As an executive and leader of a property/casualty insurance carrier, you are responsible for making consequential decisions that impact policyholders, employees, credit ratings, regulators, investors and others.

Executive Summary

Carol Williams, a risk management and strategy consultant for P/C insurers and recurring contributor to Carrier Management, builds on the work of executive coach and author Melody Wilding to help leaders make better and more timely decisions. Here, Williams applies Wilding’s tips for moving past the paralyzing effects of overthinking and the compulsion to rely on too much information and too many data inputs to the everyday decisions of insurance leaders.Whether it concerns the company’s strategic goals, a marketing strategy, what the post-COVID remote work policy should be or why the company is experiencing an upward trend on claims, your decisions will play a defining role in the future course of the company.

Putting deliberate thought into these types of decisions is an inherent expectation of the role of company executives, while possessing the skill of examining different perspectives and nuances of a problem or situation is a necessary quality of any type of leader, especially in today’s world.

Executive coach and author Melody Wilding defines individuals with these traits as “sensitive strivers,” and while they can be quite effective at processing complex information, this quality also comes with a major drawback. Contemplation eventually turns into overthinking and, thus, causes the insufferable problem of analysis paralysis.

There can be countless reasons why executives and decision-makers struggle with this problem. Some of these reasons are outlined below, but an overarching reason can be found in the book “Decision Quality: Value Creation from Better Business Decisions,” where the authors Jennifer Meyer, Carl Spetzler and Hannah Winter state: “All decisions are about the future, which is uncertain. Even with a high-quality decision, the outcome is not guaranteed. Since the only way to achieve value is through action, this discomfort must be overcome.”

Analysis paralysis is a common problem, especially with the plethora of data available to help drive decisions. Let’s use one of the examples mentioned above—your company’s long-term remote work policy. Gathering data on productivity levels of in-office vs. remote work and comparing it against external data is a likely way to arrive at an informed decision.

Remaining in data gathering mode, especially when uncovering new areas to research, makes it easy to fall into the analysis paralysis trap.

Finding yourself (or others at the company) in this situation is frustrating, but it also exacerbates the possibility of a host of consequences like missed goals, a ratings downgrade or worse if left unchecked. This is especially the case in light of different and numerous challenges plaguing insurers today.

Fortunately, there are steps executives can begin taking immediately to address the challenging issue of analysis paralysis. Each step represents a common way insurance carrier executives experience analysis paralysis and actions that can be taken to prevent it or at least reduce its impacts.

- Stop aiming for perfectionism.

Whether a new product launch, marketing strategy or moving into a new market, every executive wants to be successful in their pursuits. However, when taken too far, it becomes an “all-or-nothing” mindset that can wind up preventing timely and effective decision-making.

To prevent this mindset from creeping in, see if there are ways to break a decision into manageable chunks and separate out those parts that should take the highest priority. Doing this also allows you to identify the one thing you can do today to move the needle toward your goal.

When you are ready to launch a new internal initiative, do not think it has to be rolled out to the entire company. Choose a department where you can run a pilot to work out the kinks. Starting small like this can help overcome the nagging fears that keep many companies stuck.

The following idea, which entrepreneur and CEO of The ASK Method Company Ryan Levesque says is his mantra, speaks directly to this challenge: “You don’t have to get it perfect, you just have to get it going.” (Editor’s Note: Some online sources attribute the idea to success coach and author Jack Canfield.)

Another quote attributed to former President Harry S. Truman also sums this up well: “Imperfect action is better than perfect inaction.”

- Stop placing every decision on the same level.

Which decision do you think is more important: the color palette on a marketing flyer or the language in a policy form? How many vacation days employees should receive or the company’s main strategic goal for the year?

To put a decision in its proper place, Wilding suggests a “10/10/10” test where you consider how you will feel about a particular decision 10 weeks, 10 months and 10 years from now. Framing a decision like this can help you determine which ones are consequential and which are not. (Read the CM article, “Want Your Work and Life in Balance? Take a Long-Term View, Exec Coach Says,” for another application of the 10/10/10 test.)

Another tactic is not worrying so much about what others will think. Soliciting advice is one thing, but trying to satisfy everyone all the time will lead you to a place of analysis paralysis—and satisfying no one at all.

- Don’t be afraid to go with your gut.

Today’s world, especially the world of insurance, is awash in data. This will only continue to grow in the years ahead. Whether it is internal policy or claims data or external data of storm patterns or industry financial trends, there is no shortage of ways to understand a particular issue from a quantitative perspective.

On the other hand, intuition or “going with your gut” uses past personal experiences and other knowledge gained to make the best call possible. You make decisions using your “gut” all the time without realizing it for small decisions. When blended with data and analytical thinking, intuition can be a powerful tool for more confident, better decisions on bigger topics.

Besides bringing your own intuition to the table, you can also lean on the wealth of experience at your disposal within your company. Whether it is from fellow executives, managers or even entry-level employees, everyone has a perspective to offer.

If you have an idea on changing how your company compensates agents or different ways to manage these relationships, you can lean on the experience and intuition of others in the company for constructive feedback of your idea.

- Prevent mental burnout by limiting the number of decisions you have to make.

Making decisions can be mentally exhausting, especially when you consider that the average person makes 35,000 decisions a day,according to some estimates. When combined with the high-impact decisions P/C executives make daily, the ingredients for mental burnout become readily apparent.

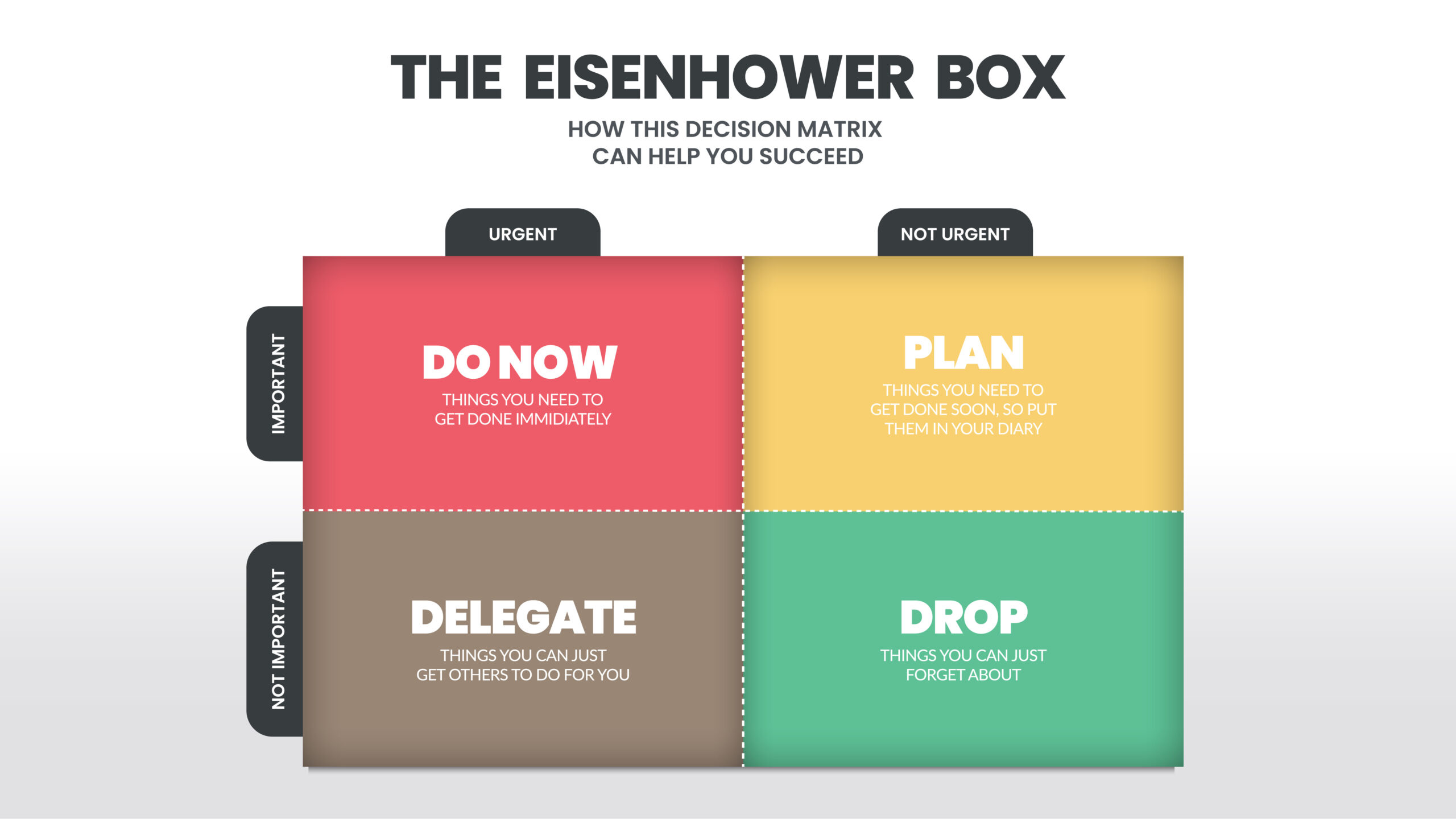

Besides creating routines and delegating some decisions to others to conserve brainpower, you can also harness tools like the Daily Priority or “Eisenhower” matrix first developed by former supreme Allied Commander and U.S. President Dwight Eisenhower. A tool like this helps you visualize what you absolutely must decide today (tasks with deadlines or consequences), what you can put off, what to delegate (activities that don’t require your skillset), and what is ultimately inconsequential.

Another tactic involves reframing decisions as opportunities. Doing so gives the act a better connotation in your mind. Whereas a decision tends to be focused on choosing right or wrong, good or bad, an opportunity sounds more like an exciting journey or a new direction.

- Place time boundaries around a decision.

There is a concept known as Parkinson’s Law that says that no matter how simple a task or decision is, we will take as long as we are allowed to make it. This condition is something “sensitive strivers” struggle with mightily.

If you have a week to kick around an idea, you will take a week even if the decision does not require that amount of time.

Setting deadlines can be helpful for combating this, but what really can address this issue is to have an accountability partner. Commonly used in exercise regimens, you can communicate deadlines to a designated person and encourage a culture of gentle reminders and encouragement when something is due. Another method of accountability is proactively communicating expected decisions with impacted parties.

Without these sorts of boundaries or constraints, it is likely the decision will continue to get postponed, and analysis paralysis quickly sets in.

Remember, you are not alone.

Analysis paralysis is something everyone encounters, even the most seasoned executives and professionals, and it is even more of an issue with certain personalities like sensitive strivers.

This dreadful problem can be a major roadblock for insurers and other companies, keeping them from ultimately reaching their goals. As an executive, being mindful of analysis paralysis for yourself and your people, while also taking steps like the ones outlined above, can be tremendously helpful in alleviating a troublesome burden and ensuring your company’s success.

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation