Progressive Insurance Group is the top U.S. commercial automobile insurer by 2015 premium volume, an accomplishment that comes as the broader sector’s overall performance continues to deteriorate, according to a new A.M. Best special report.

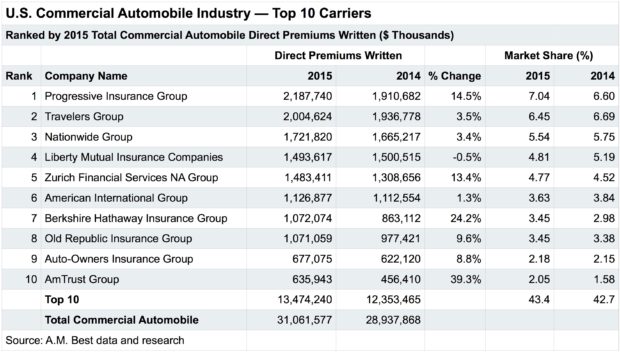

The insurer booked nearly $2.2 billion in direct premiums written premiums in 2015, the year A.M. Best used for a ranking of the top U.S. carriers handling U.S. commercial automobile coverage. That’s a 14.5 percent jump compared to the carrier’s $1.9 billion in direct premiums written in 2014.

At the end of 2015, Progressive’s share of the commercial automobile market surpassed 7 percent, versus 6.6 percent in 2014. It’s commercial automobile combined ratio was at 83.1 for 2015, and its five-year average combined ratio was 93.7.

Progressive’s gain comes as the U.S. commercial automobile sector produced a combined ratio of 108.6 in 2015, a jump from 103 in 2014 and more than 106 in 2012 and 2013. What’s more, the sector as a whole produced an underwriting loss of nearly $2.6 billion in 2015, versus a $1 billion loss the year before, a $1.78 billion loss in 2013 and a $1.6 billion net underwriting loss in 2012, the report noted.

U.S. commercial auto net premiums earned have grown steadily from $21.2 billion in 2011 to more than $26.8 billion in 2015. But the sector has also seen sizeable jumps in crashes involving large trucks and buses, related injuries and numbers of injuries. Miles traveled by all motor vehicles are also substantially higher (more than 3 billion in 2014), than in previous years. All of these factors cut into the sector’s bottom line, according to the A.M. Best report.

Progressive knocked Travelers Group to second place in 2015 in the commercial automobile insurer rankings, and A.M. Best credits the change with its focus on continuing to grow its agency-driven commercial automobile premium base. That, in turn, was “sparked by the growth of the company’s long-haul and specialty trucking risks,” A.M. Best said.

Progressive is among a handful of carriers that continue to dominate market share, A.M. Best said.

“Despite the difficulty that most writers of commercial automobile business have had generating profits in this line, four of the top ten organizations generated double-digit year-over-year [direct premiums written] growth in 2015,” A.M. Best noted.

Beyond Progressive, those top-10 carriers in the double-digit growth club include No. 5-ranked Zurich Financial Services (13.4 percent growth in 2015), GEICO-driven (and 7th place) Berkshire Hathaway Group (24.2 percent), and No. 10-ranked AmTrust Group (39.3 percent).

A.M.Best said that Berkshire Hathaway’s growth came from the continued expansion of its primary commercial lines business, and that AmTrust’s soaring DPW was in line with its strategic plans. Both also benefited from commercial automobile rate increases, according to the report.

Source: A.M. Best

The Future of HR Is AI

The Future of HR Is AI  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies