When thinking about commercial insurance, there is a simple concept that stands out as it relates to the customer experience: business-to-business buyers are more demanding. They have a responsibility to make the right decisions when purchasing on behalf of their companies. They have high expectations when it comes to quality and the expertise to recognize when they’re not getting it. They are also more likely to regard themselves as interacting with the product or service supplied to them rather than playing the role of passive recipient.

The expertise and risk tolerance of a business buyer can vary with the size and complexity of the business, but generally business buyers simply demand more.

In the J.D. Power 2017 Large Commercial Insurance Study, the overall Customer Satisfaction Index (CSI) for commercial insurers writing in the large commercial space (commercial insurance buyers with annual revenues greater than $100 million) was 761 on a 1,000-point scale. This was a seven-point improvement from 2016 but still considerably below personal lines insurers at 842 and national banks at 835 as reported in the J.D. Power 2017 U.S. Insurance Shopping Study and the J.D. Power 2017 National Bank Satisfaction Study, respectively.

Even when commercial insurers are compared to other B2B-focused industries, such as large national enterprise wireless carriers, commercial insurers score 50 points lower (J.D. Power 2017 Large Enterprise Wireless Satisfaction Study). It is clear that insurers in the large commercial space have a significant task ahead of them if they expect to achieve customer satisfaction levels nearer to other B2B firms and even more work to reach the levels achieved by consumer-facing insurers.

The 2017 Large Commercial Insurance Study was conducted in conjunction with RIMS (the Risk Management Society), a global not-for-profit organization whose members participated in the study. The study results supported the notion that B2B buyers have high expectations and suggested the following opportunities for carriers to respond:

- Provide comprehensive insurance products.

- Demonstrate a complete understanding of the businesses they are insuring.

- Offer meaningful consultative services in a variety of risk-related areas.

- Anticipate and share insights into the changing risk and financial environments their customers are facing.

- Create a seamless communication path that is efficient and minimizes delays and interruptions in the customer’s primary business.

Having a comprehensive product offering is the leading driver of satisfaction in the J.D. Power study. Within the product offering, insurers need to focus both on policy and service offerings. Commercial customers are not simply buying an insurance policy to protect their business after a loss—they are buying a bundle of products and services that can support and protect their business development and needs pre- and post-loss.

Insurers must become more customer-facing with products that are aligned to the customer’s actual business needs. This is especially true as it relates to cyber, workers compensation and professional liability. These lines ranked at the bottom of the study with respect to customer satisfaction—not surprising given the volatility of workers comp, the shifting professional markets regarding inconsistent policy wording and the changing definition of a professional, and the fact that cyber is still not well understood.

Not having the right product offering can have a profound financial effect on the customer’s business, and for that reason commercial insurance products must be better integrated into the customer’s business from a product, claim and risk management perspective. To achieve a high level of customer satisfaction, insurers must understand their customers’ business requirements and learn how to better integrate product offerings into those requirements.

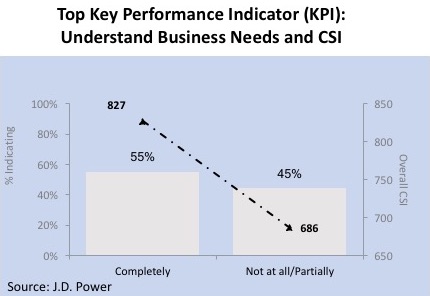

In fact, demonstrating understanding of customers’ business needs is one of the most impactful Key Performance Indicators (KPIs) for large commercial insurers. Often, customers conduct business in niche industries and markets that typically require greater expertise on the part of their insurer; thus, having their insurer understand what they do is critical to their experience.

The impact on satisfaction when this KPI is missed (141 points) is the greatest across the top KPIs in the study. While this KPI is an industry best practice, it is not a standard practice. The compliance rate, or the rate at which insurers deliver on this practice, is only 55 percent. The balance of the time (45 percent), customers say their insurer either “partially” or does “not at all” understand their business. That’s nearly half of customers feeling as if their insurer—the company that may be responsible for the survival of their business in case of a significant insured loss—doesn’t even understand what they do. No wonder customers have a pretty low opinion of their insurer.

KPMG’s Insurance CEO Outlook Report from August 2017 found that CEOs are now starting to understand how critical the customer really is to their success. Half of the CEOs reported they have aligned their middle and back office operations to become more customer-focused, while 68 percent have taken personal responsibility to protect their customers’ interests.

However, 43 percent of the CEOs report being concerned with the lack of quality customer data, which they believe hinders customer insights. Similarly, the Large Commercial Insurance Study found that understanding the customer journey through the customer’s eyes puts insurers on the right track to improving that experience, and without a clear insight into the customer, the insurer has slim-to-no chance of meeting customer expectations. How insurers achieve this greater insight into their customers must be a critical part of their strategic initiative now rather than later.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage