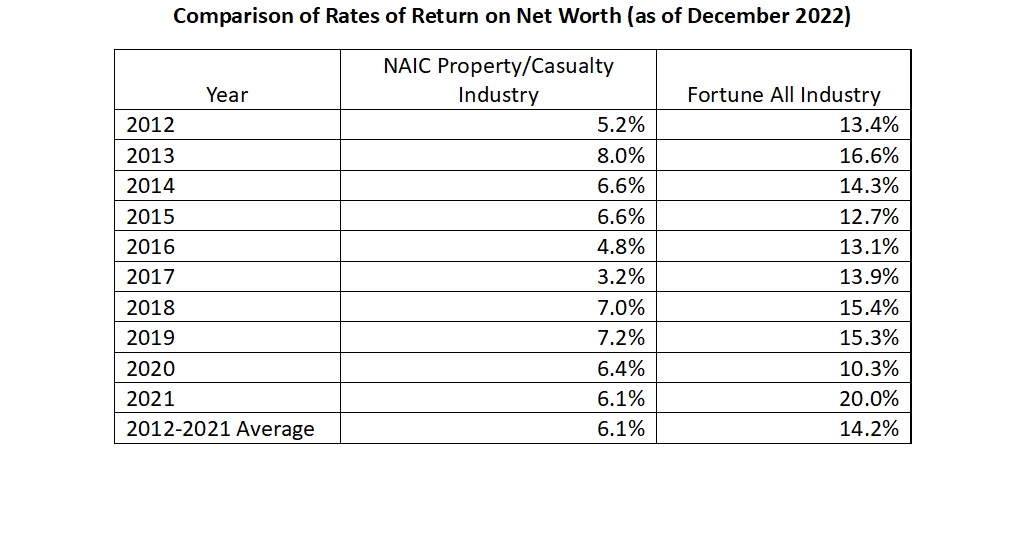

The National Association of Insurance Commissioners (NAIC) 2022 Report on Profitability by Line and by State provides a comparison of the rates of return on net worth for the last 10 years (through 2021) for the property/casualty insurance industry. The table below compares this to Fortune magazine’s all-industry average, which represents an approximation based on a simple average of Fortune’s industry and service sectors.

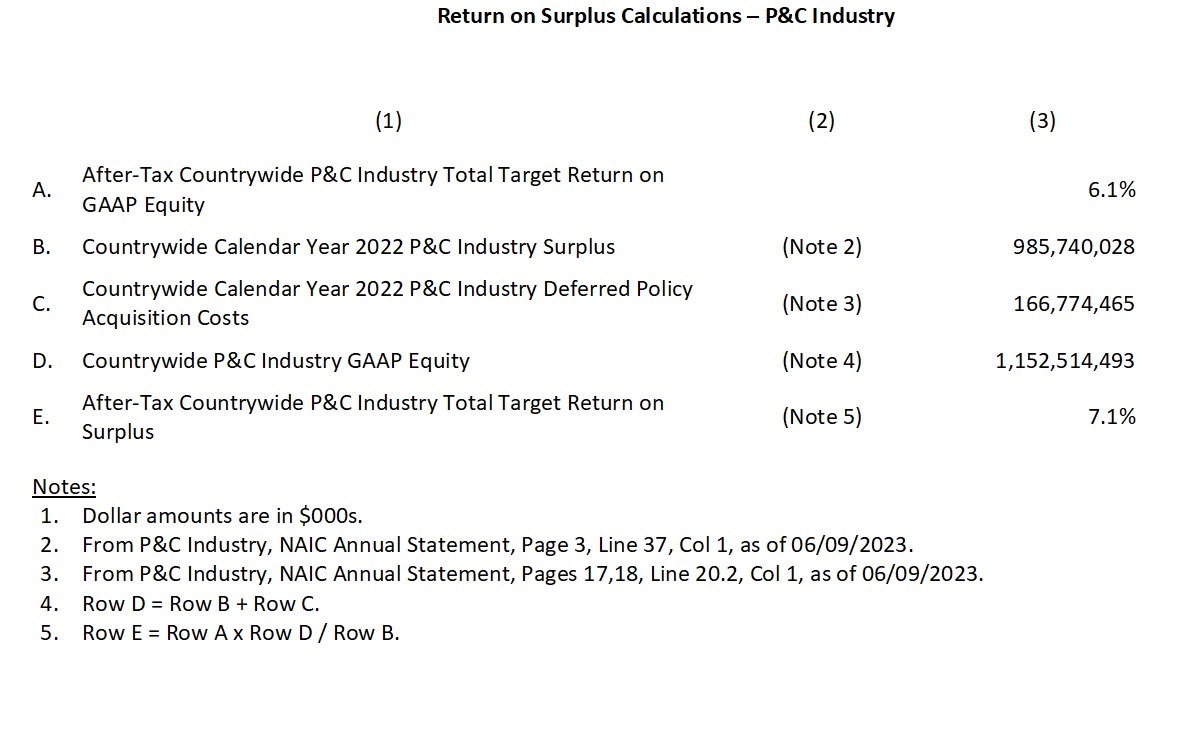

Assuming that property/casualty companies needed to target at least a 6.1 percent rate of return on net worth from 2012 to 2021, this can be translated to a 7.1 percent rate of return on surplus, as shown below.

This already almost exceeds the California Department of Insurance’s average maximum allowable rate of return during this period—7.5 percent), without accounting for several factors that would require companies to seek even higher returns.

This already almost exceeds the California Department of Insurance’s average maximum allowable rate of return during this period—7.5 percent), without accounting for several factors that would require companies to seek even higher returns.

For more on those factors, see related articles, “Rebuilding the California Property Market: Reinsurance Costs and Recent Reforms” and “Permitted After-Tax Returns for California Insurers (2012-2021)”

The Future of HR Is AI

The Future of HR Is AI  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers