XL Catlin’s North America Construction insurance business recently hit a major milestone, surpassing the $2 billion gross written premium mark.

Executive Summary

How did XL Catlin build a $2 billion business in North America Construction? A project-centric leadership, planning and execution model and a dedicated team of efforts focused on one customer segment—North America’s top construction contractors—helped it become a $1 billion business in just four years and a $2 billion business just 18 months later.Here, Gary Kaplan, president of the division, describes the project-centric process used to prioritize efforts on what matters the most, the compilation of a talent database that fuels continued growth, and the use of metrics to keep things on track.

In other words, in its six-and-a-half years of existence, this dedicated team underwrote $2 billion of multiline insurance coverages exclusively to the construction industry. The most interesting thing about this feat is that, having hit the $1 billion premium milestone in 2015, we doubled it in just a little over 18 months. This says a lot about the vitality of our current construction market, but it also says quite a bit about how a team that is dedicated to serving its customers can achieve such unbelievable success.

Here’s a bit more about why, in my opinion, our team has succeeded and is poised for continued growth, profitability and success.

Establish a Vision and Set Strategy

Building this business unit was both the easiest and most difficult thing that I have personally ever done. The easy part was recognizing what the customers—top contractors—wanted and seeing the opportunity. The best contractors in North America want an insurance partner that works with them to help them grow profitably, provides a complete solution to their risk management needs and is responsive by listening well. And most importantly, they want a partner that will execute on what they say through the development of products, services and talent required for delivering on those needs.

At the time we started building, other carriers were moving away from this customer-centric focus and were busy focusing on building internal efficiencies. Unfortunately, such a focus often comes at the expense of delivering what customers needed. Clearly, there was an opportunity.

The hard part came in writing the actual business plan, which when done included six insurance lines—primary casualty, builders risk, subcontractor default insurance, professional liability, pollution and excess casualty—plus dedicated risk engineering. The plan also had a big, hairy, audacious goal built into it: achieve $1 billion in premium in six years. The company leadership agreed, however, and put enthusiastic support behind the plan.

To get the ball rolling, we used a process called a WorkOut to launch the Construction Business Unit in 2010. This process can be used to quickly develop an operational plan. The output was 13 projects designed to put in place all we needed to hit the plan in the first year. More than 35 people volunteered to help, as we only had two employees at that time. These projects were complete within 90 days, and we were off and running as a new business unit. (Editor’s Note: WorkOuts, commonly associated with General Electric Co. and Jack Welch, the former chairman of GE, and Rapid Results Initiatives, referred to later in this article, are also described on the website of Schaffer Consulting, which collaborated with Welch in devising these business strategy development methods.)

Since we hired a permanent team in Construction, we have used Operational Planning each December to develop a portfolio of about 50 prioritized projects that we execute during the following plan year. (The timeline for Strategy Update and Operational Planning is described in more detail below.)

Build the Right Talent and Culture

We spent months perfecting the business plan before we officially launched the new business for a 1/1/11 start. During that time, we spoke to construction brokers, contractors and people working in construction insurance about our plan and the type of people we would need to make it successful. This was, by far, the biggest risk in the plan. Would a brand new business be able to attract top talent who would share our vision to totally commit and focus on North America’s top contractors?

When we began gearing up, we started compiling a unique database of industry talent. This wasn’t just a spreadsheet of names. We documented expertise, where they learned the business, current employers and what positions they might fill. But most importantly, we included a measure of how well each person would fit on our team. The database now has almost 1,200 names, and we’ve used it extensively as we’ve expanded. This tool has allowed us to grow at more than 45 percent average annually with the right people in the right geographic locations adding the right contractors to our pool of top contractors. This process helped us find people who not only were experts in their own line of business but could also represent the entire construction vertical as we focused on building lasting relationships with North America’s top contractors.

More importantly, the business plan seemed to appeal to the best talent in our market. In fact, many of those who joined us said the reason they made the move was because they wanted to work on a tight-knit team focused only on the best contractors. And once we started to add top talent, other top talent followed. People wanted to work on this team and are proud to be part of it. A key reason for this is our focus on development—not just training, though that’s important. We make sure colleagues can move around within the team across the profit centers and support functions.

The Extended Leadership Team (ELT) was created to ensure we develop the next generation of leaders. Developmental activity is a big part of being a member of our ELT. The members are joining the Construction Leadership Team (CLT) this year during the Strategy Update in May and Operational Planning in October. When not meeting face to face, the members of the CLT focus on development of the ELT via conference calls including topics such as:

- Finance 101: What Every Leader Needs to Know

- Building Development Plans

- Actuarial Deep Dive: Leadership and Reserving Practices

- Project Management: Application as a Leader/Underwriter

- Managing from a Distance

- Effective Communication/Using Charts

Our overall goal is to continue to engage and support the leadership growth of the ELT to have a pipeline of talent for the future both inside and outside of the business unit.

A Project-Centric Leadership, Planning and Execution Model

We’ve adopted a project-centric leadership, planning and execution model. It’s a process where we prioritize our efforts on what matters the most. I’ve been refining the model for most of my 38-year career. We used it from Day 1 to start up the Construction business at XL Catlin, and we use it every day to lead the business.

The focus on project-centric leadership may have started for me as a young student in science class. I always loved the process associated with experiments. State a hypothesis and either prove or disprove it through experiments—just like we do with projects.

When I began my career with one of the largest property carriers, I often volunteered to be a team member or leader on projects that would improve the way we did things. And as a risk engineer, I reviewed hundreds of projects for customers, some of the largest oil and chemical companies in the world. Many of these were construction projects. I could clearly see how projects were so important to changing the way these companies competed. I also began to see how executing successfully on bigger and bigger projects led to more and more responsibility for me personally.

The model provides a road map of what to do and when to do it. And it works for all leaders—both functional and business leaders—because it does all of the following:

- Focuses on results.

- Provides an effective change management process.

- Incorporates the voice of the customer.

- Leads to better decisions.

- Spurs innovation and continuous improvement.

- Develops talent.

- Empowers people through accountability and engagement.

- Boosts morale.

- Tests critical assumptions.

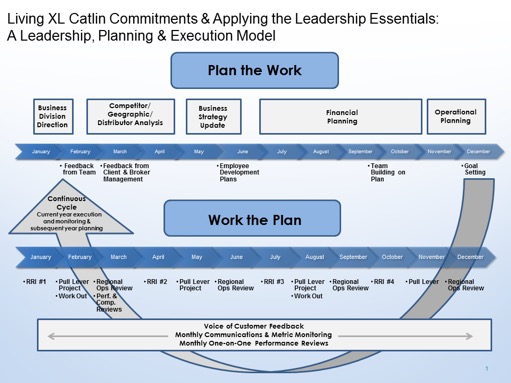

It takes all year to Plan the Work, including a strategic, financial and most importantly an operational plan. During that same year, leaders must Work the Plan that they created the prior year, executing the operational plan to make the changes needed to implement the strategy and hit the financial plan. We use projects to initiate change and stimulate performance that assures we execute what matters most and helps to achieve our plans and optimally serve our customers.

It takes all year to Plan the Work, including a strategic, financial and most importantly an operational plan. During that same year, leaders must Work the Plan that they created the prior year, executing the operational plan to make the changes needed to implement the strategy and hit the financial plan. We use projects to initiate change and stimulate performance that assures we execute what matters most and helps to achieve our plans and optimally serve our customers.

Even though planning is a continuous process, it typically starts by taking into account direction from your boss or senior leadership. We then develop our own vision and mission statement to make it crystal clear to our team members where we are going. Our team then conducts an in-depth competitor analysis to provide needed market context for developing and updating the business strategy. With the strategy set in May, we are much better prepared for financial planning that starts in June.

For each of these steps to be successful, it’s critical to have input from all levels of your team. Not only does it provide you with more diverse thinking, it also strengthens buy-in when it comes time to deliver. The same is true for the Operational Plan developed prior to the new year in December. The Operational Plan needs to be a top-down/bottom-up process with all members of the team setting and agreeing on priorities. Our team uses a 2×2 matrix to prioritize (urgency versus value) and to track projects needed to hit the financial plan. We then review for progress with all team members during our monthly virtual conference calls.

The lower half of the model is called Work the Plan. We launch projects from the Operational Plan sequenced throughout the year to stimulate performance, change processes to improve efficiency, create new products and services, address profitability issues, grow in certain markets or segments, take advantage of opportunities, and address issues identified through metrics and operational reviews. We use 90-day, results-focused projects called Rapid Results Initiatives (RRIs). RRIs are team-based, problem-solving, change-driving projects, which were originally developed by Schaffer Consulting. Because it’s a sprint, the RRI team needs a tightly focused, result-oriented goal to keep them engaged and on track.

(Read more about RRIs in my article, “It’s All About the Pace: Using Rapid Results Initiatives (RRIs) to Drive Change.”)

The best way to develop your people is through effective delegation and coaching. Projects are almost perfect for this purpose. The RRI process includes a sponsorship statement and goal-setting by the team, which helps to clearly communicate the challenge and what outcome is expected.

We review the Operational Plan every month, adjusting it as needed based on what we hear from customer feedback, operational reviews and monthly performance metrics. All of that work sets us up nicely to repeat the cycle as we begin to develop the plan for the next year.

Boosting Accountability

An important part of ongoing communications about the plan is the utilization of metrics to inform our team. We develop a portfolio of metrics that let us know either monthly or quarterly where we are at against the plan. The top-line performance (gross written premium) is the easiest to measure. Knowing where we are at every month helps us decide what actions to take to proactively get us back on plan. We have initiated several grow projects over the years to address any shortfalls.

Assumptions are made as part of every financial plan. There are certain things that will or will not happen while executing on a plan that have to be considered as part of the math associated with developing a financial plan. Examples include hit ratios, quote ratios, changes to rate used to calculate premium, attachment points, limits provided, new premium and renewal retention ratios. The more assumptions that are correct, the more likely to hit the plan.

In an article on the XL Catlin website titled “It’s All About the Pace: Using Rapid Results Initiatives (RRIs) to Drive Change,” Gary Kaplan gives a primer on the business strategy development and project management tool developed by Schaffer Consulting, which Kaplan’s Construction team uses on a regular basis.

A critical aspect of the RRI process is the presence of “Zest Factors,” creating enthusiasm to generate results, Kaplan writes. Explaining this further, he says that an RRI “is a must-do project and the participants have a short time frame to bring forth the expected result.

As a result, the team members feel:

- Challenged and empowered.

- A sense of urgency.

- Excited, like taking part in a game.

- Driven, because stakes are high.

- Success is near and clear.

- A sense of accomplishment.

In the RRI article, Kaplan goes on to give a step-by-step guide for setting up an RRI, which includes setting a sponsorship statement, picking a team, holding a launch session, and outlining the roles of the sponsor, team leader and team facilitator.

More information on Rapid Results, WorkOut and other Schaffer innovations is available on the Schaffer website at www.schafferresults.com.

Each of our five profit centers also have at least five metrics that we calculate each quarter that are early indicators of our performance against the financial plan. If we hit or exceed (in a positive way) all of the top-line and quarterly metrics, there is a very good chance we will hit the financial plan. Again, early warning via these metrics allows us to quickly adjust what we are doing and to proactively impact performance for the remainder of the year.

Development Opportunities Everywhere, for Everyone

Knowing the numbers is really important for someone leading a business. Over my career, I have seen certain leaders who know the numbers perfectly. They are spot on reciting the number every time someone asks a question. But many times they do not know the relevance of the number in relation to the plan or even what direction the number was moving over time. I have always felt that it is more important to understand where the numbers (metrics) are trending and what to do about this movement. What levers should the leader pull to influence movement in the more positive direction? What projects have been implemented or should be launched to address this movement?

This model has been instrumental in helping the team make effective decisions. We prefer to use inclusive decision-making when we have the luxury of time. Using the Leadership, Planning and Execution Model allows us to be proactive, so we have the time to include our next generation of leaders. We understand the benefits of including many in important decisions: greater diversity of experience and thinking as well as higher buy-in to the ultimate decision made. However, we also understand that all decisions are not created equally. Some are time-sensitive. The extreme case is during a crisis where sometimes it is better to make a quick decision and allow for immediate feedback and adjustment instead of waiting for consensus before making a perfect decision.

Keeping the right team motivated and collaborating with each other is also important. With a team scattered across the country, having too many face-to-face meetings is often price prohibitive. Face-to-face meetings are important when people don’t know each other, like at the launch of a new project or when leading a new team. Face-to-face is also important for longer meetings—one or two days—like our Business Direction meeting, our Strategy Update and our Operational Planning session. Other staff meetings are held using the video conference system. Meetings that are report-out only can be done effectively using conference calls. This saves valuable time when the team is together, allowing them to focus on team building and the synergies of working together.

And let’s not forget the value of listening, which is why this whole Construction Business Unit was developed in the first place. Everyone on our team is charged with listening to the voice of the customer. We invest considerable time in learning to listen better—not only to the customer but also to each other. The time is well spent, hearing what our Construction colleagues have to say and responding as a leader, coach or mentor.

Final Thoughts

It all started with getting the right team focused on the right plan and giving them opportunities to learn—to take hold of a project and run with it. As a result, in my opinion, not only did we build what most would consider the best group of construction specialists in the industry; we built a business model that works under the most competitive conditions, develops skills, and pushes teams to think in new innovative and collaborative ways. And it appears to be working very well.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?