While the U.S. personal auto insurance industry continues to be a sick patient, homeowners coverage is a significant bright spot, according to Fitch Ratings’ latest report.

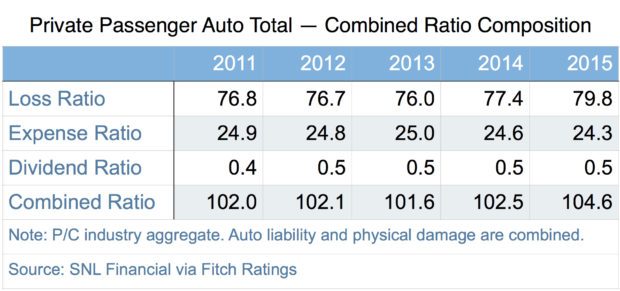

Private passenger auto insurance saw its industry combined ratio grow to 104.6 in 2015, up from six consecutive years of results that ranged between 101 and 102. The U.S. personal auto combined ratio for the first six months of 2016 was 98.5, versus 97.4 over the same period in the previous year.

Homeowners liability, meanwhile, hovered at just under 92 for 2015, compared to 92.5 in 2014, 90.3 in 2013, 104.1 in 2012 and 122.3 in 2011. For the first six months of 2016, higher catastrophe losses drove the homeowners combined ratio up to 94.7, compared to 87 in H1 2015.

As far as private passenger auto, it’s not as if carriers in the sector aren’t trying. Fitch noted that many are more focused on using technology for risk selection and pricing. Carriers are also increasingly relying on telematics to monitor driving behavior (in exchange for discounts), a move that helps boost understandings of how clients behave on the road. Regardless, it hasn’t been enough, Fitch said.

As far as private passenger auto, it’s not as if carriers in the sector aren’t trying. Fitch noted that many are more focused on using technology for risk selection and pricing. Carriers are also increasingly relying on telematics to monitor driving behavior (in exchange for discounts), a move that helps boost understandings of how clients behave on the road. Regardless, it hasn’t been enough, Fitch said.

“These advances have not translated into better understanding of performance, as recent deterioration is significantly tied to unfavorable claims frequency and loss severity patterns,” the Fitch report states.

At the same time, Fitch pointed out that claims frequency trends for insurers were favorable in recent periods, thanks to air bags, back-up cameras and parking assist technology. But lower gas prices have led to more customers on the road and higher miles driven. In turn, loss severity increases have gone up, something that is a big worry for auto insurers “due to challenges in managing medical costs and litigated claims.”

Fitch points out that homeowners insurance, on the other hand, has been a bright spot, despite the sector’s historical volatility and its traditional use “as a loss leader to capture more attractive automobile business.”

“Homeowners generated a substantial industry underwriting profit in each of the last three years,” Fitch noted. “Shift in underwriters’ pricing and geographic mix have influenced results, but this change is largely due to a reduction in insured catastrophe losses relative to historical norms in the last three years.”

Even so, homeowners insurance volatility won’t go away, and diligence is required to minimize the impact of volatility when it strikes.

“Management of catastrophe exposures and risk concentrations remains essential,” Fitch said. “Successful homeowners writers also maintain a keen focus on insuring properties to value; active claims management, including vigilance against fraudulent claims; and managing regulatory processes and uncertainty, particularly in states with more restrictive pricing practices.”

Both private passenger auto and homeowners insurance stand out collectively in another way, the Fitch report said, both in opportunities and challenges ahead.

Each sector continues to see written premium growth expand faster than most other property/casualty industry market segments. Still, while automobile pricing is increasing, it will take some time to “meaningfully improve” results, Fitch said. And with homeowners insurance, the jump in catastrophe losses that hit in H1 2016 was “more in line with historical norms,” according to the report.

Source: Fitch Ratings

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  The Future of HR Is AI

The Future of HR Is AI  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best