Across many sectors of the insurance industry—including cyber, reinsurance, even marine—market hardening is forecast to persist despite slowly easing inflation. Even when market conditions for the insurance industry are less than ideal, though, MGAs are well-positioned to uncover new growth opportunities. This skill to adapt and thrive at the leading edge of emerging risks is what sets competitive MGAs apart.

For MGAs looking to grow by capitalizing on new niches or honing their expertise for specialty lines, there are proven routes to success.

>>Read also: Five things to know about today’s MGA landscape

Three avenues to growth for MGAs

MGAs have three main avenues to increase revenue, each with separate pathways and unique considerations. Extracting more value out of current lines of business is the most direct avenue for growth, but the pathways of raising rates or writing more business may be unfeasible in certain cases. If rates increase too much, an MGA risks being underpriced by a competitor. For well-established lines, the market may be fully saturated, with no realistic potential to increase sales.

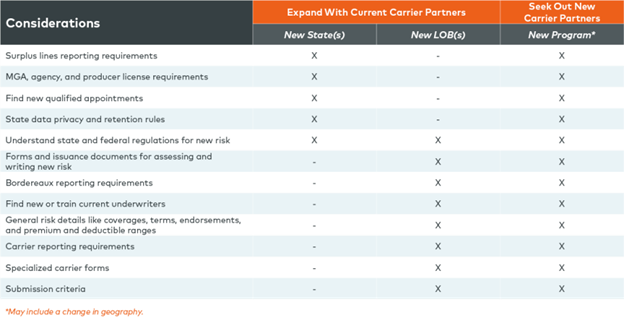

The second avenue for expansion centers on opening new lines of business with current carrier partners or entering new territories with their backing. For the third avenue—the most ambitious and intensive without the right guides to navigate—MGAs can also seek out new carriers with which to launch entirely new programs. To be attainable, these pathways require substantial preliminary research, and there are several considerations MGAs should be aware of before proceeding.

To help, this table illustrates the main considerations for MGAs thinking of expanding through new states, new lines of business, or new programs.

Considerations for MGAs exploring new growth opportunities

The process for MGAs preparing to expand

To open a new line of business or enter a new state, MGAs must do their research. They must scope out prospective competitors, determine how best to distinguish their offering, and identify carrier partners that can support a program in the target market with excellent coverage at competitive prices—and without channel conflicts. All of this must be completed before even writing the business plan.

Once the business plan is written, MGAs must examine their internal operations to ensure they have the right staff to sell, quote, underwrite, and service this new program business. If the team checks all these boxes, then it’s time to establish an agreement with a carrier. This work consists of defining coverage, rates, forms, carrier-specific underwriting needs, commissions, and all other pertinent information to include in the carrier agreement.

Once the carrier agreement is finalized, the work begins with agencies and brokerages. MGAs may need to scope out new or additional retail agencies. through sources such as Neilson Marketing or Program Business.

New Program Research Checklist for MGAs

Reviewing this checklist can help you get the most out of your research.

The best way forward

Whatever path MGAs take to expand their business, they all depend on trustworthy data resources to accurately navigate this process. Access to publications from top insurance publishers provides leading MGAs the up-to-date, critical risk profile information they need to quickly underwrite high-profit, complex lines of business.

If you’re ready for forward-looking solutions with proven results, see how Vertafore can help.

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers