The American Academy of Actuaries has revised the qualification standards for actuaries who issue statements of actuarial opinion (SAOs) in the United States, the association announced this week.

The revised Qualification Standards for Actuaries Issuing Statements of Actuarial Opinion in the United States (USQS) will replace the existing qualification standards as of Jan. 1, 2022, said the Academy, which sets standards for qualification, practice, and conduct for actuaries practicing in the United States across practice areas that include casualty, as well as life, health and pension.

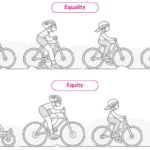

Changes to the USQS include a new requirement for actuaries to complete one hour of bias education annually as part of their continuing education requirements. The existing requirement, which calls for 30 hours of continuing education in total, remains in place, as does the requirement that three of the 30 hours be related to professionalism topics.

“Actuaries play an important role in helping maintain the public’s trust in financial security systems, products, and services. Therefore, this new requirement is consistent with assuring the public that actuaries will fulfill that role in a future in which big data, artificial intelligence, and evolving regulatory and societal requirements will place new demands on, or expectations of, such systems, products, and services,” explains a memo addressed to “Members of Actuarial Organizations Governed by the Qualification Standards of the American Academy of Actuaries” from the Academy board of directors that introduces the new USQS document.

“Bias topics include content that provides knowledge and perspective that assist in identifying and assessing biases that may exist in data, assumptions, algorithms, and models that impact Actuarial Services. Biases may include but are not limited to statistical, cognitive, and social biases,” the new USQS says.

The new standards document supersedes the Qualification Standards (including Continuing Education Requirements) for Actuaries Issuing Statements of Actuarial Opinion in the United States that took effect January 1, 2008.

Another USQS change that is part of the new standards document involves clarifying qualification standards for issuing SAOs in particular subject areas, and changes related to non-U.S. actuaries issuing SAOs in the United States.

For one particular type of SAO relevant to the Carrier Management audience—the “Statement of Actuarial Opinion, NAIC Property and Casualty Annual Statement”—a specific education requirement in the 2008 USQS that referred to the completion of exams on specified subjects administered by the Casualty Actuarial Society has now been amended to recognize that the Society of Actuaries also administers relevant examinations.

The new standard states, “An actuary should successfully complete relevant examinations administered by the American Academy of Actuaries, the Casualty Actuarial Society, or the Society of Actuaries on the following topics: (a) policy forms and coverages, underwriting, and marketing, (b) principles of ratemaking, (c) statutory insurance accounting and expense analysis, (d) premium, loss, and expense reserves, and (e) reinsurance.” (Note: The language of both the 2008 and 2021 USQS documents allowed for the education requirement for signing these opinions to be met by work experience or self-study as well, but those qualifying under this alternative need to obtain a signed statement from another actuary qualified to render SAOs that the standard has been met)

Explaining the reason for any revisions to be made at all, the memo introducing the revised document explains that action taken by the National Association of Insurance Commissioners in 2019 to change the instructions and definitions related to the qualifications for an Appointed Actuary signing an NAIC Statement of Actuarial Opinion, Property and Casualty Annual Statement, prompted the review of existing standards in the first place. The NAIC amendment expanded the definition of actuaries qualified to issue the P/C opinions to include not just members of the Casualty Actuarial Society, but also members of the Society of Actuaries that completed that society’s general insurance track of courses.

“As a result of the change, the American Academy of Actuaries board of directors instructed the Committee on Qualifications (COQ) to review and recommend any appropriate changes in the language related to the specific qualification standards for NAIC Statements of Actuarial Opinion for Property and Casualty Annual Statements and to consider whether any other changes should be recommended given the passage of time since 2008, the last time the USQS were amended,” the new USQS says.

In general, the language of the basic education section of the USQS document “was revised to emphasize that the basic education requirements focus on education and credentials earned, rather than current membership in organizations. The revised language is in no way a reflection on the credibility or value of any particular actuarial organization, but rather reflects the determination that it is the actuaries’ basic education that qualifies them to practice in the U.S., independent of a particular organization’s current membership criteria,” the memo preceding the new USQS explains.

In the casualty practice area, an appendix to the revised USQS document lists the following examples of SAOs: NAIC Property and Casualty Annual Statement Opinion, reserve opinion, profit tests for regulators, state exam opinion, tax issue opinion, actuarial appraisal, rate filing opinion; opinion regarding a rate level indication, among others. In addition to these items listed as always being SAOs, the appendix lists communications that “may contain an SAOs, depending on the content and intent,” such as internal management reports, Congressional testimony, speeches, letters to the editor and media interviews.

“This update is the result of a comprehensive public exposure process and review of the USQS by the Academy’s Committee on Qualifications (COQ) as an integral part of the Academy’s professionalism mission. The revisions will help to ensure that actuarial qualifications in the United States remain appropriate and clear both to actuaries and to the public,” said Academy President Maryellen Coggins, in a media statement.

“Actuaries who plan to issue SAOs in the United States in 2023 or after should take time to familiarize themselves now with the updated standards because they include a new continuing education requirement actuaries will need to satisfy during the course of 2022 and thereafter,” she noted.

The amended U.S. Qualification Standards take effect January 1, 2022. That means the revised document applies to actuaries issuing statements of actuarial opinion starting on January 1, 2023.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark