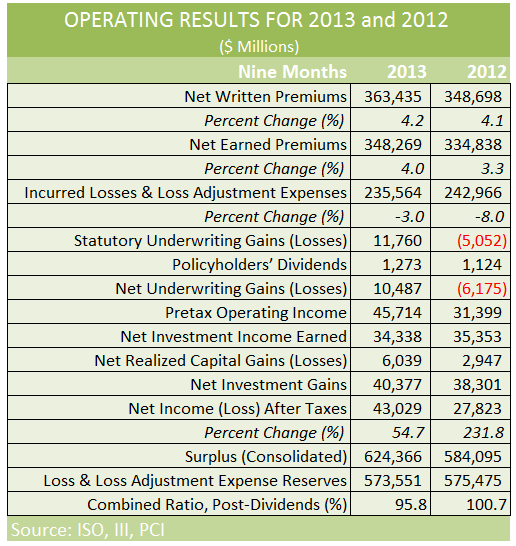

With a combined ratio of 95.8 through nine months translating into $10.5 billion of underwriting profit, the U.S. property/casualty insurance industry is on track to report its best year in the post-crisis era.

Robert Hartwig, president of the Insurance Information Institute, shared the prediction in a commentary about P/C industry results for U.S. carriers published on Monday by ISO, a Verisk Analytics company, and the Property Casualty Insurers Association of America (PCI).

The ISO/PCI aggregate industry figures reveal a combined ratio improvement of nearly 5 points from the first nine months of 2012, when the combined ratio was 100.7, representing $5.1 billion of underwriting losses.

As was the case in for the first half, the only major component of net income moving downward for the industry during the first three quarters of 2013 was investment income, according to the compilation of aggregate industry figures.

With investment income (from interest and dividends) falling just 2.9 percent and realized capital gains more than doubling from levels reported in the same period in 2012, net income after taxes rose to $43.0 billion in nine-months 2013 from $27.8 billion in nine-months 2012.

According to ISO and PCI, insurers’ overall profitability as measured by their annualized rate of return on average policyholders surplus increased to 9.5 percent from 6.5 percent.

Largely as a result of insurers’ $43 billion in net income after taxes, policyholders’ surplus grew $37.3 billion to $624.4 billion at Sept. 30, 2013, from $587.1 billion at year-end 2012, the two organizations reported.

The nine-month bottom line net income and underwriting figures put the P/C industry “on a firm trajectory for what will assuredly be its best year in the post-crisis era,” Hartwig asserted in his commentary, highlighting 4.2 percent growth in net written premiums, a reduction in catastrophe losses and favorable prior-year development.

Looking ahead, he wrote: “There is no question that 2013 fourth-quarter performance for the P/C insurance industry will be far superior to 2012. This is because last year’s fourth quarter includes the impacts of Hurricane Sandy, which resulted in $18.8 billion in insured catastrophe losses.

“No event in the fourth quarter of 2013 comes remotely close,” he said, adding that P/C insurers will also benefit from a strong performance in financial markets during the final quarter of the year.

Breaking It Down

Michael R. Murray, ISO’s assistant vice president for financial analysis, noted that the 9.5 percent return was the highest annualized rate of return through nine months since 2007, and that the 95.8 nine-month combined ratio was the best in six years as well.

The industry’s 9.5 percent return was the net result of double-digit rates of return for mortgage and financial guaranty (M&FG) insurers and single-digit rates of return for other insurers.

Focusing on the underwriting results, Robert Gordon, PCI’s senior vice president for policy development and research, noted that a drop in net loss and loss adjustment expenses incurred (LLAE) accounted for almost half of the improvement in underwriting results in nine-months 2013 for the industry overall.

“More specifically, insurers’ combined ratio improved by 4.9 percentage points in nine-months 2013, with the drop in net LLAE accounting for 2.1 percentage points of the improvement. The remaining 2.8 percentage points of improvement are due to premium growth.”

Much of the decline in non-catastrophe LLAE was a result of favorable prior-year reserve development, ISO and PCI reported, noting that the amount of favorable reserve development increased $5.5 billion to $13.9 billion in nine-months 2013 from $8.4 billion in nine-months 2012, with much of the increase in favorable reserve development attributable to special developments in the M&FG sector.

Excluding M&FG insurers, the amount of favorable loss reserve development rose less than $1 billion— to $10.8 billion in nine-months 2013 from $10.1 billion in nine-months 2012.

The decrease in overall net LLAE was also driven by a decline in catastrophe losses, with ISO estimating that private insurers’ net LLAE from catastrophes dropped $4.5 billion to $12.5 billion in nine-months 2013 from $17.1 billion in nine-months 2012. (Note: Those catastrophe loss amounts exclude LLAE that emerged after insurers closed their books for each period but do include late-emerging LLAE from events in prior periods.)

Net LLAE excluding catastrophes fell $2.9 billion, or 1.3 percent, to $223 billion through nine-months 2013 from $225.9 billion through nine-months 2012.

According to ISO’s Property Claim Services (PCS) unit, catastrophes striking the United States in nine-months 2013 caused $11.7 billion in direct insured losses (before reinsurance recoveries) for all insurers (including residual market insurers and foreign insurers and reinsurers), down $4.5 billion compared with the $16.2 billion in direct insured losses caused by catastrophes striking the United States in nine-months 2012 and $8.3 billion less than the $20 billion average for nine-month direct catastrophe losses during the past ten years.

Source: ISO, PCI, III

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?