fraud lawsuit brought by the New York Attorney General’s Office.

The New York Court of Appeals, the state’s highest court, last month ruled that the state can pursue its case against Greenberg over his role in a sham reinsurance transaction and can seek an injunction banning him from the securities industry and from serving as an officer or director of a public company.

Greenberg, 88, argued the suit was fatally flawed after court approval of a $115 million settlement of a class-action suit that resolved claims against him and former AIG Chief Financial Officer Howard Smith. After the settlement was approved, the attorney general’s office said it was withdrawing its claim for damages in the case.

Greenberg, in a filing today, urged the state Supreme Court in Manhattan to dismiss the case before trial, according to his attorneys with the firm of Boies, Schiller & Flexner LLP. Greenberg is also asking Justice Charles A. Ramos, who’s been presiding over the lawsuit, to recuse himself, saying the judge has shown he’s biased, the lawyers said.

The attorney general’s office “has no valid sovereign interest in the continued prosecution of this matter” and the suit should be dismissed as there is “no genuine threat of irreparable harm or reasonable expectation that the alleged wrong will be repeated,” according to the documents, which couldn’t be immediately verified in court records.

Judge’s Statements

Greenberg and Smith said Ramos should remove himself from the matter because he made a number of statements during proceedings in April 2010 and in a decision issued in October 2010 that “continued to demonstrate the appearance of partiality against defendants,” according to the documents.

Ramos “had also been aggressive and argumentative toward counsel for defendants, even on occasion going so far as refusing to give counsel for defendants a fair chance to speak,” according to the documents.

Eric Schneiderman, who took over the case when he became attorney general, contends that Greenberg and Smith bear responsibility for the transaction with General Reinsurance Corp. in 2000 and 2001 that inflated AIG’s loss reserves by $500 million.

‘Highest Court’

“Since the highest court in the state determined last month that our case can move forward, the attorney general looks forward to bringing this matter to trial and holding Mr. Greenberg and Mr. Smith accountable for their role in this fraud,” Damien LaVera, a spokesman for Schneiderman, said today in an e-mail.

David Bookstaver, a spokesman for the New York State Unified Court System, said judges can’t comment on pending litigation and that the motion for recusal will be considered in due time.

“The attorney general, who no longer seeks damages, should not be allowed to prop up his meritless case by seeking remedies to which he is not entitled as a matter of law,” David Boies, an attorney representing Greenberg, said in a statement. “The defendants are further entitled to have the case decided by a judge who does not have the appearance of partiality.”

The original case is State of New York v. Greenberg, 401720-2005, New York State Supreme Court, New York County (Manhattan).

Editors: Peter Blumberg, Mary Romano

The Future of HR Is AI

The Future of HR Is AI  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard