The 2020 hurricane season will be an active one according to all the major forecasters. Colorado State University said there is a 69 percent chance of a major U.S. landfalling hurricane. The tally began early with two tropical storms in May—ahead of the official start of the season on June 1.

KCC analysts suggest insurers should anticipate larger than normal losses if hurricanes do make landfall this year due to complications caused by COVID-19. Pandemic mitigation measures will make preparing for impending hurricanes more difficult for property owners, and it will cost more to repair hurricane damage that does occur. Contractors will require personal protection equipment (PPE) and may limit the number of workers on a site to comply with social distancing requirements.

The longer it takes to make repairs after a storm, the higher the cost of those repairs.

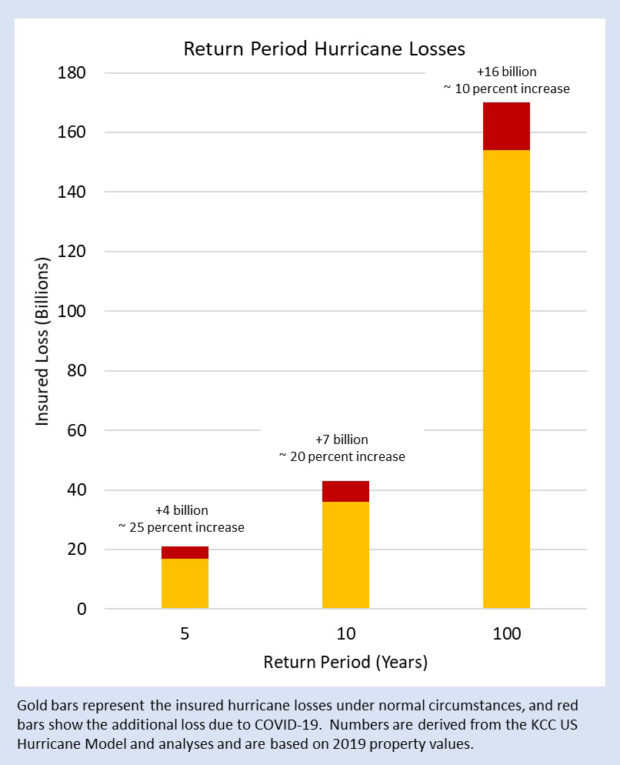

Smaller event losses—those at the low return periods of the Exceedance Probability (EP) curve—will likely increase proportionately more because contractors may be less willing to incur the costs and risks of COVID-19 to make minor repairs, and insurers may decide to settle small claims remotely. On the other hand, the long return period losses, such as the 1-in-100-year losses, already incorporate significant demand surge that accompanies large event losses, so larger losses may increase less on a percentage basis.

Of course, in terms of actual dollars, the increase in losses rises steadily across the EP curve. For example, the 100-year industry hurricane loss increases from $154 billion to $170 billion in the COVID-19 environment.

See related article, “Managing a Pandemic: Are There Lessons From Catastrophe Modeling?“

Markel Group Announces Leadership Changes

Markel Group Announces Leadership Changes  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage