In early March 2020, AM Best released Scoring and Assessing Innovation, our formalized criteria for measuring a company’s innovativeness. Within weeks of its official launch, this methodology was put to the test by the COVID-19 pandemic.

Executive Summary

In this article, AM Best analysts give Carrier Management readers a glimpse at how carriers are performing on the rating agency’s innovation assessments. Just over a year since AM Best started using the innovation assessment criteria unveiled in early 2020, they find that only 1 percent of rated companies earned the highest scores as innovation “leaders,” and many struggle to transform innovation efforts into results. In other words, rated company innovation output scores lag far behind innovation input scores in the two-part assessment.This is a summary of several reports published by AM Best on its website on May 10, 2021.

COVID-19 was a real-life fire drill. It challenged insurers’ ability to pivot and innovate in the midst of global upheaval and great uncertainty. Not surprisingly, the pandemic accelerated insurers’ moves toward digitalization, increased their focus on customer experience and spurred product innovations. While some insurers had to recalibrate resources and shift their attention toward maintaining operations in a remote environment, others were able to double down on their innovation efforts.

One tumultuous year later, AM Best set out to see how insurers performed in their innovation efforts since implementation of the criteria.

In a series of innovation-focused research reports that were released on Monday, May 10, 2021, we looked at scoring trends, examined innovation efforts by line of business, evaluated regional approaches to innovation and dissected innovation scores by category (financial size, financial strength rating, business profile and operating performance).

One clear takeaway emerged: While the pandemic has forced businesses to cram years’ worth of innovations into one year, most companies still have a long way to go.

Innovation Scorecard

AM Best’s innovation scores are the sum of two factors: an input score and an output score. Innovation input scores are based on leadership, culture, resources, and processes and structure. Output scores are based on results and levels of transformation. Innovation scores are then translated into five innovation capability assessment categories: Leader, Prominent, Significant, Moderate and Minimal.

While the pandemic has forced businesses to cram years’ worth of innovations into one year, most companies still have a long way to go.

One year in, we found that insurers generally still face difficulty drawing clear linkages between innovation inputs and results, especially in times of crisis where quantitative evidence may be obscured by noise. As a result, our innovation assessment output scores are slightly lower than our preliminary results.

More than half of our rating units scored Moderate versus 19 percent for Significant, 18 percent for Minimal, 6 percent for Prominent and 1 percent for Leader. Overall, these results remain closely aligned to preliminary assessments.

Insurers fared better on input scores than output. Leadership, in particular, was a bright spot, with 4 percent of organizations earning the highest score of 4 for senior management’s commitment to innovation efforts. Management teams have largely recognized that innovation is a critical aspect of an organization’s operations.

Ultimately, though, innovation must lead to measurable results that make the investment of resources worthwhile. This is where insurers have struggled. Only 1 percent of companies earned the highest score of 4 on the results subcomponent, with 12 percent scoring a 3. Output scores for the level of transformation are even less favorable; less than 1 percent of organizations earned the highest score of 4, while just 6 percent earned a 3.

The low output scores show that actual sustainable results have yet to be proven over a longer period in what is considered to be the new normal business environment.

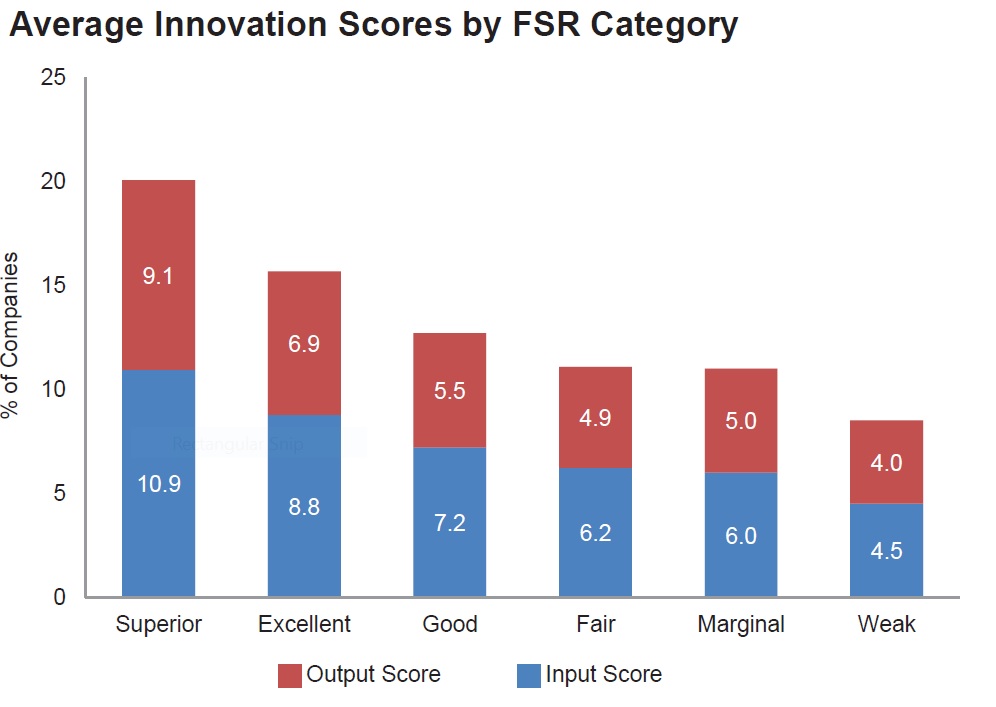

Nonetheless, it is important to note that one scoring trend holds true: More favorable innovation assessments skew toward higher-rated organizations.

Benchmarking

There is a high correlation between the financial strength rating of organizations and the innovation capability assessment. This correlation implies that innovation was always embedded within our rating process before AM Best formalized it within our methodology.

The average innovation score for companies with a Superior financial strength rating was 28 percent higher than that of those with an Excellent rating and 58 percent higher than that of those with a Good rating.

Superior-rated insurers, effectively using cutting-edge processes and technology, transform their innovation initiatives into transformative results comparable to those achieved by leaders outside the industry. This became apparent as the pandemic unfolded. Higher-rated companies generally had already made innovation-focused investments and were more prepared to deal with the challenges brought on by the pandemic, while other companies had to make years’ worth of changes instantaneously to improve customer engagement and continue growth opportunities.

We also saw correlations between innovation scores and business profile, operating performance and financial size category. Companies with more favorable operating performance assessments post a higher average innovation output score, demonstrating that these companies have proven tangible results from their innovation efforts.

We also saw correlations between innovation scores and business profile, operating performance and financial size category. Companies with more favorable operating performance assessments post a higher average innovation output score, demonstrating that these companies have proven tangible results from their innovation efforts.

Companies with larger amounts of capital at their disposal tend to have more financial resources, and thereby receive higher scores for the resource input. The distinction is clear as about 60 percent of companies with more than $500 million of capital and surplus scored a 3 or 4 versus just 15 percent of companies with capital and surplus of less than $500 million.

Line of Business

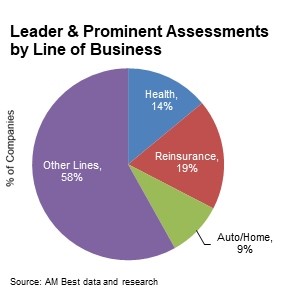

According to our insurance industry innovation assessments, reinsurance, health and auto are the lines of business that have been the most transformed by innovation.

In our preliminary assessments last year, the reinsurance segment scored the largest share of Leaders (6 percent) of any segment. That trend continued into 2021. For reinsurers, growing competition, ongoing third-party capital and InsurTech opportunities have driven innovation and created an environment of innovativeness. Over the next few years, reinsurers are likely to continue to innovate primarily in distribution, third-party capital management and using their expertise to get closer to cedents.

More than 10 percent of the health segment scored in the top two innovation capability assessments—Leaders (5 percent) and Prominent (8 percent). The health insurance market continues to change rapidly owing to regulatory and legislative changes, market demand, and medical advances. As a result, health insurers are quite receptive to new technologies and are usually early adopters that have produced quantifiable results.

More than 10 percent of the health segment scored in the top two innovation capability assessments—Leaders (5 percent) and Prominent (8 percent). The health insurance market continues to change rapidly owing to regulatory and legislative changes, market demand, and medical advances. As a result, health insurers are quite receptive to new technologies and are usually early adopters that have produced quantifiable results.

Finally, in auto insurance, technological advancements such as usage-based insurance and telematics, as well as customer interactions are driving significant changes, the speed and scale of which are transforming the line into one of the most innovative in the property/casualty industry. Personal auto is characterized by a higher level of interaction with consumers. As a result, customer expectations are driving innovation efforts.

International Efforts

Innovation is increasingly critical to insurance companies globally, as they continue to pursue long-term competitiveness and profitability. Having said that, we’ve observed many interesting differences in regional approaches to innovation.

In Asia-Pacific markets, we looked at how specific circumstances in each market shape innovation initiatives. For example, geographic and demographic challenges are shaping innovation in Japan, while in South Korea, changing consumer behavior and preferences, the threat of external disrupters, and shrinking profit margins are persistent drivers of innovation. (Article continues below)

There are many similarities between European and U.S. markets when it comes to innovation, as European insurers also have prioritized efforts related to digital transformation, customer experience, innovative product offerings, as well as expansion of distribution channels.

In emerging markets, where insurance penetration is relatively low and customers tend to be price-motivated, innovation efforts focus on improving insurance distribution, operational efficiencies and product affordability. Microinsurance and microfinancing schemes for customers in the agriculture sector, which is the leading industry in many of these markets, are an ongoing priority for retail insurance lines.

Real-Life Test

The pandemic presented a real-life test showcasing both the limitations and the success of current capabilities. Those insurers that already had an innovation mindset in place were quick to adapt and fend off competitive threats. Those that failed to innovate have significant ground to make up. And for all insurers, there remains tremendous opportunity to innovate.

Five AI Trends Reshaping Insurance in 2026

Five AI Trends Reshaping Insurance in 2026  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash