Since reinsurance costs are ultimately a substitute for direct costs of capital, we can better understand the ratemaking process in California by understanding how companies are allowed to incorporate cost of capital into their rate filing support.

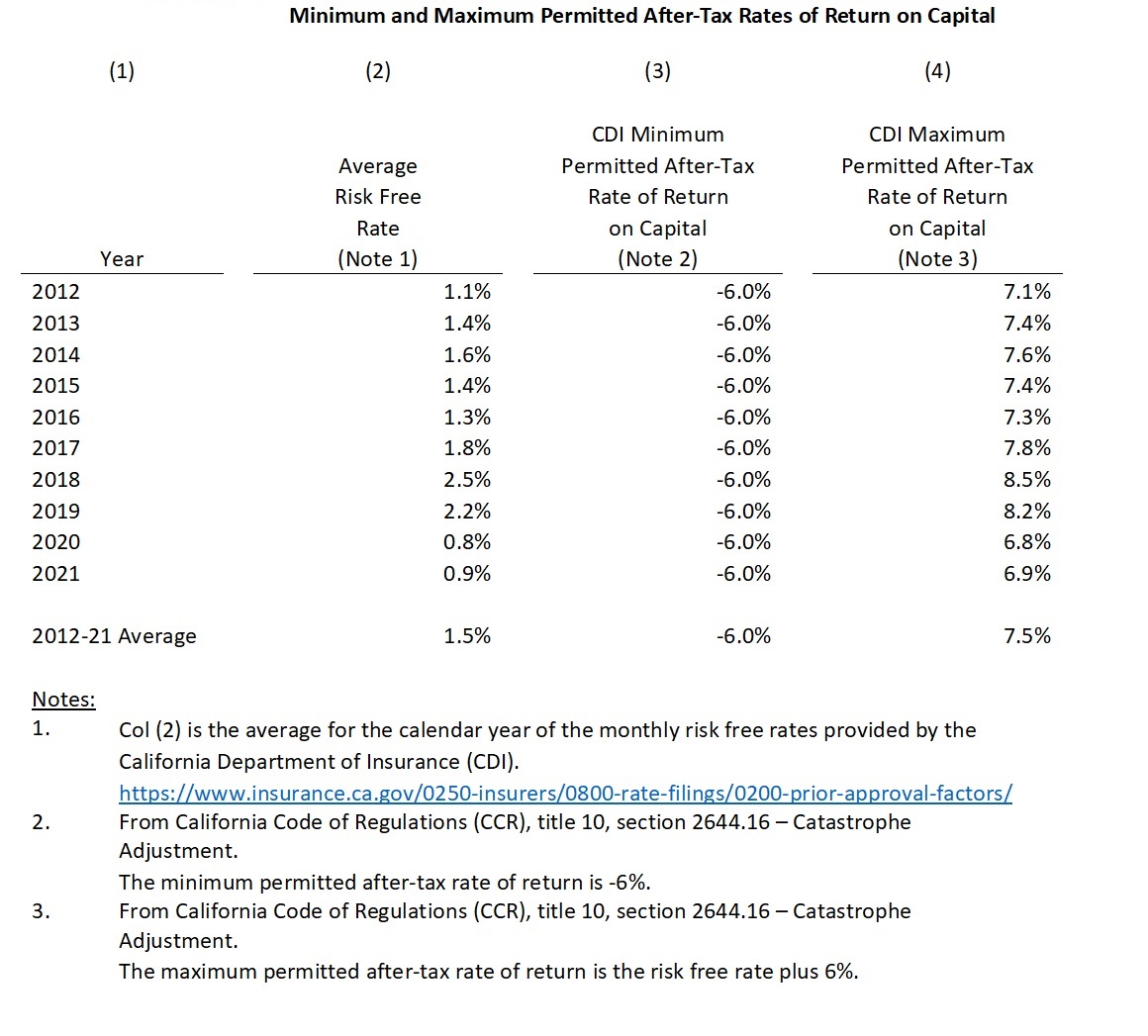

California Code of Regulations (CCR), Title 10, Section 2644.16–Catastrophe Adjustment provides guidance on the maximum and minimum permitted after-tax rate of return on capital as follows:

- The maximum permitted after-tax rate of return means the risk-free rate, as defined in section 2644.20(d), plus 6 percent.

- The minimum permitted after-tax rate of return shall be -6%, which the Commissioner finds is high enough to prevent any undue risk of insolvency and to prevent injury to competition through predatory pricing.

As of August 2023, the risk-free rate of return calculated by the CDI is just below 4.6 percent, resulting in a maximum permitted after-tax rate of return on capital of just under 10.6 percent.

This rate is actually substantially higher now than over the past decade, due to recent increases in interest rates. By comparison, the average maximum allowable rate of return from 2012 to 2021 was 7.5 percent.

How does this compare to the necessary returns that insurance company shareholders expect?

See related articles, “Rebuilding the California Property Market: Reinsurance Costs and Recent Reforms” and “Calculating Targeted California Returns on Surplus.”

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage