Whether they are updating customer profiles, printing ID cards or simply viewing policy information, auto insurance customers are less satisfied with their online self-service experiences this year, according to the results of a J.D. Power Survey.

On a positive note, the J.D. Power 2015 Insurance Website Evaluation Study (IWES) released last week revealed better customer ratings from auto insurance shoppers seeking quotes on carrier websites.

To build the survey results, consumers performed a number of tasks online and then rated the ease of performing them on a five-point scale. J.D. Power used those ratings to compute an overall index for shopping and service experience based on a 500-point scale.

- The overall service satisfaction index averaged 420, down 5 points from 2014. Fifteen of 20 insurers included in the study posted annual declines, with some declining significantly in service satisfaction.

- The overall industry shopping satisfaction improved by a significant 17 points year over year to 369, with indexes for 19 of the 20 insurers coming out higher this year.

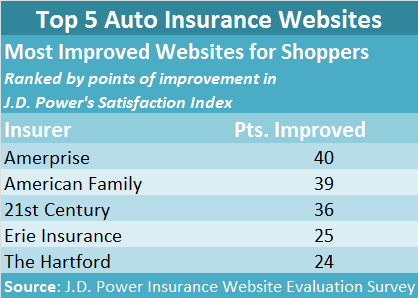

J.D. Power characterized 10 of the boosts as significant. Responding to an email inquiry, Valerie Monet, director of J.D. Power’s insurance practice, revealed the five insurers with the biggest positive changes in shopping indexes but declined to name those with lower service scores this year.

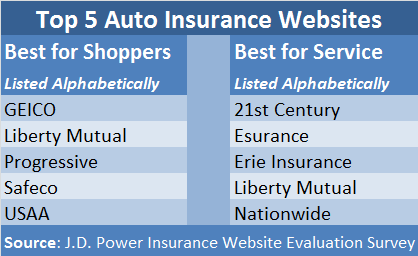

Monet also shared the names of the insurers with the best overall results for shopping and servicing.

“The J.D. Power Insurance Website Evaluation Study is designed to provide an objective assessment of auto insurance website usability for shoppers and customers,” Monet told Carrier Management in an email. “The study examines the functional aspects of websites rather than such aesthetic aspects as look and feel.”

Asked exactly what tasks determine each index, she said the overall Service Index model used in the 2015 IWES is comprised of nine tasks: log in to account; update profile; schedule a one-time payment; view policy and related information; research claims process; print or request replacement ID cards; locate contact information; add a driver/vehicle; and enroll in paperless billing.

There were five tasks used to determine the overall shopping in for 2015: request a quote; compare prices and/or coverage; research policy information; research discounts; and locate contact information.

The service task declining the most year over year was bill paying—down .06 points on a 5-point scale. This was also cited as the reason that most existing insurance customers have for visiting their insurer’s website, with some 39 percent saying that is the reason they venture online.

The most difficult self-service tasks performed by customers include updating their customer profile; printing/requesting replacement ID cards; and viewing policy and related information.

While ratings for all the shopping tasks have improved from 2014, the most notable improvements are in requesting quotes and comparing prices and coverage—each up by 0.17 points. Coming next in terms of gains was researching policy information, a task for which scores on a 5-point scale advanced by 0.15 points.

Still, despite all the money and effort insurers are putting into website improvements for all types of devices, researching policy information remains the most difficult aspect of the shopping experience, while finding contact information is the easiest.

Responsive Design Technology

According to J.D. Power, the percentage of consumers shopping for an auto insurer via smartphones and tablets has increased—up 14 percentage points to 42 percent for smartphones, and up 11 percentage points to 43 percent for tablets in 2015.

Some insurers have deployed websites with responsive design technology, enabling insurance shoppers and customers to view the same website content across a variety of devices and screen sizes, including desktop, smartphone and tablet. “Although 10 of the 20 largest insurers offer responsive design, this is not nearly enough to meet shopper and customer demand,” J.D. Power reports.

While responsive designs are generally providing experiences comparable to traditionally designed websites, according to survey results, differences in experience showed up when performance was analyzed by device. In particular, the responsive website servicing experience on a tablet scored 410, compared to 425 for the traditionally designed website servicing experience on a tablet.

J.D. Power said that this isn’t an insurance-specific problem. In other industries, responsive design websites struggle to provide an equally satisfying experience on smartphones and desktops, despite the site offering the same content/functionality.

Still insurers lag other industries in overall experience, according to Monet, “If the site doesn’t function well, regardless of the device being used, shoppers may turn to other sources for their insurance needs, while current customers will become frustrated trying to perform the tasks that are most important to them, driving them to contact their agent or a call center. These must be key considerations for insurers when making website enhancements.”

“Insurance companies are particularly challenged when it comes to designing their websites. Not only do they have to keep up with the changing technology as more consumers use tablets and smartphones, but they also have to build a site that meets the demands of both shoppers and current customers,” Monet said. “While providing an easy quoting experience and making sure information on the website is easy to find will help bring shoppers through the door, customer service expectations for online and mobile servicing are being led by other industries, such as banking.”

The 2015 IWES is based on more than 3,700 service evaluations and more than 4,600 shopping evaluations. The study was fielded in February and March 2015.

Insurance companies can contact their account representatives at J.D. Power to obtain copies of the study, Monet advised.

The 20 insurers included in the study are:

- 21st Century

- Allstate

- American Family

- Ameriprise

- Amica Mutual

- Auto-Owners Insurance

- Erie Insurance

- Esurance

- Farmers

- GEICO

- Liberty Mutual

- Mercury

- MetLife

- Nationwide

- Progressive

- Safeco

- State Farm

- The Hartford

- Travelers

- USAA

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Preparing for an AI Native Future

Preparing for an AI Native Future  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb