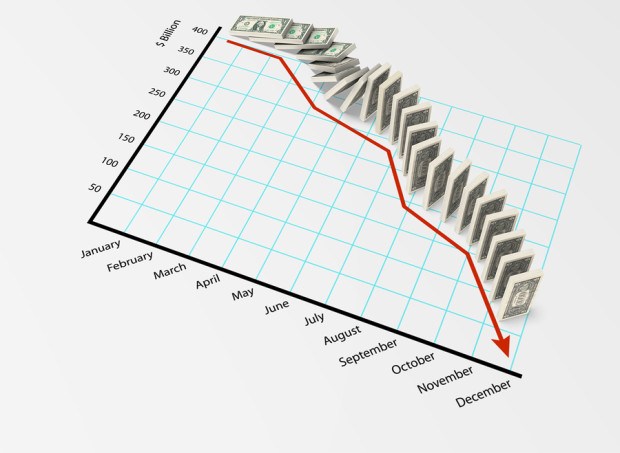

No matter how you slice it, overall program pricing for directors and officers liability insurance was down on average for the fourth quarter and the full year in 2014, according to the latest report from Aon.

In fact, the first number presented in Quarterly D&O Pricing Index report from Aon’s Financial Services Group for the fourth quarter is an eye-popping double-digit decline of 12.2 percent, comparing fourth-quarter 2014 pricing to fourth-quarter 2013. The report contains some important caveats that suggest a more reliable figure of 7.4 percent—still moving in the downward direction, however.

Separately, Aon Risk Solutions published a pricing index for employment practices liability insurance. Contrasting the D&O index, the EPLI index was up for the fourth-quarter by 3.9 percent.

Trends for small employer accounts explain some of what is happening on the EPL side, a footnote to the Aon EPLI report points out noting that these stand in contrast to EPLI price declines for larger insureds. On the D&O front, primary pricing, which had been moving up since first-quarter 2012 is starting to show signs of moving in the same downward direction as excess layer pricing, the D&O report reveals.

The D&O Index

Overall, Aon’s D&O pricing index, which tracks D&O premiums relative to a base year of 2001, came in at 0.86 for fourth-quarter 2014, compared to 0.98 for fourth-quarter 2013—suggesting a 12.2 percent pricing drop. The fourth-quarter 2013 figure, however, is heavily impacted by the long-term policy of a large financial institution that is not set to renew until second-quarter 2015, Aon’s report explains.

Suggesting a more reliable comparison would focus only on programs that renewed both in fourth-quarter 2013 and fourth-quarter 2014, Aon recalculates the 12.2 percent to come to a 7.4 percent decline.

On an annual basis, the story is similar. After three consecutive years in which the index averaged 0.90 (2011, 2012, and 2013), the overall index fell to 0.83 for 2014—down 7.8 percent. Adjusting again for the one large FI account (which was in the 2011, 2012 and 2013 calculations, but not 2014) by comparing pricing for only the programs that renewed in both 2013 and 2014, Aon calculates a 5.6 percent decline.

Digging deeper, to analyze the primary and excess components of D&O programs, Aon finds that overall price declines continue to be driven by excess-layer price drops. But there a hints in Aon’s policy data suggesting that primary layers may soon be on the same pricing trajectory as excess layers.

- Although the average primary D&O premium rose 1.4 percent for the full year in 2014, primary pricing on policies that renewed in both fourth-quarter 2013 and fourth-quarter 2014 (with the same limit and retention) decreased 0.2 percent, on average.

- Simply counting up the number of insureds that benefited from decreased pricing on the primary layer, Aon found that 26 percent were in this category during last year’s fourth quarter. While still in the minority compared to the 33 percent of buyers with flat renewals and 41 percent with primary price increases, the percentage of D&O customers experiencing primary price hikes has been growing in recent quarter.

- The 26 percent, in fact, is up from 24 percent in the third-quarter, 16 percent in fourth-quarter 2013 and 11 percent in fourth-quarter 2012—and it’s the highest level of primary D&O price declines reported by Aon since first-quarter 2012 (38 percent).

The EPLI Index

Examining EPL insurance, Aon reports that its 2014 EPLI pricing index was 1.05 for fourth-quarter 2014, compared to 1.01 for fourth-quarter 2013—an increase of 3.9 percent.

For the full year, however, the index dipped to 0.99—1 percent below the 1.00 index Aon calculated for 2013.

Aon attributes the full-year decline to decreases on large employer accounts, particularly in the first half of the year. These more than outpaced the rising premiums for small employer accounts, which continued throughout the year as increases in the frequency and severity of single-plaintiff claims drove insurers to seek higher premiums.

Explaining the fourth-quarter rise, Aon said: “Overall, however, our experience reflects the same trending as earlier in the year which is that accounts with retentions above $500,000—and especially above $1 million—are generally seeing decreases, while accounts below $100,000 are still seeing increases, especially [those] with any California exposure.”

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes