Neglected no more.

Independent agents are feeling the love from property/casualty insurance carriers—and the scores they are giving carriers are moving higher, J.D. Power reports.

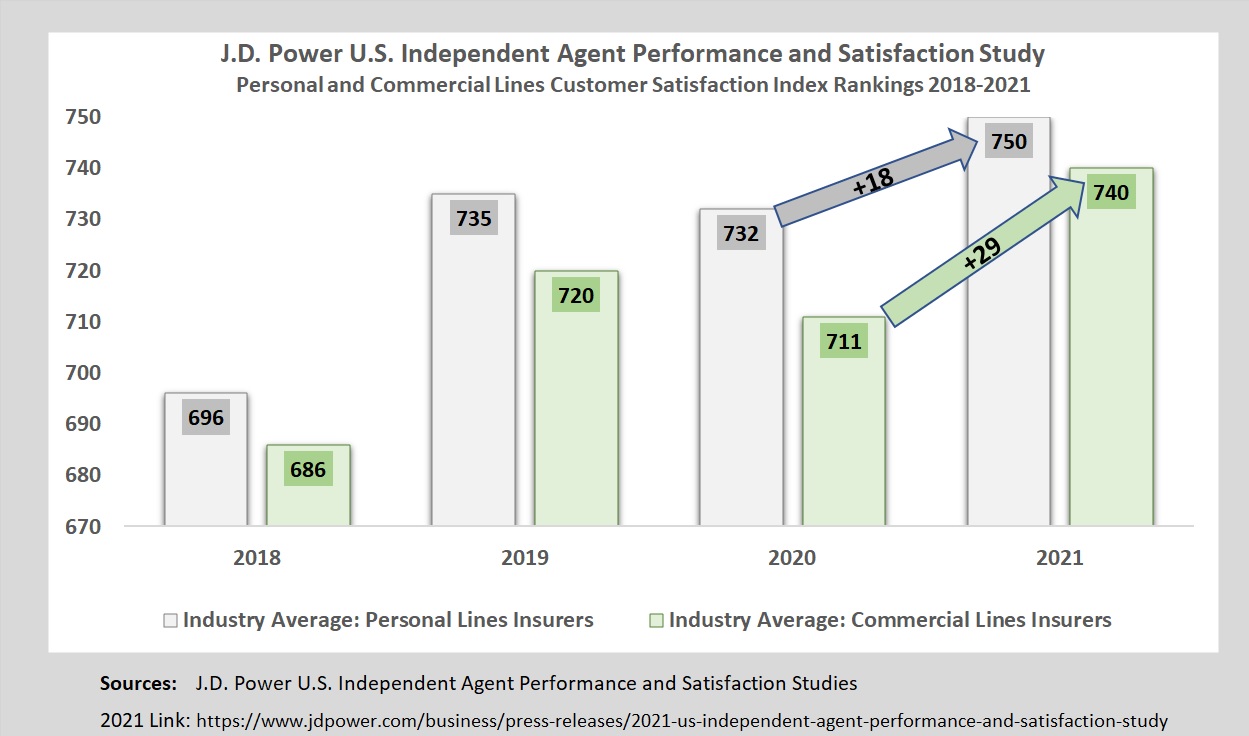

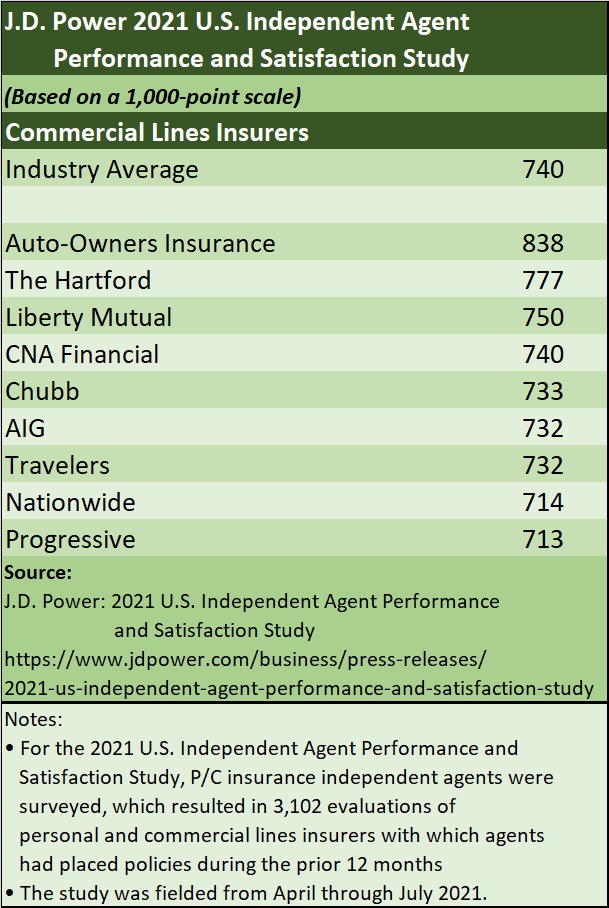

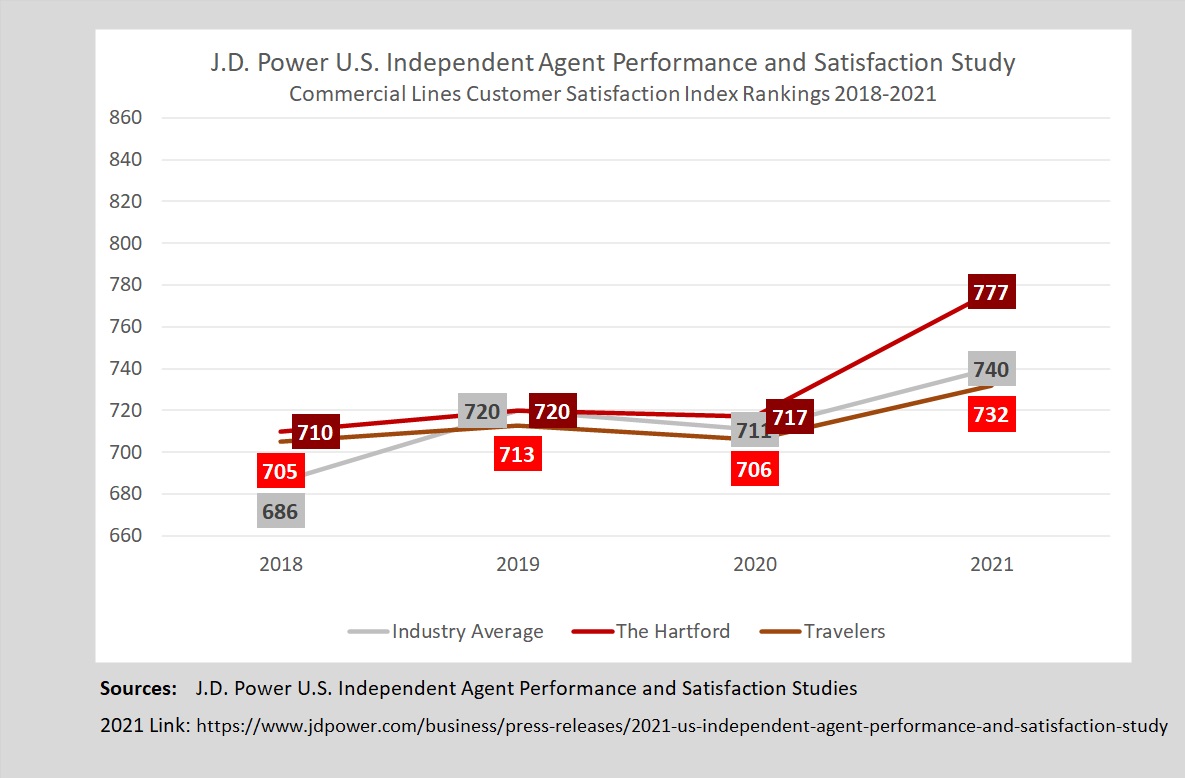

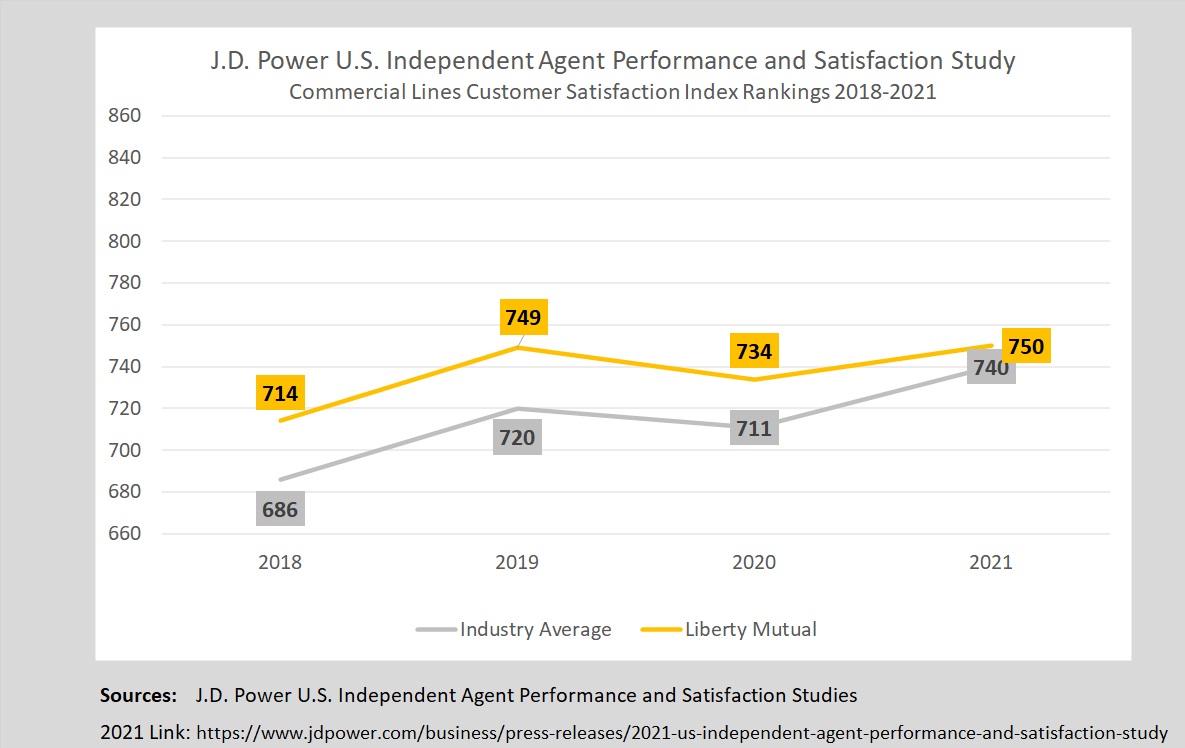

According to results of the J.D. Power 2021 U.S. Independent Agent Performance and Satisfaction Study, released on Oct. 5, agent satisfaction has reached an all-time high since 2018—with the overall satisfaction scores among personal lines and commercial lines agents jumping 54 points over the four-year period. For personal lines agents, the overall 2021 satisfaction score, measured on a 1,000-point scale, reached 750, up 18 points since 2020. For commercial lines, the 2021 overall score came in at 740, scaling up 29 points from a year ago.

In a media statement, J.D. Power said that the latest year-over-year gains in satisfaction with quoting, support and communications and servicing helped to drive up the overall scores.

“During the past year, some of the industry’s most notable acquisitions and operating model investments have thrust the independent agent channel back to the forefront, resulting in improved agent-carrier relations,” said Tom Super, head of property and casualty insurance intelligence at J.D. Power, in a media statement.

Compare that to what J.D. Power said back in 2019, when the firm headlined its media statement with the title “Insurers Come Up Short for Independent Agents Despite Critical Role Agents Play in Driving Business,” and reported that overall independent agent satisfaction scores of 735 for personal lines insurers and 720 for commercial were “among the lowest overall satisfaction scores in any business study currently conducted by J.D. Power, lagging even financial advisors (737).”

The 2021 J.D. Power report is the second survey report in recent days revealing that carriers are paying attention to agents’ wants and needs. Late last week, Celent, a global research and tech advisory firm for financial institutions, offering results of a separate survey it conducted from a carrier perspective, reported that 94 percent of 35 North American carriers said they want to create above-average digital experiences for agents, with one-third of those aiming to be “world class.”

The Best and the Worst

Erie Insurance made its debut in the J.D. Power rankings from the survey this year, topping all other personal lines insurers with an overall satisfaction score of 857—more than 100 points above the average.

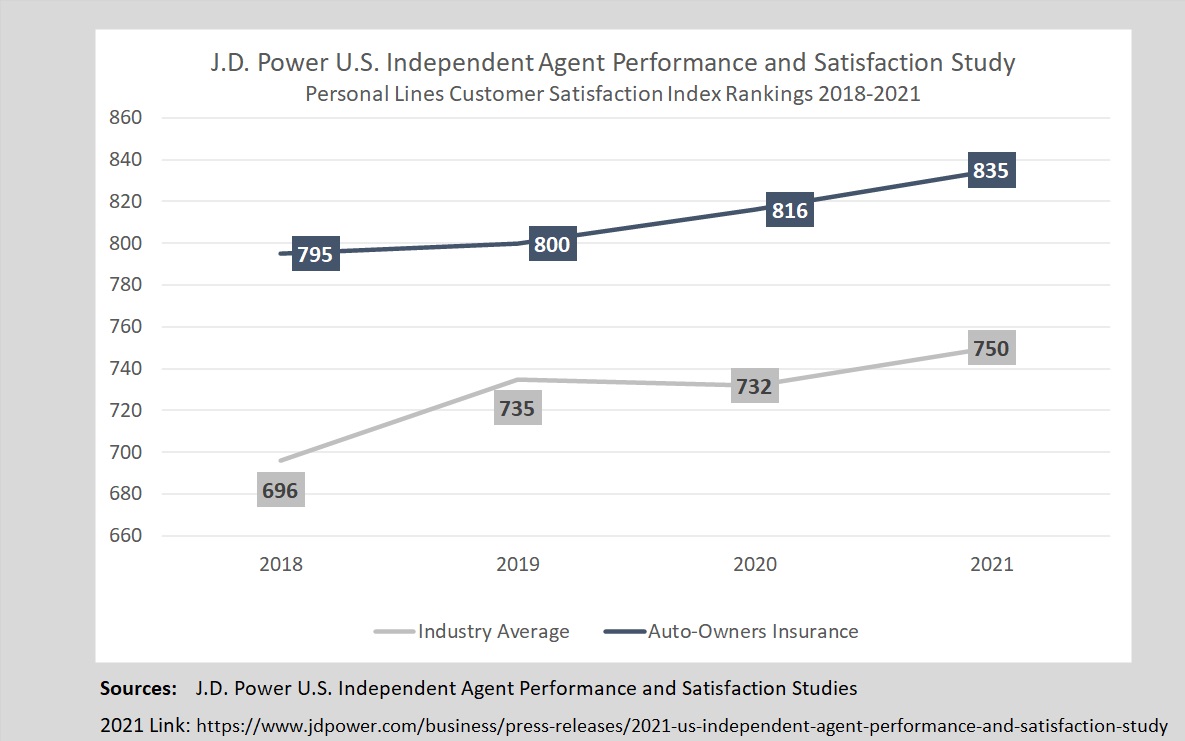

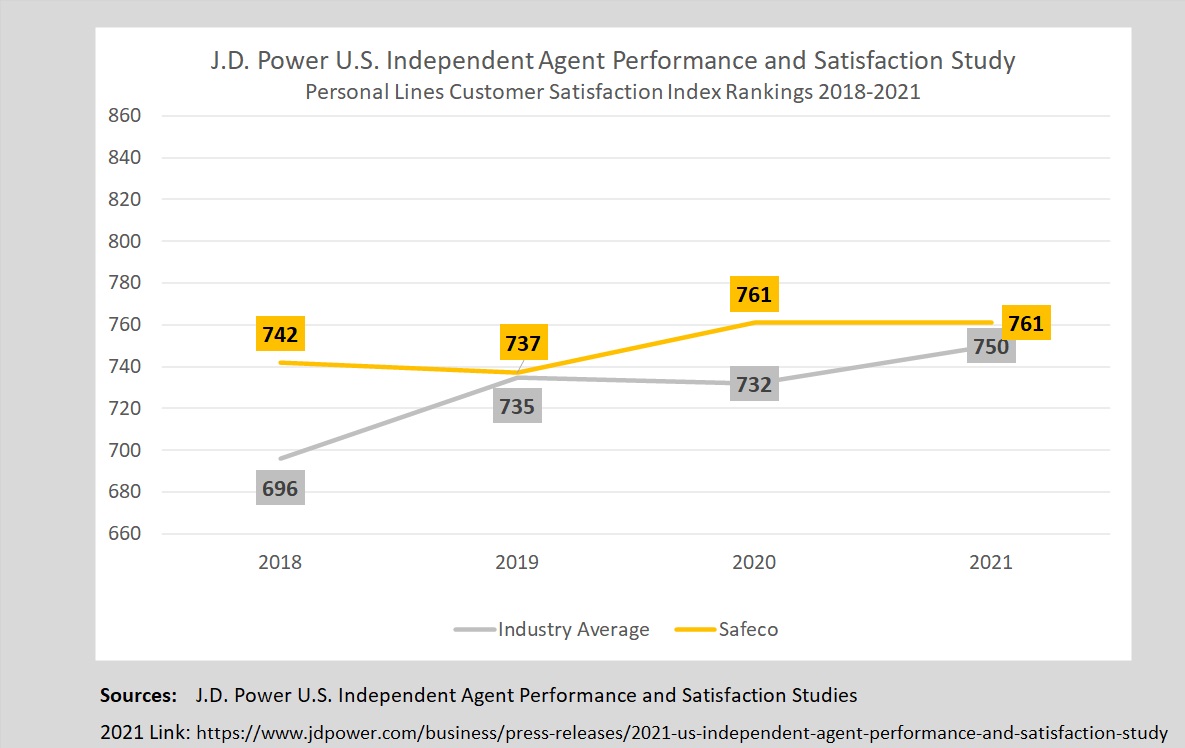

Auto-Owners Insurance ranked second among personal lines carriers, and Safeco came in third.

Both Auto-Owners and Safeco have reported overall satisfaction above the industry averages in each of the four years, but Auto-Owners score has consistently risen while Safeco’s fluctuating scores are closer to the industry average.

The most dramatic rise in agents’ personal lines satisfaction scores in the last year was recorded by Nationwide, with a 2021 score of 691 vs. 650 in 2020. Although the Columbus, Ohio-based carrier did not appear in the 2018 ranking, its scores have remained below the industry average for the last three years.

On the commercial lines side, Nationwide saw its score rise above 700 for the first time this year, coming in at 714 for 2021 vs. 621 in 2020.

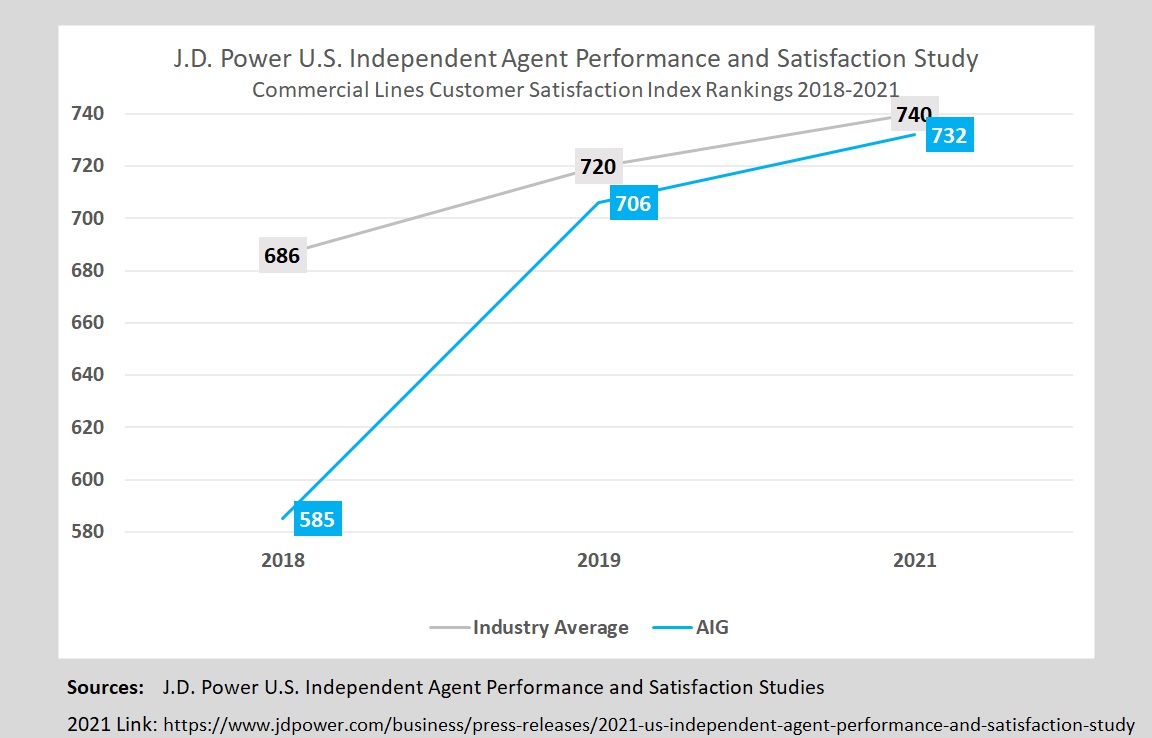

(Editor’s Note: J.D. Power didn’t award top rankings or publish scores for commercial lines insurers in 2020. For a segment to be award-eligible, at least four insurers must reach 100 or more completed surveys and have at least 67 percent market share, which did not happen in 2020, said a J.D. Power representative. J.D. Power did, however, share the scores with Carrier Management, which are included in some of the charts accompanying this article.)

Making a more impressive climb from a sub-700 score over the years was AIG. Although not ranked in 2020, AIG saw its satisfaction score from commercial lines agents soar from a low of 585 in 2018 to 732 in 2021.

In 2021, Auto-Owners Insurance ranks highest among commercial lines insurers with an overall satisfaction score of 838, up from 821 in 2020. Auto-Owners did not appear on the commercial lines rankings in 2018-2019.

For 2021, The Hartford (777) ranks second and Liberty Mutual (750) ranks third.

The Hartford, Liberty Mutual, AIG and Travelers are the only four commercial insurers ranked by J.D. Power in 2021 that were also ranked in each of the three prior years (with at least 100 surveys completed for the company).

While scores for The Hartford and Travelers have hovered near the industry average in prior years, The Hartford, edging up just a little bit higher in 2018 and 2019, and rising 45 points above Travelers in 2021, maintained its position in second place for all years except 2020.

Liberty Mutual, which ranked No. 1 in 2018 and 2019, fell to third place in 2020 and 2021, as the rest of the industry improved at a faster rate.

Other Findings

J.D. Power also summarized other industrywide findings about multiline agents, score differences among different agency sizes and agents’ use of carrier digital tools. Among other results:

- Multiline carriers. Overall satisfaction is significantly higher among agents that offer health, life and group benefits as well as P/C coverage than among those who only offer P/C policies. Agents servicing multiple lines also report receiving increased flexibility and support from their carriers.

- Agency size. The largest commercial agents (those with more than $500,000 in direct written premiums) and the agents with the smallest books of business (under $15,000 in direct written premiums) reported satisfaction declines in 2021. “Issues at both ends of the spectrum involve communication challenges as accounts grow more complex and as agents require more hands-on training and support,” J.D. Power said.

- Digital tools. Agent utilization rates remained stubbornly low, even for two interaction channels that did not show usage declines in 2021—digital chat and mobile app. But overall satisfaction is notably higher among agents who do use them, J.D. Power said, reporting that 12 percent of agents surveyed use digital chat and 11 percent use mobile apps.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  The Future of HR Is AI

The Future of HR Is AI  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?