Mosaic Insurance, the Bermuda-headquartered startup and Lloyd’s specialty insurer, operates with a unique structural twist. Its hybrid model has the flexibility of a managing general agent (MGA), the stability of a carrier’s long-term capital, plus the ratings, global licenses and distribution reach of Lloyd’s of London.

Executive Summary

Mosaic Insurance is the brainchild of industry veterans Mitch Blaser and Mark Wheeler, who came up with a new business model that deploys flexible syndicated capital, enabling the insurer to export Lloyd’s paper anywhere in the world. They aim to combine the best “pieces” of the industry, like a mosaic, to re-shape the way the business operates.Launched in February 2021, Mosaic is the brainchild of insurance industry veterans Mitch Blaser and Mark Wheeler, who conceived the new model and now serve as co-CEOs.

With 40 years of industry experience, Blaser helped found Ironshore in Bermuda in 2006 after previous executive roles with Swiss Re and Marsh. He met Wheeler when Ironshore bought Pembroke Managing Agency, a company that Wheeler founded. Wheeler joined Mosaic in April 2021.

The name “Mosaic” was chosen for the company because it aims to combine the best “pieces” of the industry, making a whole that is greater than the sum of its parts, said Wheeler.

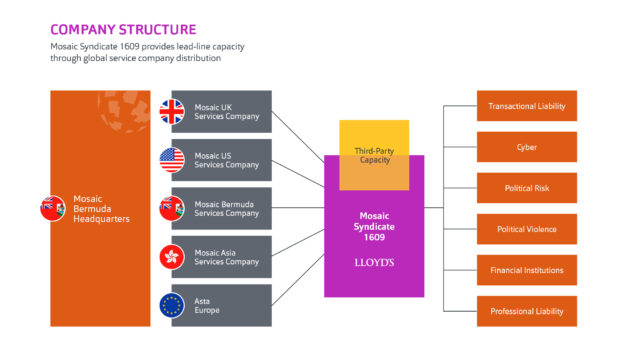

Centered on its Lloyd’s Syndicate 1609, Mosaic operates a network of wholly owned capital management agencies, or distribution offices, in Bermuda, London and New York. Additional hubs are expected to be launched next year in Asia, Canada, the Middle East and Europe.

Each hub has full underwriting authority, bringing new regional retail business directly to Lloyd’s.

The structure effectively syndicates global capacity into local markets, said Wheeler in an interview with Carrier Management. Mosaic deploys syndicated capital, enabling it “to export Lloyd’s insurance paper anywhere in the world.”

“Our Syndicate 1609 is the lead syndicate on those binding authorities issued to our underwriting hubs,” Wheeler said, noting it was essential Mosaic had a physical presence with underwriters located in its chosen jurisdictions. “We’re not just a postbox in those cities.” (The number 1609 refers to the year Bermuda was settled by English colonists when they shipwrecked en route to America.)

Within its global network, Mosaic sources third-party insurance capital, or trade capital, to build out additional capacity, enabling the insurer to provide a pre-syndicated line-slip to its insurance clients. Wheeler described this syndicated structure as one of the most important aspects of the company’s business model.

By third-party insurance capital, Wheeler was referring to both Lloyd’s and non-Lloyd’s insurers who want to participate on a risk. In essence, they are hiring and paying a fee to Mosaic for its underwriting expertise and distribution. The pre-syndicated slip allows for a pre-set determination of terms and the layer of risk in which the insurer wants to participate.

“This type of syndicated product wasn’t available anywhere else in the world outside the London market, prior to Mosaic. We’re effectively pre-syndicating the risk, then selling that syndication in major hubs around the world.”

Its Lloyd’s syndicate provides Mosaic with global licenses, rating and brand strength. The company operates a single P&L across all its businesses, which Wheeler said helps it maintain responsibility and accountability in different offices and product lines while avoiding the antagonism that can occur within an organization that balances separate P&Ls across geographies.

Mosaic has two groups of clients: “There are the insureds, who buy the policies we underwrite, deploying our proprietary capital, and we also underwrite on behalf of third-party, trade capital,” Wheeler said.

“In effect, we are then an underwriter’s underwriter, providing specialty underwriting expertise and market access for a fee.”

By doing so, Mosaic leads syndicated underwriting risks for its third-party capacity providers in six specialty lines: political violence (war and terror, strikes, riots and civil commotion), cyber, transactional liability (M&A), political risk, financial institutions and professional liability. Next year, it will begin offering environmental liability. Most of the company’s insured clients are midsize to large corporates.

“Mosaic underwriters are operating as market makers,” said Wheeler, “so we’re a lead market rather than providing follow-market capacity.”

In a separate interview, Co-CEO Blaser said Mosaic aims to be at the top three in these lines within five years. “We want to have a billion dollars that we write in total in four to five years and continue growing at a rapid pace, but always sticking to our knitting and focused on our specialty lines of business.”

High Technical Barriers to Entry

Long before the company was launched, the decision was made to focus only on specialty lines with high technical barriers to entry. “We’ve chosen lines we believe are going to have increased relevance and resonance with clients and third-party capital providers,” Wheeler said. “This enables standard property/casualty companies to diversify with specialty products that complement their portfolios.”

Specialty capital typically will only delegate if it doesn’t have in-house underwriting expertise or distribution reach in lines of complex business, he said.

Since the company’s launch, it has spent the remainder of the year developing products and building out underwriting teams, growing from about 15 employees at launch to a projected 75 by the end of the year.

Blank-Slate Brainstorming

Mosaic was born from a process of “blank-slate brainstorming” to determine the best lines to underwrite. One criterion was “to provide a growth run rate that exceeds normalized gross domestic product. The decision was made to avoid commoditized, short-tail products, such as property catastrophe. We want to be able to demonstrate to our non-aligned capital that we expect to outperform the market in terms of growth and profitability,” Wheeler explained.

“We’ve chosen lines we believe are going to have increased relevance and resonance with clients and third-party capital providers. This enables standard property/casualty companies to diversify with specialty products that complement their portfolios.”

“We’ve chosen lines we believe are going to have increased relevance and resonance with clients and third-party capital providers. This enables standard property/casualty companies to diversify with specialty products that complement their portfolios.”

Mark Wheeler, Mosaic

Blaser said that Mosaic developed a model that could be profitable regardless of market conditions. “We chose high-value, non-commoditized lines of business with strong growth trends, not only in the current market but looking ahead to the coming years as well. Then we focused on getting the best people and most agile technology as key drivers for success. The flexibility of being able to leverage both proprietary and trade capital also allows us to adjust nimbly to market conditions.”

During those early conceptual sessions, the optimal business model was carefully contemplated before any money was raised. Mosaic’s team decided against conventional balance-sheet models that would mimic what many other Bermudian startups do: raise a billion dollars, then seek to deploy capital as quickly as possible, usually in property-catastrophe business.

“Such business can be very profitable, but it is much more volatile. It’s the easiest way to get volume on the books, but we didn’t want to go down that route,” said Blaser, noting that with a conventional balance-sheet model, the company would have to launch separate pools of capital in each of its underwriting hubs.

“We couldn’t be sure at what speed the business was going to develop. And all of these things would be risks in terms of return on equity and whether you have the money in the right location,” he added.

Wheeler further explained that once capital has been launched in a regulated entity, it’s very hard to move it around afterward, which highlights “the frailty of a balance-sheet model.”

Mosaic does not write any natural-catastrophe exposures.

Considering an MGA Structure

The founders also looked at another alternative: an MGA structure with no capital, just underwriting expertise. “This is where underwriters would be paying you for product expertise and for distribution,” explained Wheeler. “In financial modeling terms, it’s incredibly attractive. It requires minimum equity capital and no underwriting capital.”

Such a structure can provide a superior ROE if it’s done right, he admitted. “But there are structural problems with MGAs—first and foremost is that, ordinarily, an MGA has limited claims-settling authority. If you’re in an MGA environment, it’s very hard to look a client in the eye and say, ‘I know who our lead capital provider’s going to be in four, five, six years’ time when your claim gets paid,’ and feel good about that promise you’re making. By contrast, claims handling is key at Mosaic; it’s integrated into the process of every risk we write.”

Unlike a traditional MGA, Mosaic doesn’t have to go to its third-party insurers and pitch a product idea with rating proposals, with wording and an underwriting business plan, he noted.

Lead Capacity

Mosaic underwriters provide lead capacity and control their own underwriting parameters, a significant difference between its model and an MGA. “We have the first line on the slip and the line that agrees the claims. We have the lines that agree what the selection criteria might be, what the contract language is, the deal structures and the pricing.”

“We want to have a billion dollars that we write in total in four to five years and continue growing at a rapid pace, but always sticking to our knitting and focused on our specialty lines of business.”

“We want to have a billion dollars that we write in total in four to five years and continue growing at a rapid pace, but always sticking to our knitting and focused on our specialty lines of business.”

Mitch Blaser, Mosaic

Another difference is Mosaic’s capital support. The company is backed by Golden Gate Capital, a San Francisco-based private equity firm that operates a perpetual fund that allows less restriction over the length of time governing an investment, Wheeler said.

Mosaic should not be viewed as “an opportunistic company that’s looking to gorge itself for the next two or three years and then look for an exit,” he emphasized. “We feel very confident we have a backer in Golden Gate that understands our longer-term aspirations.”

Blaser said Mosaic aims to have a very strong ownership culture, with every employee provided an equity stake. “We want to be entrepreneurial. We want our people thinking, feeling and being owners of the company. That’s something not many firms can offer.”

Technological Advantages

Mosaic also has an important competitive edge, Wheeler said, because it has neither a legacy balance sheet nor legacy technology. “That plays a key part in how we inform our underwriters about risk exposures and processing, and also data sharing with our syndicated capital partners.”

Through a partnership with DXC Technology announced in August, Mosaic deploys cutting-edge tech to inform underwriting decisions, share real-time data and analytics, and streamline every process along the way, said Wheeler.

“Our focus on governance allows capital partners to gain equal access to discerning risk selection performed by our team,” he said, noting the creation of syndicated placements allows stakeholders to participate alongside Mosaic using its plug-and-play InsurTech platform. “It’s groundbreaking, and it really does underscore the fact Mosaic is doing things differently and reshaping the way our industry operates.”

Blaser and Wheeler

The co-CEOs of Mosaic Insurance, Blaser and Wheeler, first met in 2008 when Blaser’s company, Ironshore, acquired Pembroke Managing Agency, which had been founded by Wheeler.

“There’s a really high level of trust between us, and we enjoy working together. It is a good partnership,” Wheeler said, noting the co-CEO arrangement works well because both men bring complementary skills and experience to the equation.

Wheeler’s background is more on the underwriting side of the business, while Blaser has corporate and operational expertise. “I think the overarching comment about us working together is we’re totally aligned on the business strategy and the purpose and direction of Mosaic,” said Wheeler.

While the Mosaic model is very different from Ironshore and Pembroke models, he said, Mosaic’s development was informed by their early career experiences.

Based in Bermuda, Blaser has more than 40 years of experience in international insurance. In 2006, he joined Robert Clements as a founding executive of Bermuda-based Ironshore with $1 billion in private-equity capital and helped drive its growth to become a global P/C insurer with over 800 employees in 15 countries. In 2017, Ironshore was acquired by Liberty Mutual Group, and he became chief transformation officer of the company’s commercial lines division. Earlier in his career, Blaser was chief financial officer, Americas, for Swiss Re, and a member of the leadership team at Marsh, which included roles as both global chief financial officer and head of technology & corporate services.

Also based in Bermuda for Mosaic, Wheeler has served in a variety of leadership roles during his more than three decades of industry experience across global markets and product lines.

He was the founder of Lloyd’s Syndicate 4000 and Pembroke Managing Agency, purchased in 2008 by Ironshore, where his current co-CEO Blaser was a founding executive. Wheeler served as CEO of Ironshore International, overseeing expansion to 14 countries. He later held executive roles in global client engagement and international markets for Liberty Mutual Group following its 2017 acquisition of Ironshore. Prior to Pembroke, Wheeler spent 17 years at Lloyd’s, 14 at SVB where he was active underwriter of the group’s flagship Syndicate 1007 in 2000.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk