While the property/casualty insurance industry has reported three consecutive years of significant underwriting profits, the commercial auto market as a whole reported an underwriting loss for the fifth consecutive year in 2015.

In short, U.S. commercial auto insurance has evolved into a “chronically underperforming product segment” for U.S. P/C insurers, according to Fitch Ratings.

At the same time, Fitch notes, a number of carriers underwriting the line continue to do well.

Underwriting losses have accelerated with the segment statutory combined ratio rising to approximately 108.8 for the latest year—the worst result since 2001. The commercial auto combined ratio averaged 106 from 2011-2015, according to analysts at Fitch.

“The poor performance is a reflection of previous overly aggressive pricing in commercial auto and a recent extended period of heightened claims severity, particularly relating to bodily injury claims,” said James Auden, managing director, Fitch Ratings.

As Fitch noted, commercial P/C insurance prices continued to decline moderately—an average of 3.1 percent— during the third quarter of last year, according to a survey by The Council of Insurance Agents & Brokers. But, The Council found the market did see a slight uptick in rates for commercial auto in last year’s fourth quarter and again in the first quarter of this year.

Fitch said commercial auto written premiums expanded by more than 7 percent in 2015, and by 30 percent in aggregate over the last five years. Insurers have responded to poorer underwriting results with repricing and underwriting actions, but these rate changes have not kept pace with loss experience, Fitch says.

While pricing in the broader commercial lines market is now more competitive with most sectors experiencing flat to declining pricing changes, Fitch says commercial auto rates are likely to continue to increase significantly in the near term, which should contribute towards better underwriting results in 2016. A shift to underwriting profits may still be several years away.

“Despite a poor overall performance and weaker industry profits, a number of companies continue to produce significant underwriting profits in this line,” Auden added.

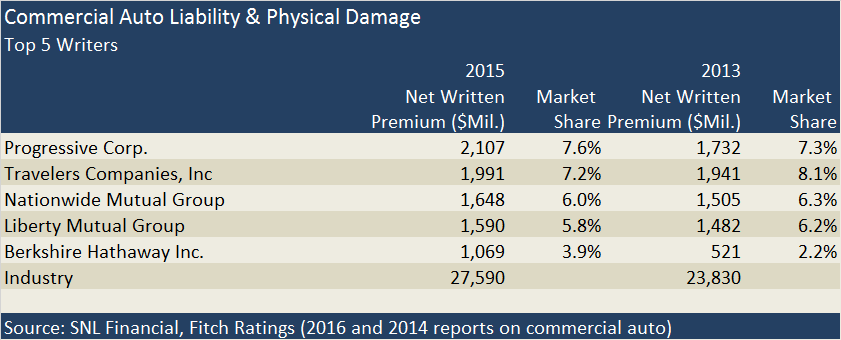

Top Writers

Progressive has grown to become the largest writer of commercial auto business based on 2015 net written premiums while also generating substantial underwriting profits, according to Fitch.

The report includes a list of the top 15 writers compiled using data from SNL Financial, with Progressive’s $2.1 billion and 7.8 percent market leading the pack. The top 5 based on 2015 net premiums are show below, along with their premiums and market share from 2013 reported in a prior Fitch report.

Berkshire Hathaway Inc., which has rapidly expanded in primary commercial lines, has managed to generate underwriting profits in commercial auto, according to Fitch. Ranked ninth in 2013, Berkshire is now in the top five.

American International Group, which ranked fifth in 2013, has fallen to sixth place on the latest ranking based on 2015 net written premiums. W.R. Berkley and Hartford Financial, both ranked in the top 10 in 2013, are in the 11th and 12th place spots in Fitch’s latest ranking.

Meanwhile, Tokio Marine U.S. and Cincinnati Financial both climbed into the Top 10, the Fitch report shows.

Last month, MetLife Auto & Home said it is entering the market and introduced its first commercial auto policy. The product is now available in Illinois, Indiana and Ohio, with more states planned in the near future.

Fitch notes that underwriting results are uneven for the top writers. “A personal lines company will typically write smaller commercial accounts that have less complexity and lower average premiums and coverage limits,” Fitch said, offering one reason for differences.

Old Republic International Corp., ranked seventh in premiums with $1.1 billion) stands out as in terms of underwriting profits, continually to report commercial auto profits despite an emphasis on riskier larger trucking business, Fitch noted.

On the other hand, Nationwide is the only company in the top 15 writers group with above market premium growth that generated large, steady underwriting losses over the last five years, Fitch said, noting that Nationwide’s average five-year combined ratio in commercial auto was 112.

While Nationwide grew much faster than the industry in commercial auto premiums, several top writers with below-industry average growth also underwriting losses, including Liberty Mutual, Zurich American, State Farm, Hartford and American International Group.

(A version of this article originally appear on Insurance Journal, a sister Wells Media publication to Carrier Management. Reporter Andrew G. Simpson is Chief Content Officer for Wells Media)

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers