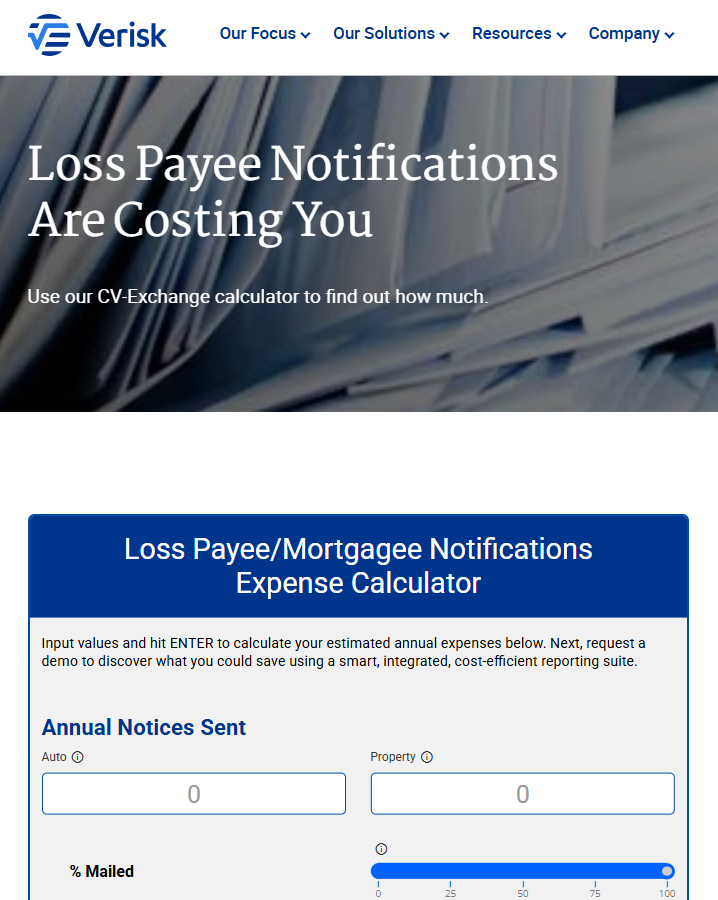

Verisk recently added a new online Loss Payee/Mortgagee Notifications Expense Calculator to help P&C insurers estimate annual expenses for manual loss payee and mortgagee compulsory reporting obligations.

Reporting is complex, costly, constant, and compulsory

Reporting activities challenge P&C insurers with competition for technical resources, inefficient workflows, and rising costs. These obligations add no revenue, making efficiency essential.

For more than 50 years, Verisk has set the standard in supporting legal and regulatory insurance compliance. While many in the industry know of our deep compliance roots, some are less aware that we also help support insurers in keeping insurable-interest parties interconnected to policy, insured, and lien details.

Loss payee and mortgagee notices are inefficient and cumbersome

Is your loss payee notice process as efficient as it could be? Check out the online Loss Payee/Mortgagee Notifications Expense Calculator to estimate your annual expenses to see how much it is costing you.

Lienholders account for 10% of inbound contacts for auto insurers and up to 50% for property insurers.1 In addition, postage costs rose 46% over the past 10 years, with four rate hikes in the past two.2

There’s a better way to manage these required tasks: “Hang up the phone” on manual coverage verifications with an integrated platform that streamlines loan and insurance data flows across the digital ecosystem.

Reduce resource strain, cost, and distraction

CV-Exchange® tames outbound interested-party reporting logistics, while CV-Policy Portal provides a platform for validating inbound insurance inquiries from a growing network of credentialed users, including loss payees, trackers, additional interests, and dealerships.

- Deliver policy change notices to carriers from lienholders, loss payees, mortgagees, lessors, and others

- Navigate labor-intensive communications between lenders and insurers seamlessly

- Facilitate the exchange of coverage verification and change requests via a secure, streamlined hub: CV-Policy Portal

- Simplify proof of distribution, address correction, return mail, and escrow invoice handling with an audit-ready web portal

CV Services: Smart, once-and-done reporting

Coverage Verifier (CV) provides a rich resource to power the CV Services Integrated Reporting Suite—a comprehensive platform that blends innovation with extensive insurer and lender contributory networks to manage reporting functions across multiple lines of business, including personal and commercial auto and property, so insurers can focus on revenue and growth.

At its heart, a state-of-the-art decision engine drives an intelligent approach to meeting legal and regulatory requirements by combining policy events, configurable business logic, and scalable automation to help optimize each distributed notice for accuracy and recipient-specific compliance.

This comprehensive suite is not limited to modernizing loss payee and mortgagee reporting, it helps automate complex automobile liability insurance reporting (ALIR) to state departments of motor vehicles, streamlines cross-industry communications, and detects changes at each stage for critical policy updates.

Stop burning time, money, and resources on manual and inefficient reporting. Free your team to focus on growth and revenue instead of paperwork. Check out the calculator and then request a demo to find out how much you could save by outsourcing compulsory reporting.

- Verisk client experience

- United States Postal Service first-class postage rates, Wikipedia, December 2025

Stacy Howard, Assistant Vice President Product Management at Verisk. manages the CV Services Integrated Reporting Suite, supporting compulsory reporting and notice distribution among carriers, state departments of motor vehicles, and lenders. She has 20+ years of experience in the P&C insurance industry, with expertise in data compliance and supporting insurance carriers in a business process outsourcing environment.

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists