Using terminology that’s more common among weather forecasters and catastrophe event modelers, a commercial lines insurance executive described an increasingly uncertain risk landscape uncomfortably coupled with a declining trajectory of insurance prices last week.

Still, Neeti Bhalla Johnson, president of Global Risk Solutions (GRS) at Liberty Mutual, said she was confident in her team’s ability to navigate a dynamic operating environment in 2025, after the segment reported improved underwriting profits for the fourth quarter and the full year in 2024 compared to the same periods in 2023.

Speaking during Liberty Mutual’s fourth-quarter earnings conference call, Bhalla Johnson said, “Loss cost pressures in the aggregate remain high with a large cone of uncertainty around trends across different lines.”

“Loss cost pressures in the aggregate remain high with a large cone of uncertainty around trends across different lines… The industry is seeing positive but decelerating price increases, which stand in contrast to sticky high and more uncertain loss cost trends.”

Neeti Bhalla Johnson, Liberty Mutual

“It’s worth noting that the World Uncertainty Index has risen sharply and is at its highest point in the last five years,” she said, referring to a measure of uncertainty from economic and political events developed by the International Monetary Fund in 2020.

“Meanwhile, increased competition fueled by cumulative rate increases across many lines and geographies is leading to a rapid softening in the cycle,” Bhalla Johnson said, noting that loss cost trends across commercial lines was in the mid-single-digits in 2024, with North America trends sitting above international.

“While the pricing cycle isn’t one-size-fits-all across lines and geographies, the industry is seeing positive but decelerating price increases, which stand in contrast to sticky high and more uncertain loss cost trends,” she said.

The executive reported that the aggregate pricing change for GRS, which mainly houses larger commercial, specialty and reinsurance businesses (and a small amount of personal lines business outside the U.S.), was 4 percent in the quarter and 5.4 percent for the year, excluding sharing economy business in commercial auto.

A slide accompanying her presentation showed commercial auto renewal rate changes in the mid-teens in 2024—the highest for any of the commercial and specialty lines captured on the slide—and the lowest retention (just over 70 percent in the fourth quarter). Bhalla Johnson noted that commercial property rates decreased throughout 2024, although executives believe the line remains “rate adequate.”

“Our underwriting discipline and diversified insurance and reinsurance portfolio provide us with the confidence in our ability to be there for clients as they navigate climate change and geopolitical risks,” she stated, also noting continued softening in cyber and D&O while describing specialty pricing overall to be “generally in line with loss cost trend.”

Offering some specific commentary on U.S. casualty, where she said increased litigation rates continue, Bhalla Johnson said, “While we may not share the optimism of some peers, we view the current market as responsive to loss cost trends.” Specifically, she noted that auto, umbrella and excess lines had mid-double-digits rate changes throughout all of last year and primary general liability rate change accelerated in the second half of the year, reaching low-double-digits.

U.S. excess and umbrella loss trends continue to rise, she said, noting “the leveraged impact of lengthening loss development in the primary coverages.”

“It is critical for casualty pricing to keep up with loss cost trends, and we must remain disciplined while also engaging with clients on mitigation,” she said.

While the executive repeatedly talked about maintaining a commitment to primary, umbrella and excess casualty product offerings, she also described the GRS segment’s transformation to become a more “risk-aware” business several times during her presentation. Beyond building underwriting expertise and specialty, risk-awareness means growing only in lines with appropriate risk-adjusted returns and “taking decisive actions in the areas of our portfolio where returns aren’t up to par,” she said.

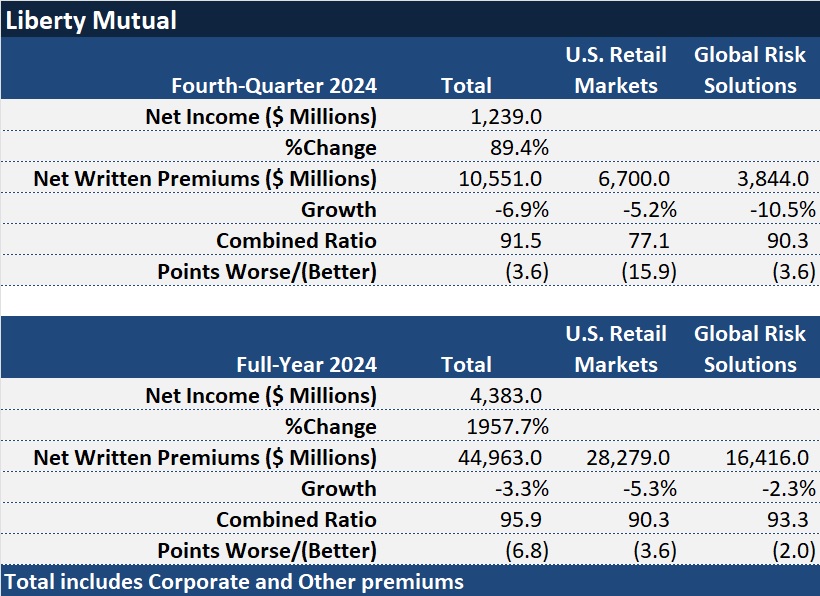

A 10.5 percent drop in GRS net written premiums in the fourth quarter of 2024 reflected “continued de-risking in less profitable pockets of our portfolio, primarily U.S. casualty, the re-estimation of premium assessments and the impact of an intercompany reinsurance transaction in the prior period that did not recur,” she said.

“While we continue to look for opportunities to optimize our growth, we will remain disciplined and maintain our focus on profitability,” she said. “Our rigorous execution and underwriting actions over the past three years have enabled us to deliver more consistent returns over time,” she said, highlighting an underlying GRS combined ratio of 88.4 recorded in the fourth quarter, 5.3 points lower than fourth-quarter 2023.

The underlying combined ratio excludes catastrophe losses and some prior-year loss development. Including these impacts, the reported fourth-quarter GRS combined ratio was 90.3, and it was 93.3 for the full year—both improved from 2023.

Reserve Actions and a Knife Fight

Bhalla Johnson made her comments after Hamid Mirza, president of Liberty’s U.S. Retail Markets business, consisting of U.S. personal lines and small commercial businesses, described the significant improvement in the results for that segment. “With profit challenges firmly in the rearview mirror, we are primed to fight for market share in 2025 and beyond,” Mirza said, at one point noting that the company is particularly bullish on its prospects for “winning in the package business” for personal auto and homeowners together.

Related articles: Liberty Mutual Q4 Income Up Nearly 90%, Year Earnings Climb ; Liberty Mutual to Sunset Safeco Brand in 2026

Liberty Mutual President and Chief Executive Officer Timothy Sweeney led off the call, reporting that the carrier closed the year 2024 with the strongest balance sheet in its history and its lowest combined ratio in 20 years.

Contributing to the strong balance sheet was loss reserve strengthening of $760 million in the quarter and $683 million for the year. Chief Financial Officer Julie Haase reported that the full-year boost represented roughly 1 percent of overall reserves and reduced pretax income by about 10 percent.

“We had a very strong earnings year, and I think that context is important… It really was a management decision to mitigate the uncertainty and the future volatility in those lines of business that have the highest potential impact from emerging mass torts and legal system abuse,” she said. Explaining that the additional reserves are booked in the corporate segment rather than the operating businesses, she said they were not a reaction to anything more specific than the legal landscape. “I think about it more as a level of prudence to protect against negative surprises in the future,” she said.

Sweeney and Bhalla Johnson addressed questions about how Liberty Mutual is addressing the problem of “legal system abuse” as the company handles individual claims. An analyst questioned an industry practice of settling claims quickly, suggesting that this drives more activity from the plaintiffs’ bar.

Related articles: A New Claims Playbook: United and Street Smart on Litigation Demands; Unite and Conquer: How the Insurance Industry Can Deflate Social Inflation

“It’s better to close the claims fairly for our policyholders and make them whole before the…litigation begins, because ultimately our job is to make sure that our products and services are available to our customers—and that they remain affordable,” said Sweeney, referring to “cynical attorneys and some private equity firms that are funding” litigation, which will ultimately make liability insurance less affordable for individuals and businesses.

“Sadly, change doesn’t usually happen until there’s a crisis,” he said, noting that Liberty Mutual is “underwriting around” judicial hellholes in the same way that carriers underwrite around natural catastrophe risk as they wait for tort reforms in those litigious regions.

“We’re attacking on the underwriting side, avoiding risks where we know there’s unhealthy legal situations, [and] we are adjusting our claims processes…to just get the claims closed more quickly—so that cynical attorneys cannot take a small, run-of-the-mill claim where we, of course, are going to make our policyholder whole, and cynically turn that into something that it’s not.”

“If you close the claim, you’re in better shape,” he stated.

Bhalla Johnson offered some claims statistics, suggesting that litigated commercial auto bodily injury claims stay open four-times as long as settled claims, with severity coming in 12-times higher. Still, it’s not one size fits all. “You really do have to cut your data very granularly. You have to cut it between litigated and non-litigated in commercial auto and general liability. There are some signs of stabilization,” with claims closing earlier in those lines. “But frankly, on the umbrella side, it’s the reverse. We continue to think that’s a great area of concern because that’s where you see the leveraged impact of these lengthening loss development factors,” she said.

She also noted that different clients will take different approaches to the question of settling faster. “I hate to be dramatic about it, but we tend to say this is a knife fight at the end of the day.”

She also noted that different clients will take different approaches to the question of settling faster. “I hate to be dramatic about it, but we tend to say this is a knife fight at the end of the day.”

Beyond putting up a defense in the ultimate battle, Bhalla Johnson also spoke about helping clients to play offense. “The ultimate purpose of the offense is to tame legal system abuse before the claim is filed, but the purpose of the defense is to mitigate any downside risk when the claim is filed. You have to do both,” she said, concluding that “legal system abuse is a multidimensional issue [that will] require dynamic solutions.”

“The plaintiffs’ bar is constantly adjusting their tactics. Our clients and insurers have to also constantly adjust their tactics,” she said.

Tariff Impacts Manageable

Sweeney also addressed questions about the impact of the imposition of U.S. tariffs on Canadian and Mexican imports being introduced by President Donald Trump’s administration on Liberty Mutual’s personal auto business. Like executives at other companies, he said the fact that the insurance business has been repaired from prior inflation challenges gives the company breathing room.

“We’re really talking about three to four points of combined ratio impact on our consumer business if tariffs lead to another spike in inflation,” Sweeney estimated. “A three-to-four-point combined ratio risk is much more palatable when your starting point is at a 93 combined ratio than when it’s at a 101,” he said. “We have a much, much stronger starting point than we did two, three years ago. We have much better predictive analytics looking forward, and we’ve already modeled out the impacts of tariffs.”

“While they would be unpleasant, they would be perfectly manageable,” he said.

Related article: Progressive’s Margins Leave Room for Tariff Impacts; Others Ready Too

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers