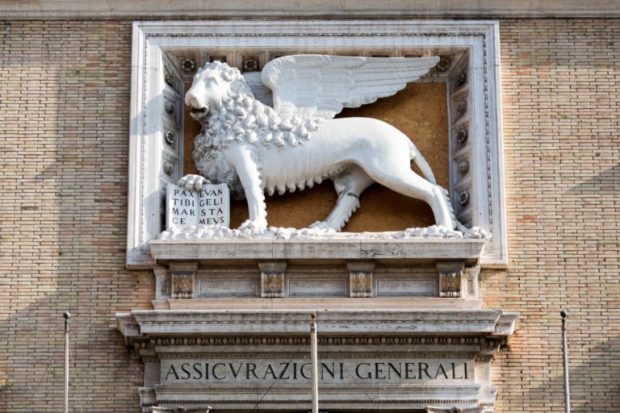

Italy’s top insurer Generali sealed its 1.17 billion euro ($1.36 billion) takeover of smaller rival Cattolica on Friday in a move aimed at cementing its domestic market leadership.

On the last day of Generali’s buyout offer, investors had tendered shares equivalent to 60.8% of Cattolica’s capital, bourse data showed.

Along with the shares it already owned, Generali now holds a stake of 84.5% in Cattolica.

Generali crossed the majority threshold on Thursday but a two-thirds majority was needed to push through extraordinary shareholder resolutions such as the decision to take Cattolica private and merge it into the group – as Generali plans to do.

Generali first moved on Cattolica last year, coming to its rescue with a 300 million euro investment after supervisors told the Verona-based insurer to bolster its finances.

Trieste-based Generali offered 6.75 euros for each Cattolica share tendered, a price deemed fair by Cattolica’s board.

Shares in Cattolica, which until recently traded above the bid’s price, closed at 6.58 euros on Friday.

($1 = 0.8624 euros)

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report