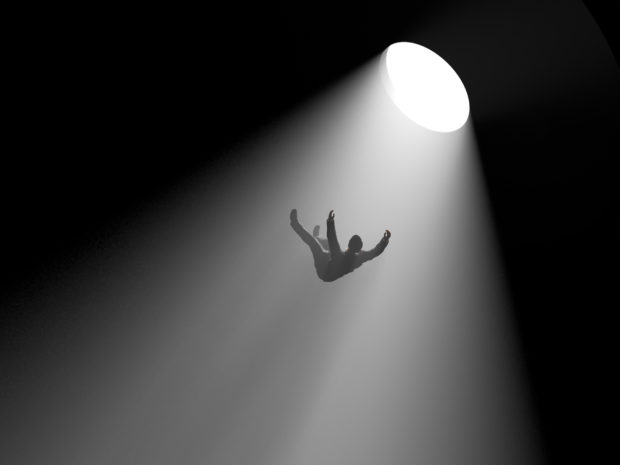

Even the most vigilant insurers and reinsurers scanning the risk landscape for potential future liability problems are likely to fall into some landmines.

What insurance and organizational risks of the immediate or distant future are being overlooked now?

Carrier Management offers a continuing look at some partially hidden risks with a new regular online feature—CM Risk Alerts. Yesterday’s article, “Risk Alerts: Mississippi Homeowner Premiums, Hacked Scooters, Seat-Back Cameras on Airplanes,” marked the first publication in the online series, compiled by Editor Kimberly Tallon from a subjective list assembled by the entire CM team. The aim is to offer short takes—flagging and summarizing just a handful of risks at a time—of items that may not yet have surfaced in property/casualty C-suites or boardrooms, on insurance conference agendas, or in the mainstream press but may well have insurance implications.

(Readers may also wish to revisit CM’s longer print publications of risk alerts: “67 Emerging Risks Nobody Is Talking About,” Oct. 18. 2015 and “Risks Hiding in Plain Sight,” March 11, 2019.)

Setting Risks Myths Aside

Also helping in the pursuit of understanding emerging risks—and, in particular, separating out risk myths that aren’t likely to hold up in court from real prospects for potential liability—Praedicat CEO Robert Reville and Senior Scientist Adam Grossman offer a series of articles about “Risks and Non-Risks.”

Expressly written for Carrier Management, the second installment, “‘Underwriting by Google’ Leads to Wrong Answers on Autism Drivers,” leads off today’s CM Daily newsletter, explaining that as of today, there is no environmental driver of autism spectrum disorders with strong enough science to support litigation. But insurance underwriters still worry about commercial products that may be identified as ASD triggers for genetically susceptible populations in the future. To replace “underwriting by Google” activities that can easily lead them astray, Praedicat executives identify the most likely candidates emerging in early stage research and also dispose of some popular theories.

The first installment in the Risks and Non-Risks series—”Are Building Products Making Us Fat?“—provides similar analysis. According to Reville and Grossman, there’s more scientific evidence that chemical compounds in building materials and plastics can be linked to obesity than that artificial sweeteners can be linked to cancer, the article notes.

Praedicat, a Los Angeles-based InsurTech analytics firm, uses algorithms that scan over 30 million scientific journal articles—a number that grows every day. “Using machine learning and artificial intelligence, we are rapidly refreshing our data to capture new articles and identify new risks,” the company says on its website.

In the article series, the Praedicat executives will continue to alert the casualty insurance community of areas of concern and risks to avoid, while highlighting insurance opportunities that lie beneath hyped theories linking products to human harm.

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best