Global reinsurer capital, which had reached a peak of $515 billion at the end of first-quarter 2013, still stood above the half-trillion mark at June 30, dropping slightly to $510 billion, according to Aon Benfield.

While falling 1 percent from the first-quarter peak, the total is still 1 percent higher than the $505 billion level that Aon Benfield tallied for year-end 2012, the broker’s latest report says.

In the weeks leading up to the Rendez-Vous de Septembre in Monte Carlo, the focus of a glut of reinsurance brokerage and rating agency reports being published in advance of the event has not been on the downward forces impacting the total figure, such as capital management activities by traditional reinsurer—dividends and share buybacks—and unrealized investment losses resulting from higher interest rates.

Instead, the spotlight has been on the fact that the overall capital figure is still too high in relation to opportunities to deploy it, and on the growing portion of the total coming from alternative sources—a number that Bryon Ehrhart, chairman of Aon Benfield Analytics, put at $44 billion during an August interview, when the officially published total from his firm still stood at $515 billon.

“The impact on reported industry capital has been mitigated by the growing involvement of the capital market investors in the reinsurance sector,” the latest Aon Benfield report says, highlighting the central theme of all the recent reports about reinsurance, and characterizing the development as a “growing challenge to ‘traditional’ reinsurer business models.”

“The amount of [alternative] capital that wants to be in the [reinsurance] space is having a far greater effect” on market dynamics and pricing than the capital already in it, said Ehrhart, who is also chairman of Aon Benfield Securities, noting that predictions about 1/1 renewal pricing offered up at past Rendez-Vous meetings historically used measurements of total reinsurer capital (supply) against insurance company demand for reinsurance coverage as a starting point.

“What we’ve seen…recently is a greater inflow of third-party or capital market capacity, which further creates a more competitive landscape,” on top of robust reinsurer balance sheets, said Robert DeRose, a vice president for A.M. Best, making a similar point on during a webinar Wednesday. “That obviously has a downward pressure on pricing,” DeRose said, who covers U.S. and Bermuda reinsurers, noting the reinsurance rates were off 15-20 percent for June and July renewals.

“While having capacity is a good thing, it really escalates the competitive market climate,” he concluded.

Stefan Holzberger, managing director of analytics for A.M. Best, speaking from his vantage point in London covering global reinsurers, said that large European reinsurers, as well as more localized reinsurers in the developing markets, are also “suffering from a good problem to have”—balances sheets that are extremely strong. “The opportunities to deploy capital in an extremely competitive market are just not there,” he said.

“Certainly, the biggest difficulty is accessing good profitable business that meets return hurdles in a very competitive environment.”

In a separate report published Thursday, titled, “Alternative Reinsurance 2013: Market Update (Convergence Here to Stay),” Fitch Ratings said alternative reinsurance is seen as a mixed blessing in terms of assessing reinsurers’ financial strength. On the one hand, it can be used to manage reinsurer’s exposure and serve as a source of fee income. But it also represents competition, which in conjunction with the strong overall capitalization of the industry “has noticeably dampened pricing.”

Rating Agency Impact

Ehrhart revealed that Aon Benfield is predicting that another $100 billion of alternative capital will come into the reinsurance space in the next five years—on top of the $44 billion already there. Like Fitch, he also talked about reinsurer actions to sponsor catastrophe bonds in order to divert the peak risks they have reinsured for our clients, and to sponsor sidecars in proportional arrangements.

He also discussed reinsurer forays into the asset management business. (For more information on reinsurer moves to manage third-party funds, listen to the accompanying podcast interview, Reinsurers Need To React Now To ILS Market Shift: Aon Benfield Exec.)

In addition, Ehrhart made a very different point—addressing the impact of rating agencies on the reinsurance market. When asked about changes in criteria announced by rating agencies this year (most notably Standard & Poor’s), he instead focused on rating agency actions over the last two decades.

“Over the last 20 years, we’ve seen rating agencies, both A.M. Best and S&P, pushing insurance companies [and reinsurers] to the point where they actually now take less risk per unit of capital than they ever have,” he said.

“It’s gotten so bad that the fully‑collateralized unrated model coming from investors is equal to or better than, in terms of price, to the levered and rated model.”

“The definition we’re using for convergence is when the collateralized, unrated product is competitive with the rated and levered model. That’s convergence,” he continued. “We’re now firmly past convergence into what we call post‑convergence. And I think a lot of that convergence actually was driven on the left‑hand side—[in] the reinsurer/insurer column, by…rating agency actions [that] have been taken.

“It’s harder to build a greater value proposition to insureds [if you’re a primary carrier], or [to] insurers if you’re a reinsurer, when you continue to have these kinds of additional capital requirements,” he said.

In the August interview, and in an earlier interview in January, Ehrhart stressed that “the insurance and reinsurance rating groups proved to be more right about how to think about managing risk” than those rating analysts who were assessing the strength and creditworthiness of other financial services firms in past years. Even though the result of rating agency scrutiny in this industry is that insurance and reinsurance companies reacted by shedding risk, they performed well through the financial crisis. “There weren’t insurer and reinsurer failures because of things that ratings agencies missed.”

In the January interview, in fact, Ehrhart went on to suggest that rating agencies and regulators have a role to play in fueling demand for insurance—and ultimately reinsurance, particularly on the casualty side.

“Corporations that take out significant debt financings aren’t subjected to the same kind of stress tests that insurance companies are subjected to when they go see the rating agencies. If that ever changed, that would actually drive additional insurance demand,” he said, at one point referring to the liabilities of BP and TEPCO related to the disasters that were largely uninsured as examples of places where capacity available from insurers and reinsurers isn’t being tapped.

$500 Billion? Or $300 Billion?

Ehrhart also took the time to explain the derivation of the $510 billion global reinsurer capital figure, which stands some $200 billion above Aon Benfield’s tally of total shareholder funds for 31 large reinsurers—$313 billion—also presented in the firm’s latest report, and well above similar tallies by other firms.

“The $500 billion is capital that we count in every aspect that’s devoted to taking catastrophe risk for insurance companies,” Ehrhart said. In addition to including alternative capital, “we do count all the capital in platforms where a carrier that writes both insurance and reinsurance,” he said, noting that while executives are making capital allocation decisions to the two areas in such organizations, those allocation are often not disclosed.

By compiling the estimate, “we’re trying to look at what the price and capacity implications are to our client,” he said, justifying the approach and going on to explain that even though most clients place parts of their reinsurance programs with pure reinsurers, that portion might only be 30 or 40 percent of total program. “The remainder is placed with the multilines” writing both insurance and reinsurance.

“We also count government funds that provide reinsurance or reinsurance-like capital,” he continued, referring to the market impact of actions on taken by the Florida Hurricane Catastrophe Fund seven years ago to explain why.

“When they [FHCF] decided to deploy $16 billion more, that had an effect of really negating the need for a lot of the reinsurance capacity that was raised by new companies in the 2005 class,” he said, stressing that the goal of the overall capital tally is to project market capacity and price implications.

Ehrhart also gave the example of the Japanese Earthquake Reinsurance scheme as a government fund included in the $510 billion total. “The JER took the vast majority of the homeowner’s or residential losses in Japan from the tsunami and earthquake. If that didn’t exist, the price of reinsurance in Japan would be dramatically different,” he said.

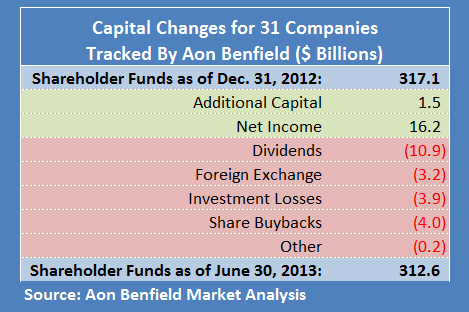

Turning to the $313 billion capital total for the 31-company aggregate at June 30, the Aon Benfield report notes that this figure dropped 1 percent from a $317 billion calculated for the same Aon Benfield Aggregate group at Dec. 31, 2012. Excluding Berkshire’s National Indemnity, the capital level for the remaining 30 companies fell 4 percent.

Breaking down the $4 billion drop for the 31-company Aon Benfield Aggregate, the report notes that improved underwriting performance relative to the prior year drove a 6 percent increase in reported net income, but this was outweighed by the effects of move active capital management, adverse exchange rate movements and higher interest rates.

While National Indemnity had $6.1 billion in unrealized gains, the remaining companies had unrealized losses of $10 billion, producing a $3.9 billion drop for the group overall.

While National Indemnity had $6.1 billion in unrealized gains, the remaining companies had unrealized losses of $10 billion, producing a $3.9 billion drop for the group overall.

- Is Third-Party Capital Wave Overshadowing Re Market? A.M. Best Weighs In

- Hurricane Would Entice—Not Spook—ILS Investors, Says Aon Benfield Exec

- Record Breaking Cat Bond Levels; Good News For Carriers

- ‘Breakaway’ Pricing Seen From Capital Markets Pressuring Traditional Re

- U.S. Property Cat Re Prices Down As Much As 25%, Casualty Softening: Willis Re

- Capital Markets Poised To Grow Even Bigger In Cat-Re Space

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered