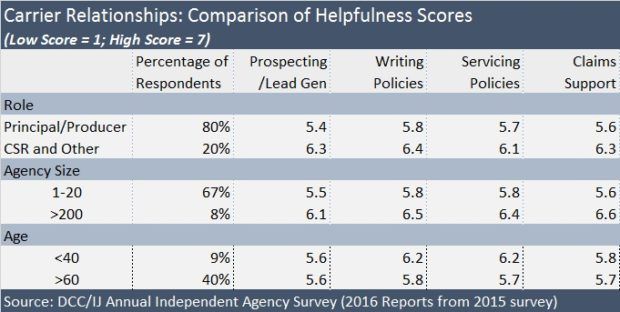

Looking across different slices of the data from two years of surveys, a few numbers stand out among a range of scores that generally fell between 5 and 6.

- The lowest “helpfulness” scores for any activity/agency group combination came in for prospecting technology from agents working in midsize agencies (between 76 and 200 employees), at 4.6.

- In the prior survey, the under-40 group also delivered the lowest score (4.5) and it was also for technology—but technology to help with claims rather than sales leads.

- Other marks under 5.0 in the latest survey came from agents working in multiline agencies (with balanced books of personal and commercial lines business), who gave an average low score of 4.9 to technology for claims support. The under-40 group gave the same weak 4.9-average score to technology for prospecting and lead generation.

- Principals and producers, as a group, tended to assign the lowest scores for the help they get from carrier relationships for all activities, while CSRs give the highest ratings. Similar trends play out on relationships scores grouped by age of respondent and size of agency—with smaller and older respondents giving the lowest scores—suggesting some overlap in the results. (More CSRs and younger agents were represented in the populations of the larger agencies delivering higher scores.)

- At the other end of the spectrum, there were a few groups of agents assigning average scores above 6.0 in the latest survey. The highest was a 6.6 assigned by respondents from the largest agencies (more than 200 employees) for the boost they get from carrier relationships when dealing with policyholder claims. That’s up from 6.0 for a comparable group answering the prior year’s survey.

- Other high scores came from the same group of very large agencies assigned for the value they derive from carrier relationships when they are writing policies and from CSRs for the same thing—both averaging 6.5 across the respective groups.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers