Given the highly competitive non-life market, and the depressed pricing that accompanies excess capacity, leaders in the global property/casualty insurance and reinsurance markets have found innovative ways to cut expenses to improve underwriting profit margins.

Executive Summary

Innovators stand out. Facing significant bottom-line pressure and seeking top-line growth, P/C industry leaders have made optimizing operating efficiency through innovation a crucial component of their overall strategy, according to AM Best.In a special report titled “Insurers Leverage Innovation for Financial Strength,” AM Best analysts used innovation assessments that the rating agency assigns to insurers and reinsurers to gauge levels of invention and then compared five-year operating performance metrics of innovators and laggards.

Here, AM Best’s Chief Operating Officer James Gillard and Associate Director Edin Imsirovic provide highlights, finding that the most innovative companies demonstrate lower expense ratios, less volatile loss ratios and combined ratios, and higher premium growth rates.

A five-year benchmarking analysis of AM Best-rated non-life companies’ innovation assessments indicates that COVID-19 has widened the innovation divide, with a clear link to better top-line growth and favorable key operating ratios across the board for insurers with more developed innovation initiatives. These companies’ investments in underwriting and claims systems, designed to reduce losses and the costs of administering policies, help them to enrich their analytical capabilities and improve their risk management capabilities—all of which enhance their underwriting efforts.

AM Best formally integrated its criteria procedure, “Scoring and Assessing Innovation,” in March 2020, and within weeks of its official launch, the criteria was put to the test by the COVID-19 pandemic. The pandemic challenged insurers’ ability to pivot and innovate in the midst of global upheaval. Not surprisingly, the pandemic accelerated insurers’ investments in digital transformation initiatives, with increased focus on customer experience. More innovative companies leveraged their digitally enabled operating models to continue business as normal even under pandemic conditions, while less innovative companies struggled to retain existing customers and attract new ones.

AM Best’s innovation scores are the sum of two factors: an input score and an output score. Innovation input scores are based on leadership, culture, resources, and processes and structure. Output scores are based on results and levels of transformation. Innovation scores are then translated into five innovation capability assessment categories: leader, prominent, significant, moderate and minimal.

In March 2021, one year after the criteria integration and amid the pandemic surge, AM Best found that insurers generally still faced difficulty drawing clear linkages between innovation inputs and results, given the impact and uncertainty of the crisis. For the purposes of this 2022 analysis, AM Best considered operating performance metrics for each innovation assessment from 2016-2020. Additionally, the leader, prominent and significant assessments were merged and given the label of innovator.

Importance of Expense Management

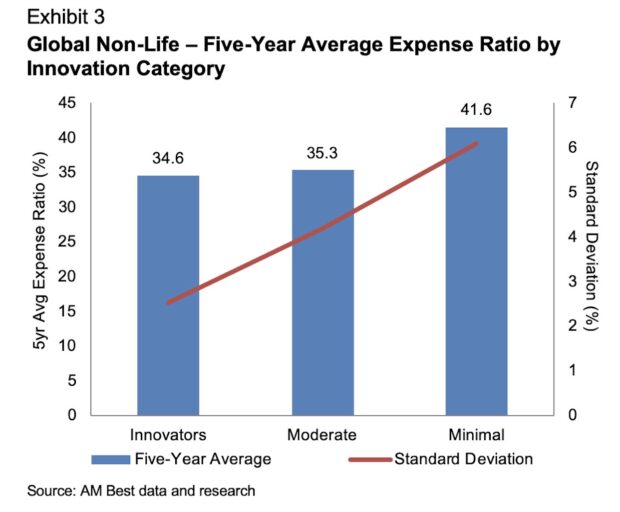

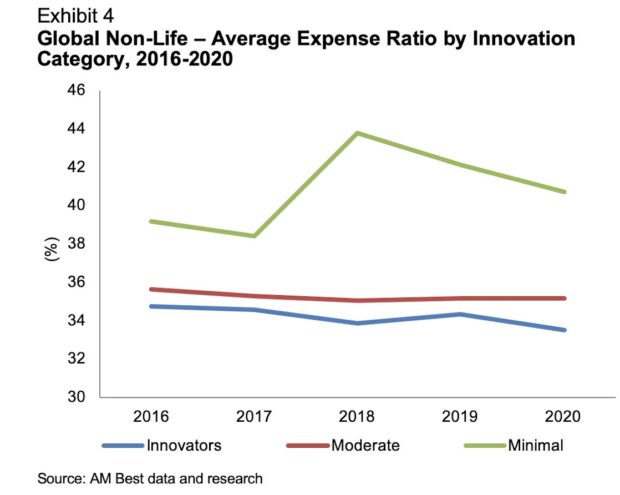

According to the analysis, companies that AM Best deemed as innovators had a five-year average expense ratio of 34.6, while companies assessed as moderate had a five-year average expense ratio of 35.3. Companies assessed as minimal had the highest five-year expense ratio, at 41.6.

AM Best notes that various other factors could impact the relationship between innovation and the expense ratio; correlation is not causation. For example, the innovator category has a higher proportion of companies from the reinsurance, health and auto segments, while the minimal category is composed of companies that may have a different expense structure. Larger companies have access to financial and human capital that may enable them to innovate at scale. Smaller companies may have a culture that allows them to be agile as well. The predominance of larger companies in the innovator category also suggests the benefit of scale may mask the overall impact of innovation on the expense ratio.

Most insurance companies realize efficiencies through automation, especially in back-office operations. Companies increasingly use automation to reduce errors, lower costs and increase speed.

Optimizing customer interactions is another area of focus, with many insurers “digitizing” their call centers and expanding the available forms of communication to include chat tools, social media and self-service channels.

Innovative players are increasingly leveraging Big Data, Internet of Things and advances in machine-learning technologies to automate more complex tasks such as claims processing, policy management, underwriting, customer service and regulatory compliance.

Non-life companies aren’t alone. Publicly traded U.S. health insurers have been heavily involved in merger and acquisition activity over the last decade, not only acquiring other health insurers but also increasing vertical integration and diversifying into other health services. An increase in scale helps insurers achieve a lower administrative expense ratio over the medium to long term as costs are spread over a larger membership base. Larger scale also creates greater bargaining power with health providers.

One of the biggest obstacles to operational innovation and its associated benefits continues to be a fragmented landscape on legacy information technology (IT), driving costs higher while hindering innovation efforts. While the pandemic unsurprisingly accelerated various automation initiatives, especially the customer-facing ones such as claims, AM Best believes that innovative companies may need to make a trade-off between higher expense ratios in the short run for lower and more sustainable combined ratios in the long run, as the costs associated with migrating to new systems can be daunting.

Leveraging Innovation for Financial Strength

Insurance industry innovation leaders have been able to leverage innovation as a competitive advantage, even in a strained underwriting and investment environment. Still, steady, favorable underwriting results that help drive strong operating performance are a key attribute of many companies with consistently higher credit ratings; lower expense ratios also help differentiate companies at higher rating levels. Irrespective of market pressures, AM Best expects innovation leaders will continue to invest into operational efficiencies to capitalize on future trends. As with the expense ratios, insurers’ innovation efforts are resulting in better performance across other key financial ratios, albeit with some deviation.

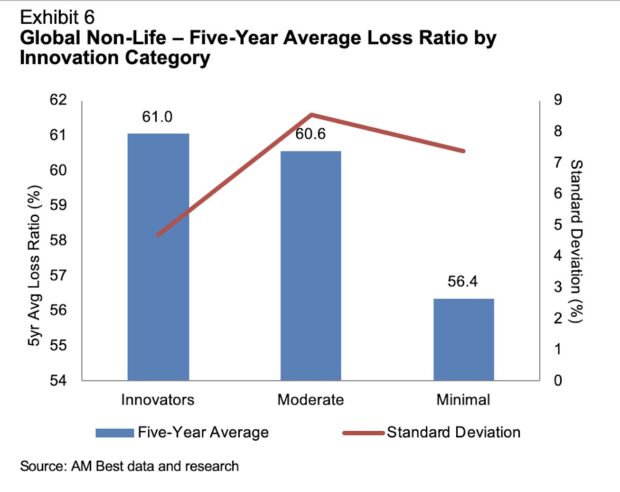

One of the main characteristics of companies assessed in the innovator category is a well-diversified spread of business, with significant assumed risks. Companies identified as innovators typically have best-in-class enterprise risk management frameworks, which help to manage the severity and volatility of losses. AM Best’s analysis shows that these companies had a five-year average loss ratio of 61.0, slightly higher than the moderate category and significantly higher than the minimal category.

Part of the reason for higher loss ratios may be because lines of business experiencing the most innovation, such as personal auto, tend to be highly competitive and have elevated loss ratios. The higher loss ratio in the innovator category also could be a function of the lower expense ratio, which allows for more competitive pricing, thus increasing the loss ratio but still achieving enterprise-wide profitability and premium growth goals.

Companies in the minimal innovation assessment rating also may face the least amount of competition due to their presence in more niche markets, reflected in a lower loss ratio.

Loss ratio volatility, however, is significantly lower for innovators than for other companies.

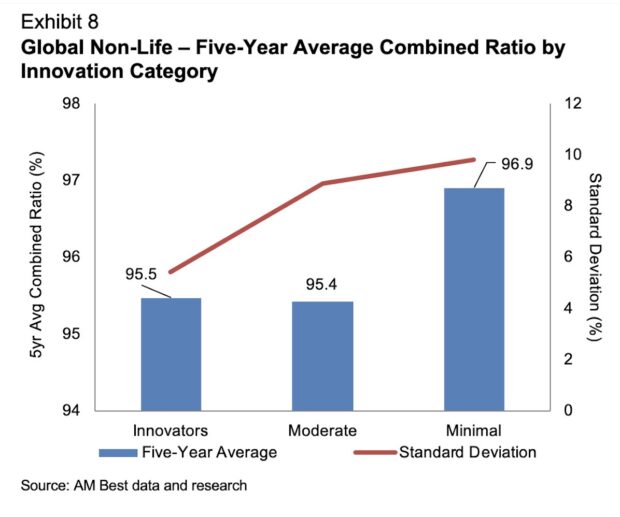

While the loss ratio and expense ratio relationship allows for an analysis of the way management incorporates innovation in an effort to increase profitability and stability from operations, the combined ratio, and its relationship with the innovation assessment, allows for an enterprise-wide view of management effectiveness. A direct correlation can be seen between the innovation assessment and the volatility of the combined ratio, as measured by the standard deviation by the innovation category. The low standard deviation of the innovators category, at approximately 5.4 percent, compares very favorably with the minimal category standard deviation of 9.8 percent. In other words, the innovators are able to achieve significantly more consistent results with very little variability year over year compared with non-innovators.

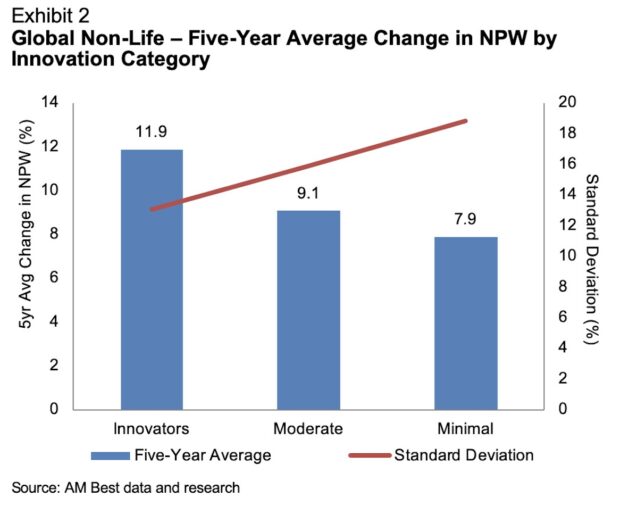

The AM Best analysis also shows that innovation and top-line growth are linked, and innovation has allowed companies deemed as innovators to not only gain a competitive advantage but maintain it as well. These companies had a five-year average net premium written growth rate of 11.9 percent, while companies assessed as either moderate or minimal lagged behind, at 9.1 percent and 7.9 percent, respectively.

AM Best recognizes that other factors may contribute to the observed correlation between innovation and premium growth. Some of the companies in the lower assessment categories dominate focused niches, reducing the need to innovate and grow. Larger companies tend to be concentrated in the innovator categories and to benefit from mergers and acquisitions. Regardless, innovative capabilities are becoming increasingly associated with sustainable growth.

Prioritizing Innovation to Get Ahead

At the end of the day, innovators stand out. Facing significant bottom-line pressure and seeking top-line growth, these industry leaders have made optimizing operating efficiency through innovation a crucial component of their overall strategy. Insurers with more developed initiatives have a clear competitive advantage in the form of profitable top-line growth compared with those behind the innovation curve.

Additionally, companies that have adequately compensated their distribution partners on the front end while providing them with profit-sharing opportunities on the back end will find themselves in a better position to control acquisition costs effectively. This will help keep them in the fight to build the loyalty among their production partners, which can lead to mutually beneficial and profitable long-term relationships.

Companies in the minimal category may not have the business need nor the immediate competitive pressure to innovate. It is AM Best’s view, however, that over the long term, a lack of appropriate and necessary innovation initiatives could lead to competitive disadvantages and place pressure on the company’s business profile.

The insurers that have not transitioned to a more automated process or modernized their IT systems have paid the price with higher expense ratios. Earlier adopters of digital transformation initiatives have been able to translate their innovation efforts into concrete results, bolstering their financial strength.

As insurers further innovate—proactively addressing consumer needs, creating seamless customer experiences and responding to emerging risks—they should be able to translate this growth into sustainable underwriting results. Innovation can help insurers expand their market position and relevance.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market