For 2013, U.S. property/casualty insurers enjoyed strong gains in underwriting results, net investment and written and earned premiums, thanks in part to a relatively light hurricane season. The year generated profit and profitability gains at a rate last seen in 2007, just before the bubble burst and the economy crashed.

“The industry’s performance in 2013 is a welcome departure from the heavily catastrophe impacted results of 2011 and 2012,” Robert Hartwig, president of the Insurance Information Institute, said in prepared remarks posted on the III’s web site.

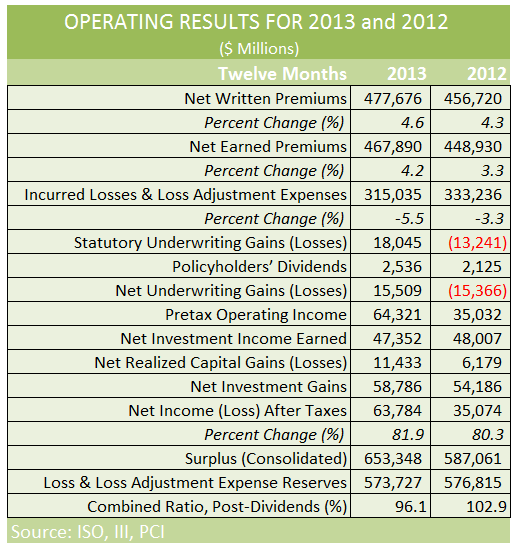

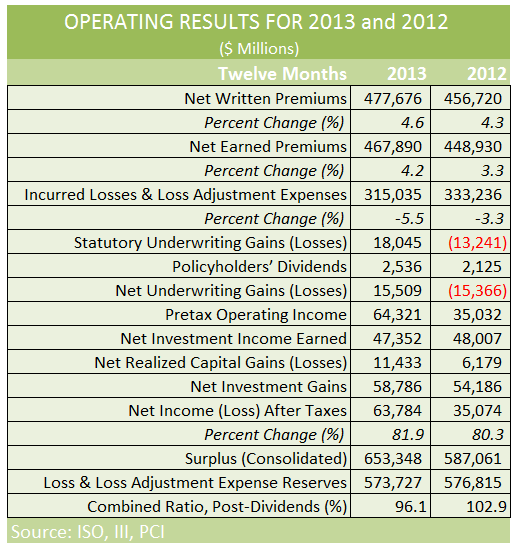

Looked at another way: the combined ratio (net losses and other underwriting expenses per dollar of premium) dropped to 96.1 in 2013. In 2012, that number nearly hit 103.

ISO (A Verisk Analytics company) and the Property Casualty Insurers Association of America reported the promising numbers in their 2013 fourth-quarter and year-end summary of the industry’s performance.

In short, the numbers were downright dazzling compared to recent years.

Net income after taxes for the industry surged to $63.8 billion in 2013, versus $35.1 billion in 2012. That reflects a 10.3 percent rate of return on average policyholders’ surplus, ISO and PCI said, up from 6.1 percent a year ago, thanks, in part to double-digit rates of return for mortgage and financial guaranty insurers, and robust single-digit returns for other insurers.

Net income after taxes for the industry surged to $63.8 billion in 2013, versus $35.1 billion in 2012. That reflects a 10.3 percent rate of return on average policyholders’ surplus, ISO and PCI said, up from 6.1 percent a year ago, thanks, in part to double-digit rates of return for mortgage and financial guaranty insurers, and robust single-digit returns for other insurers.

Both groups said that the United States dealt with a light hurricane season last year, which also helped. Back in 2007, the overall rate of return for the private U.S. property/casualty insurance industry hit 12.4 percent, the last time the number was anywhere near that high, according to the ISO/PCI-compiled results.

Insurers generated $15.5 billion in net gains on underwriting in 2013, versus $15.4 billion in net losses on underwriting in 2012. Net written premium growth played a factor, according to the ISO/PCI assessment, reaching $477.7 billion, a 4.6 percent jump. But a drop in net losses and loss adjustment expenses (LLAE) also helped. Net LLAE plunged to $315 billion, down 5.5 percent year-over-year, according to the industry assessment.

As well, insurers’ generated $58.8 billion in net investment gains (investment income and realized capital gains) in 2013, up from $54.2 billion in 2012.

Of course, it’s not all wine and roses. The months ahead could produce more problems and expenses, warned Robert Gordon, PCI’s senior vice president for policy development and research.

“The U.S. marketplace emerged relatively unscathed from the hurricane season last year,” he said in a prepared statement. “But advanced risk models show that losses from catastrophic events will continue to increase, and insurers will need to keep building on their financial resources to protect policyholders and bolster economic resiliency before the next major events like Hurricane Katrina or the September 11 terrorist attacks occur.”

Gordon acknowledged “insurers are taking the steps necessary to secure their financial commitments to consumers,” but said “catastrophe planning and preparation continue to be critical watchwords for 2014.”

The Future of HR Is AI

The Future of HR Is AI  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers