Carries seeking to boost their digital capacity for customer services will increasingly seek InsurTech partnerships to get the job done, predicts J.D. Power’s 2019 Insurance Digital Experience study.

J.D. Power, in its summary of the study, notes that InsurTech startups are already affecting the traditional insurance marketplace because of their “customer-centric digital solutions and money-saving process efficiencies” for insurers. With that in mind, partnerships are already here in force and likely to increase down the line.

“Many traditional carriers, such as Nationwide, American Family and Allianz, have already partnered with InsurTech start-ups—and more collaboration is expected,” J.D. Power said.

Nationwide in May made a strategic investment in Betterview, a machine learning InsurTech startup focusing on capturing and analyzing data from drones, satellite and other aerial imagery, among other InsurTech-related initiatives. American Family joined a $43 million financing round in early 2019 for Clearcover, a managing general agent with an artificial intelligence-driven platform focused on car insurance. Allianz’s many InsurTech partnerships to date include a team-up with Flock to launch on-demand drone insurance in the UK market through a mobile app for commercial and recreational users.

Improvement Overall

Overall, J.D. Power found that P/C insurers are improving in their digital offerings, particularly mobile self-service functionality, but its study concluded that carriers still have work to do to meet “customers’ rising expectations.”

Insurers are falling short in digital areas including ease of shopping and servicing their policies, household-level policy management and inconsistent use of social media.

“Digital has become so important to the modern insurance company by delivering two essential characteristics consumers seek from carriers: Ease and accessibility,” Tom Super, vice president Property and Casualty Insurance Intelligence at J.D. Power, said in prepared remarks. “In many cases, mobile apps and insurer websites are the primary faces of these consumer brands. As consumer behavior continues to evolve, insurers must keep pace as part of their overall distribution strategy or run the risk of irrelevancy.”

Here are other key findings from the J.D. Power 2019 study:

- Customers are often much happier with well-designed mobile apps than those who use a website via desktop computer or smartphone to interact with their insurance company. Overall, customer satisfaction with mobile app service experience is 12 points higher than last year.

- Right now, 74 percent of insurance companies evaluated in the study offer the ability to access and manage policy and claims information via a mobile app.

- Insurers aren’t terribly resourceful about their web sites’ digital capacity compared websites in other industries. They often fall short on areas including expanded self-service tools, integrated digital communications functionality and contextual insurance information, according to the report.

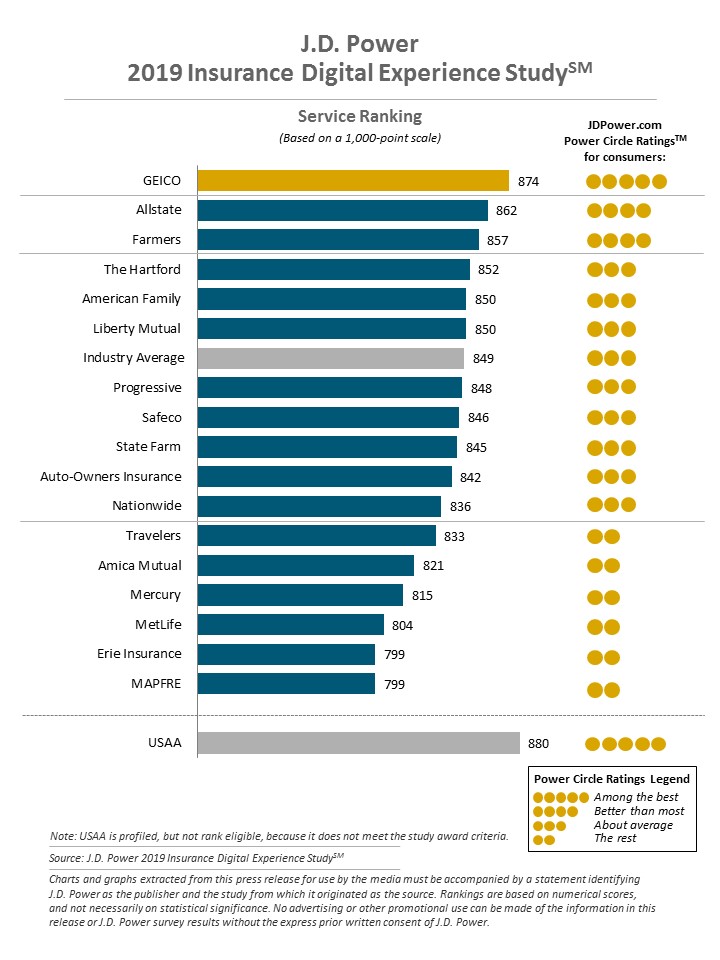

- For the study rankings, GEICO ranked highest with a customer experience score of 874 (out of 1,000), followed by Allstate at 862 for second and Farmers’ 857 ranking at third place.

- MAPFRE Insurance ranks highest in the shopping segment with a score of 811. Progressive is in second place with 803, and Erie Insurance ranks third with 798.

This is the eighth year of the J.D. Power Insurance Digital Experience study, which evaluates digital consumer experiences among P/C insurance shoppers seeking quotes and existing customers conducting typical policy-servicing activities. The study examines the functional aspects of websites and mobile apps based on: Ease of navigation; appearance; availability of key information; range of services; and clarity of the information. J.D. Power conducted the study with digital intelligence company Centric Digital, involving 11,151 consumer experience evaluations from January through March 2019.

Source: J.D. Power

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  The Future of HR Is AI

The Future of HR Is AI