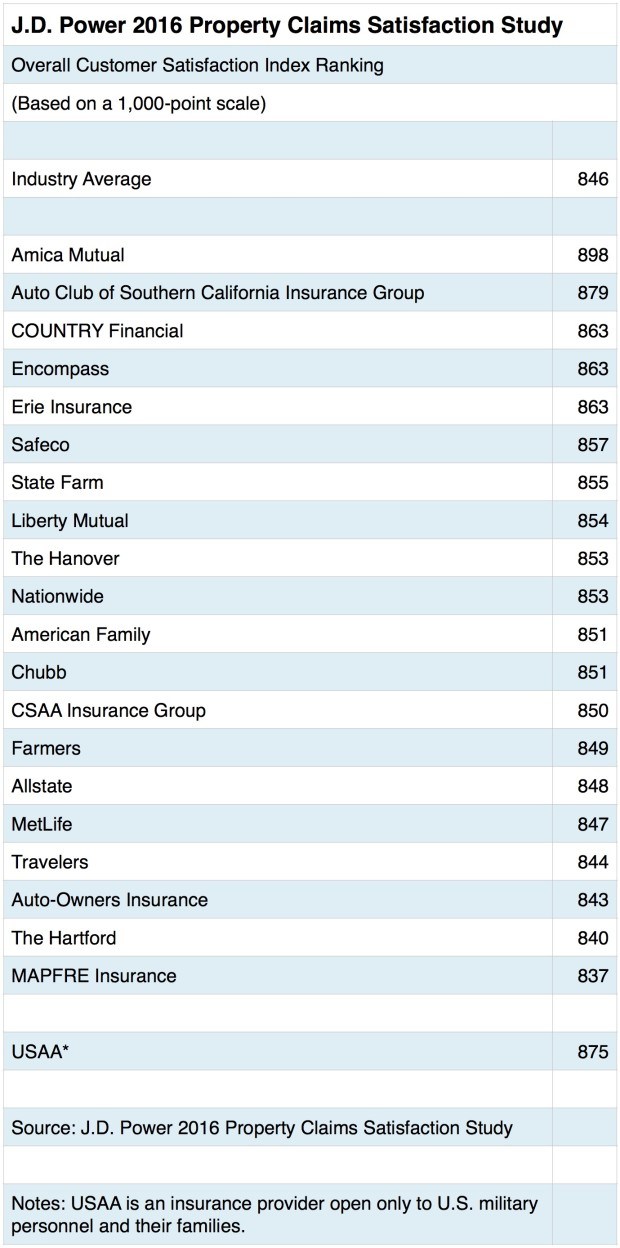

Amica Mutual ranked highest in overall satisfaction among homeowners who have filed a property claim, according to the J.D. Power 2016 Property Claims Satisfaction Study, which found household names like Nationwide, Chubb and Travelers ranked lower this year than last.

For the first time in five years, customer satisfaction with the claims process slipped for the industry overall, with the overall satisfaction score tumbling five points to 846 (on a 1,000 point scale) in 2016 compared to 851 in 2015.

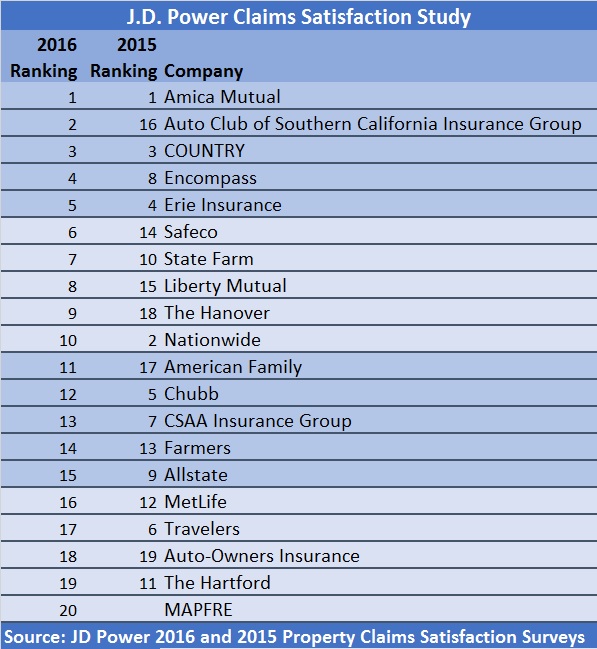

Amica, however, maintained its No. 1 spot on the J.D. Power ranking with a score of 898—10 points higher than its score in 2015.

Auto Club of Southern California Insurance Group vaulted up the ranking chart, soaring to a second-place ranking from 16th place among the top 20 last year. The California company’s score advanced more than 30 points (to 879 in 2016 from 844 in 2015).

Auto Club of Southern California replaced Nationwide as the No. 2 customer-ranked insurer for property claims handling. Nationwide, now ranked No. 10, had a score of 853 in 2016—down more than 30 points from its 2015 score (886).

Of the 19 companies that ranked in the top 20 in 2016 and 2015, eight moved up, with scores moving 15 points higher, on average. Moving in the other direction, scores decline 13 points, on average, for insurers that saw lower rankings in 2016. Like Amica, COUNTRY maintained the same position it held in 2015, coming in third place.

Besides Nationwide, Chubb and Travelers were among the insurers with score declines of 20 points or more, and those declines pushed both insurers out of the top 10.

Moving in the other direction, The Hanover saw its satisfaction score jump 27 points—to 853 in 2016—helping the Massachusetts-based insurer land in the top 10.

USAA received a lower overall satisfaction score, at 875 in 2016 compared to 895 in 2015, but the insurer was not included in the rankings because it is only available for U.S. military personnel and their families.

The 2016 Property Claims Satisfaction Study is based on more than 5,700 responses from homeowners insurance customers who filed a property claim between January 2014 and December 2015.

The study measures satisfaction with the property claims experience among insurance customers who have filed a claim for damages by examining five factors (listed in order of importance): settlement, first notice of loss, estimation process, service interaction and repair process. Satisfaction is calculated on a 1,000-point scale.

For more information on what factors caused the overall industry score to slip, see related article, “P/C Claims Customer Satisfaction Dips for First Time in 5 Years: J.D. Power.”

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs