The U.S. workers compensation insurance market achieved a “significant” underwriting profit in 2015, but trends call into question whether such a result can be repeated, Fitch Ratings concluded in a new report.

The U.S. workers compensation insurance market achieved a “significant” underwriting profit in 2015, but trends call into question whether such a result can be repeated, Fitch Ratings concluded in a new report.

For 2015, the workers compensation combined ratio came in at 95.4. That is a remarkable improvement compared to 2011 through 2014, when the sector’s combined ratio was 117.3, 110.3, 103.1 and 102.4, respectively, according to SNL Financial data cited in the Fitch report.

“Calendar-year 2015 represents the culmination of a complete turnaround for the workers compensation line,” the Fitch report stated, crediting the good results to factors “including strong premium revenue growth from better pricing and economic factors, favorable loss cost trends, and favorable loss reserve experience tied to more conservative reserving practices.”

Fitch also noted that aside from a brief recession-era spike, workers compensation claims generally trended downward in recent years due to “the evolution of better risk management and employee safety practices.”

Workers compensation as a sector even enjoyed favorable reserve development in 2015, with greater reserves helping to boost segment underwriting results for the last four years. This was particularly important in 2015, with a boost in reserves helping to decrease the calendar year loss ratio by more than 5 percentage points, Fitch said.

Fitch suggests, however, that the successes achieved by the U.S. workers compensation industry in 2015 may represent a cyclical peak.

One reason: Success in workers compensation underwriting, plus large levels of capital for insurers, is spurring greater price competition. Premium rates declined for the last five consecutive quarters and this should continue through 2016, Fitch said.

Revenue growth has also tapered down somewhat. Written premium volume produced an average growth rate of about 7 percent from 2012 through 2014. That number decreased to 3.5 percent in 2015, and Fitch warned that payroll exposure growth from job and wage expansion will be a factor that determines whether revenue growth can offset declining prices.

Moving ahead, Fitch also expects some profit deterioration, with an underwriting loss likely in 2017 and beyond due largely to competitive pressures. Fitch projects a workers compensation industry combined ratio of 98 for 2016. One glimmer of hope: Fitch said that weaker investment contributions to earnings is spurring less aggressive underwriting and pricing.

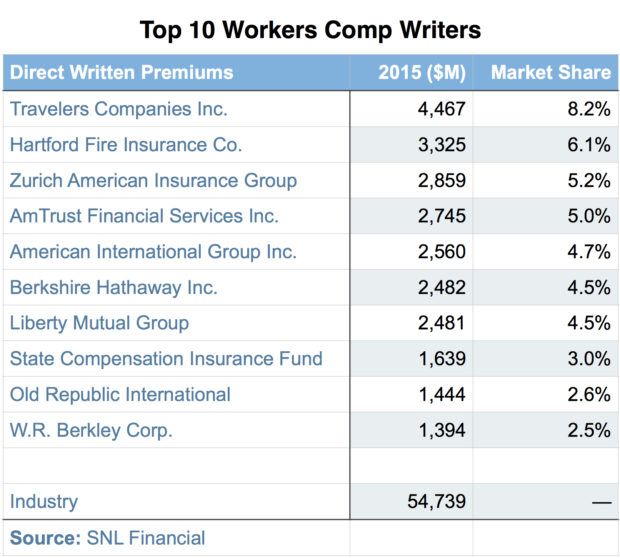

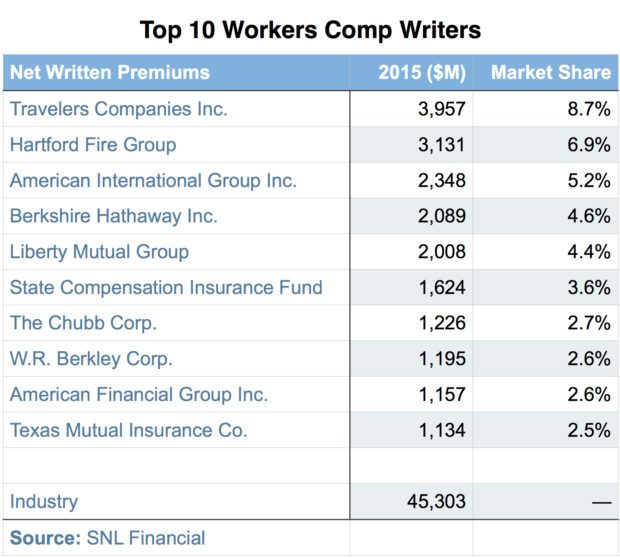

Travelers Companies scored as the top workers compensation writer in 2015 in terms of direct written premium (nearly $4.47 billion with an 8.2 percent market share), and net written premiums (almost $3.96 billion and an 8.7 percent market share).

Hartford Fire Group (part of Hartford) came in second in terms of direct written premiums ($3.3 billion, 6.1 percent market share) and net written premiums ($3.1 billion, 6.9 percent market share).

Former market leaders AIG and Liberty Mutual Group have pulled back from the market somewhat, and their results reflect accordingly.

AIG is now the 5th most popular workers compensation writer in terms of direct written premium, with $2.56 billion in premium and a 4.7 percent market share. For this category, Liberty Mutual placed 7th, with $2.48 billion in direct written premiums and a 4.5 percent market share.

In terms of workers compensation net written premiums, AIG is in third place for 2015. The insurer booked $2.3 billion in net written premiums and carved out a 5.2 percent market share. Liberty Mutual placed 5th, with $2 billion in net written premiums and a 4.4 percent market share.

Worth noting: While AmTrust Financial Services places fourth on the list of top workers compensation writers in terms of direct written premiums ($2.7 billion, 5.2 percent market share), it lands in 13th place in terms of net written premiums ($1 billion, 2.2 percent market share). Similarly, Zurich comes in third place regarding direct written premium ($2.86 billion, 5.2 percent market share), it is in slot number 14 for net written premiums ($998 million, 2.2 percent market share).

Source: Fitch Ratings

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster