Innovation in the insurance industry, accelerated by COVID-19, has continued largely due to consumer appetite and market competition, according to a newly released report by AM Best.

Predictive modeling and artificial intelligence are two ways reinsurers are developing new products, AM Best’s Special Report on post-pandemic insurer innovation noted.

Reinsurers had the largest share of Innovation Leaders, 9 percent, innovating in enterprise risk management, portfolio construction and risk accumulation. Innovation Leader is the highest designation that AM Best assigns as part of its innovation assessment process.

With market hardening in recent years due to a confluence of catastrophes, secondary perils and inflation, reinsurers have increasingly focused on risk appetite and selection.

Tailored coverages, risk modeling, and alternative risk funding vehicles have assisted reinsurers in maintaining their lead when it comes to innovation.

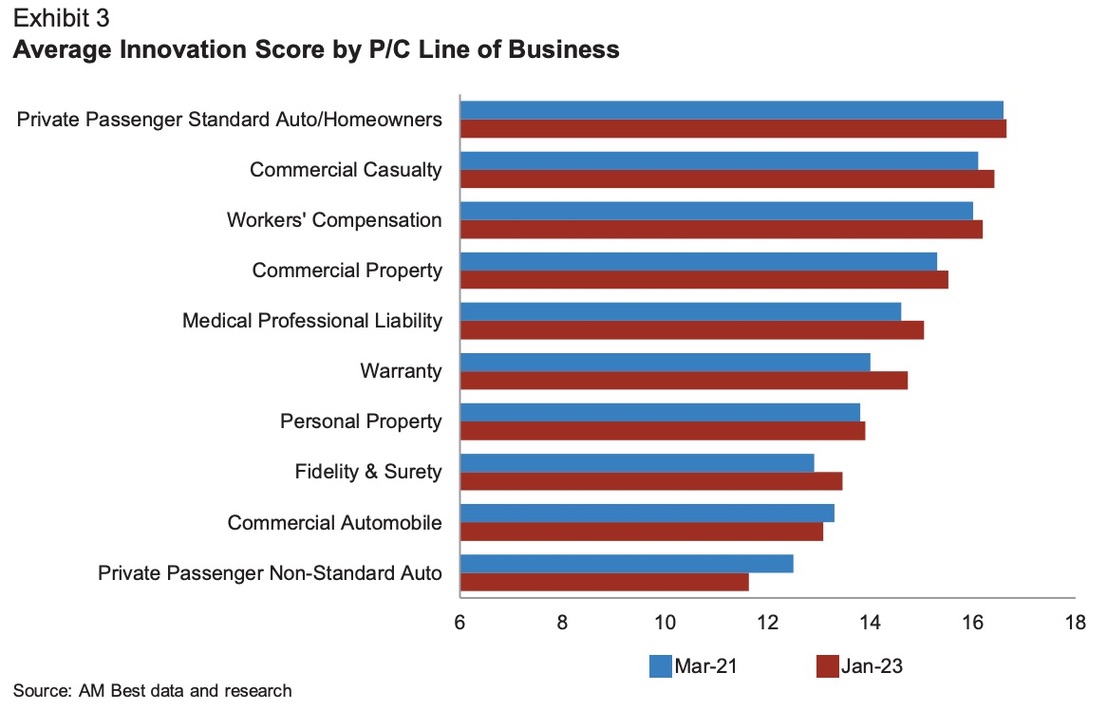

Innovation has varied on the primary property/casualty carrier side, mainly due to the varying size and scale of insurers with the segment.

AM Best found that P/C insurers fell into the moderate (63 percent) or minimal (13 percent) groups for innovation strides.

Personal auto and homeowners lines are ahead in automating claims management—mainly because of the large risk pool and less complex nature of coverages—initiatives can be scaled and replicated quickly, the rating agency stated.

While efficient, the increasing use of advanced visual computing in property claims management, underwriting and catastrophe modeling also offers the benefit of reducing hazardous work conditions for insurance staff trying to obtain roof photos after a loss or when evaluating a new property risk.

Telematics and predictive modeling have also boosted the segment’s success. The growth of IoT usage in auto and property is expected to continue.

The greatest strides in claims automation are seen in claims intake, assessment and settlement, though fraud and the complexity of some claims have hindered the move toward touchless claims processing, AM Best noted.

Manual underwriting in personal auto and small commercial lines has all but been eliminated, the report stated, with writers of more complex lines starting to embrace aspects of it.

Data continues to drive innovation, according to AM Best, with analytics extending to social engineering and behavioral economics that can easily spur highly customized products and services.

Customer interaction and back office operations are the focus of automation and generative AI efforts for many insurance companies.

Companies that allow policyholders the ability to move seamlessly from digital, self-service to human interaction services have benefited the most from their innovation efforts, the report added.

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Liberty Mutual ‘Shifting from Fixing to Building’ in 2026, CEO Says

Liberty Mutual ‘Shifting from Fixing to Building’ in 2026, CEO Says  AI-Generated Job Ads Discriminated Against U.S. Workers, Says Civil Rights Unit

AI-Generated Job Ads Discriminated Against U.S. Workers, Says Civil Rights Unit  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?