When Willis Towers Watson asked more than 100 insurance industry executives to select what they thought would be the most dangerous risks to impact their businesses in the coming year, they ranked cybersecurity on the top of the list.

The fourth annual online “Dangerous Risks” survey was conducted from Dec. 17, 2019, to Jan. 19, 2020, so it’s not surprising that the risk of a pandemic wasn’t top of mind. The last time that risk appeared on a Willis Towers Watson (then Towers Watson) ranking was in 2013, when pandemics ranked on top of a list of “extreme risks” identified by insurers. And in 2015, “rapid and massive spread of infectious disease” ranked second on the Top 5 Risks in terms of global impact developed by the World Economic Forum.

Dave Ingram, an executive vice president for Willis Towers Watson and author of the “Dangerous Risks” report, explained that the question that insurers were asked for the latest report was “what was potentially going to harm them in the coming year.”

“If you look back over the last 75 years, there’s been a couple of these scares in the last 10 years, but there’s only two pandemics that actually went anywhere—in 1957 and 1968,” he said, referring to flu pandemics in the late 1950s and late 1960s that each caused over 1 million deaths worldwide (and roughly 100,000 in the United States), according to the CDC. “If something hasn’t happened since 1968, you wouldn’t put that on your list of what’s most dangerous for next year,” Ingram said.

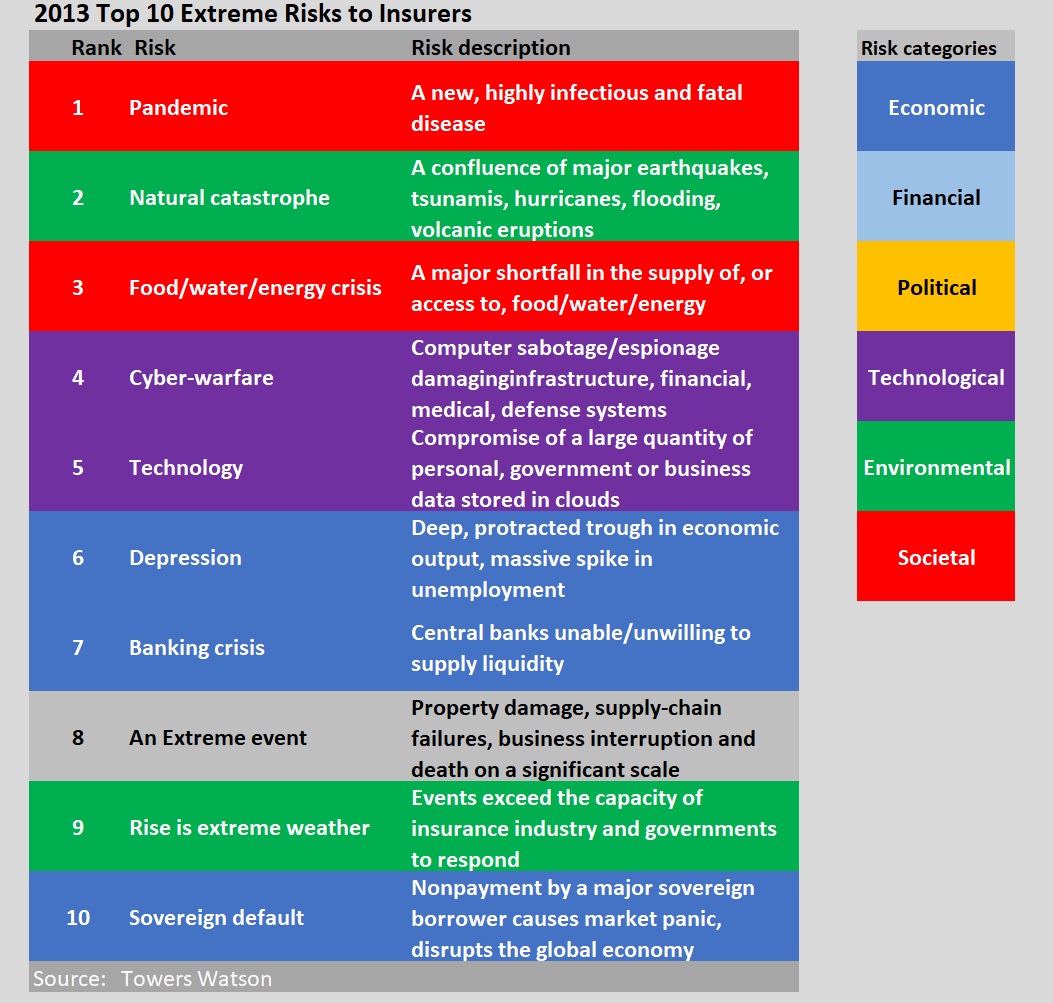

It sometimes ends up on lists of extreme risks because “if it did happen, as we’re seeing, it could be quite damaging,” he added. “Pandemic was something that some people were worried about in 2013 because that was the year there had been a scare of a pandemic. It was on people’s minds then,” he said, recalling fears surrounding the H7N9 bird flu at the time.

When the 2013 Extreme Risks survey was taken, some pandemics and near-pandemics in insurers’ recent memory included: a 2009-2010 novel H1N1 virus pandemic (swine flu), which the CDC estimates resulted in more than 12,000 deaths and nearly 61 million cases in the U.S. alone; a SARS-like virus commonly called MERS (Middle East Respiratory Syndrome) in 2012-2014; a bird flu transmitted to humans first reported in China in 2013. In 2014, pandemic fears were ignited again with news of an outbreak of the Ebola virus in Africa.What’s in the Danger Zone Now

“Issues such as the recession, increasing regulation and climate change have dominated risk discussions in company boardrooms, at the expense of a risk that last occurred 40 years ago.”

The excerpt from a Lloyd’s report published in 2009 at the height of the H1N1 swine flu pandemic in 2009 seems apt again with risks related to the economy, regulation and the environment showing up as a perceived danger to insurers while global pandemics were off the radar. But unlike 2009, when the financial crisis put economic fears above everything else, concerns about cyber risks loom large today, with cyber schemes reported during pandemic lockdowns likely now amplifying the concerns.

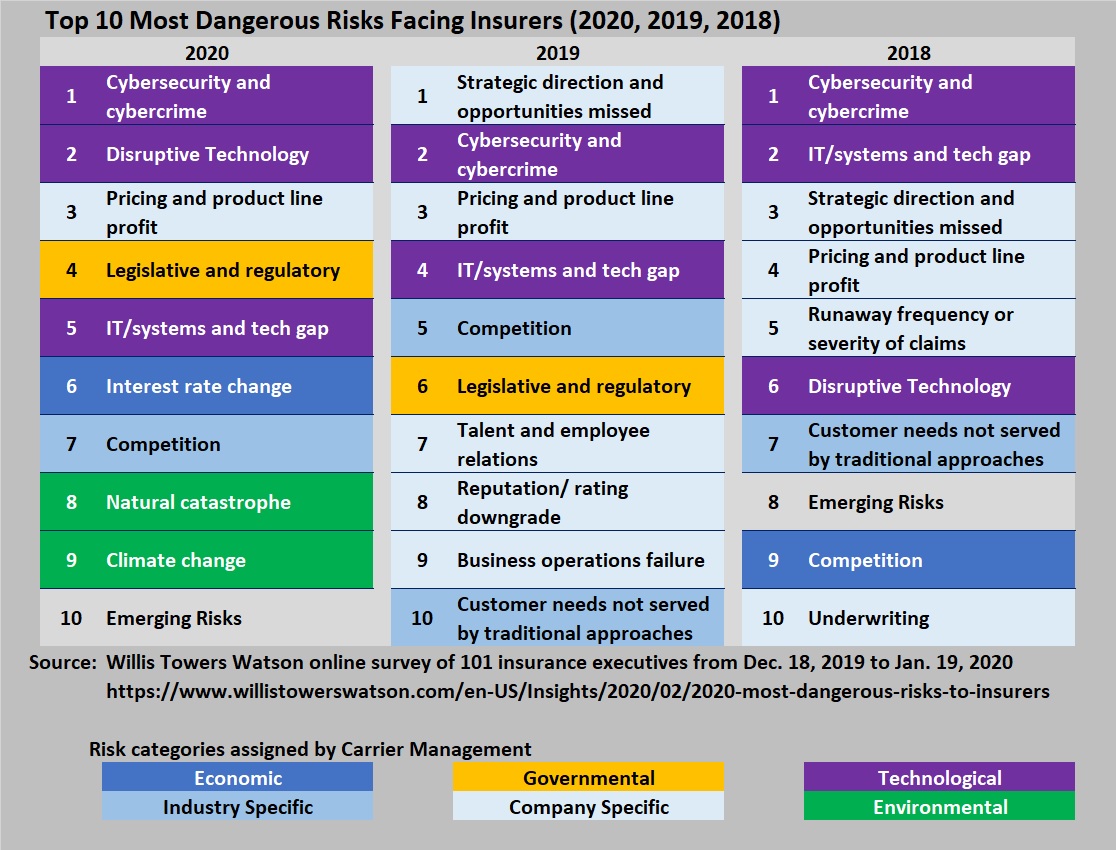

Cyber ranked among the top two risks for each of the last three years of insurer Dangerous Risk surveys published by Willis Towers Watson. Insurers have to worry about cyber from two vantage points: as providers of cyber coverage and about direct attacks on their own businesses, Ingram wrote in a blog item announcing the results in early February.

He also noted that after several years of stable responses, insurers selected five new risks among the top 10 in 2020 that were not there in 2019. Three of them—interest rate change, natural catastrophes and climate change—weren’t in the top 10 for 2018 either. Among the five, the risk of climate change showed the biggest one-year leap in ranking, moving to ninth place for 2020 from 53rd in 2019.

“Most [expert] projections are saying in 50 years it will be disastrous. But until we started seeing the wildfires both here and in Australia, I’m not sure anybody had any real specific short-term dangers you could point to,” he said, suggesting a reason that climate change suddenly emerged onto insurers’ ranking of short-term dangers.

Similarly, natural catastrophe risk jumped to eighth place on the 2020 Dangerous Risks ranking from 28th place in 2019. “Recently, we reported that insured losses from natural catastrophes in 2019 were down by 33 percent from 2018, which was down 44 percent from 2017,” Ingram wrote in his blog item, highlighting the counterintuitive 2020 ranking in spite of the favorable trend. “Likely this is a result of a suspicion that the ‘new normal’ is for erratic and more severe weather incidents due to climate effects,” Ingram said.

Ingram also noted that “disruptive technology” rose to second place in 2020, after dropping out of the top 10—to 17th place—in 2019. “I think people read a lot when they’re looking ahead, [and] there was a lot of pretty hysterical stuff about how business was going to be taken over by technology firms. There’s only so many years in a row you can scare people with that and it doesn’t happen. Then it drifts out of people’s consciousness as a danger” for a while, he said.

Also growing in importance for insurers is the general category “emerging risks,” which appears in the 10th spot for 2020, rising from 15th in 2019. “This risk can be read to mean, ‘We do not know what, but something else is likely to hit us hard,'” Ingram said, agreeing that pandemics could fall into that category.

Dangers Overlooked

For 2020, survey respondents were specifically asked to write in any highly dangerous risks that weren’t among 60 provided by Willis Towers Watson to choose from. Insurers suggested nine more risks to be added in future years, including social inflation, tort reform, biodiversity loss and project management.

Is the industry missing anything else?

Ingram, who does risk identification exercises with companies, hears the question often. “I don’t think folks are missing anything when you look at the breadth of the list. Some companies, when they pick from the list, leave out entire categories, but it’s usually because they think they’ve got it completely taken care of, so it falls out of their consciousness. A lot of insurance companies, for example, have a fairly conservative investment strategy. So, they don’t think of the fact that they have investment risk. But they still do,” he said.

David Bradford, principal of Iosis Consulting and previously a co-founder of Advisen, a technology and risk research company for the commercial insurance industry, responded to Carrier Management‘s question about unrecognized risks as well. Bradford, who was also the Guest Editor for part of CM’s May/June 2020 magazine, believes “the fact that things are changing so rapidly is a risk factor itself.”

“Not only do we have to deal with new types of risks that are emerging” but also that “they’re emerging at a rapid pace,” he said, referring mainly to the impact of technology on insurance businesses.

Drilling down to talk about a specific risk that may not yet be fully appreciated, Bradford believes insurers don’t understand how artificial intelligence and machine learning will alter the risk landscape very well right now. “I’m not sure a lot of people are really thinking that through. We’re just sort of incorporating it at this point in time. Unless you happen to be Elon Musk or Bill Gates and you’re convinced that machine learning is going to be the doom of mankind, I think that there’s a whole lot of risk aspects that are not being contemplated—and that need to be contemplated,” he said. Bradford also noted risks associated with genetic engineering, DNA and genome access, which “could potentially open up a Pandora’s box as well.”

Longer-Term Risks: Impactful and Extreme

Bradford said that only climate change came to mind as a risk that is as world-altering in scale as a pandemic, but he believes that has become more top-of-mind for all risk analysts. Looking ahead, Ingram said that economic concerns will rise on the next go-around of the risk surveys, noting the “hurt to the economy that’s going on” now because of “the way that we’re having to deal with the pandemic. I don’t think that will be repaired by the end of this year,” he said.

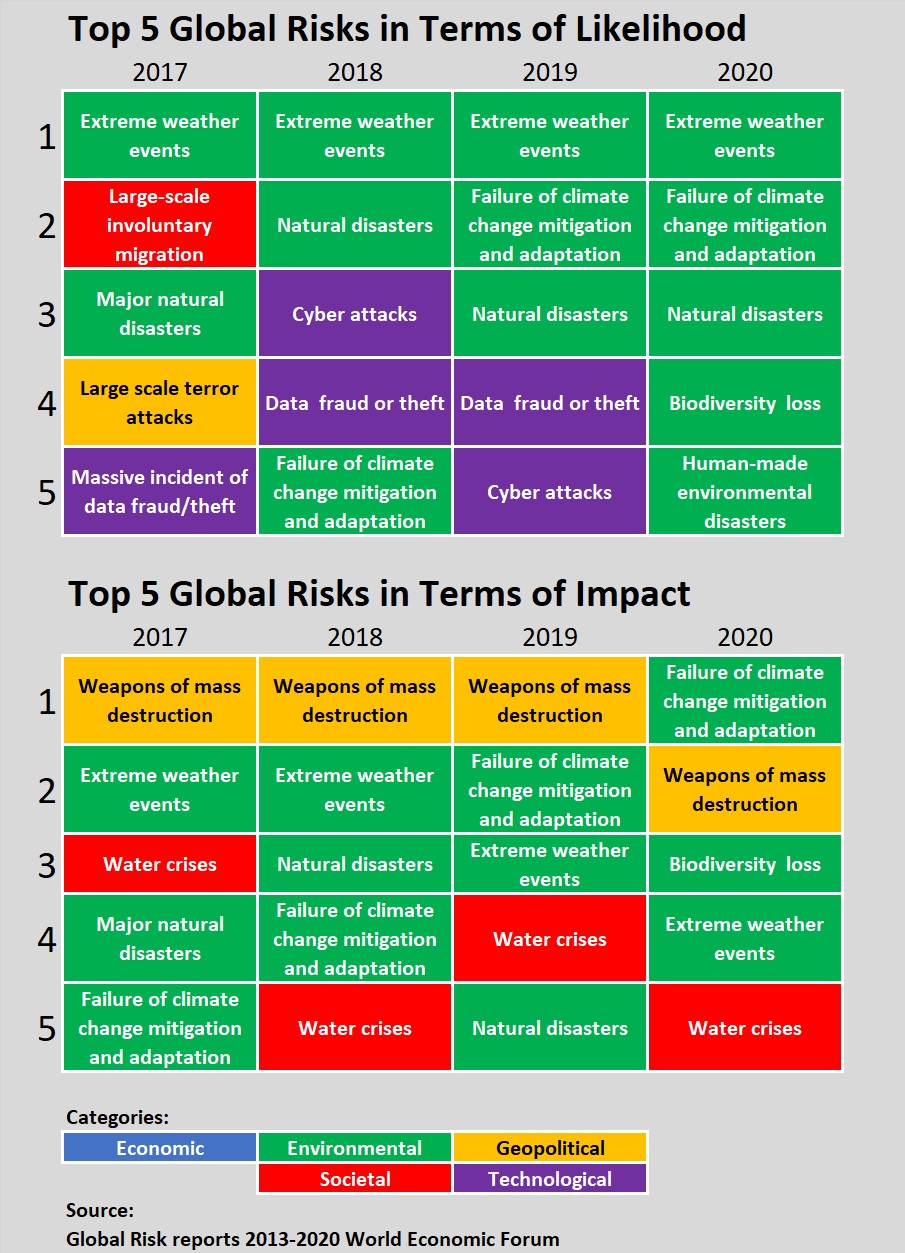

Turning from the short-term risks captured on the “Dangerous Risks” surveys to the longer-term ones, environmental risks dominated risk rankings of the first such risk survey report published this year—the World Economic Forum’s “Global Risks Report 2020,” released in mid-January. That report defines “global risk” as an uncertain event or condition that, if it occurs, can cause significant negative impact for several countries or industries within the next 10 years. Over 750 global experts and decision-makers asked to assess the prospect of a global risk occurring over the course of the next decade ranked extreme weather, climate action failure and natural disasters as most likely. In terms of severity, climate change failure also rose to the top.

A summary of the Global Risk Report rankings for the last four years presented below shows the predominance of environmental risks (shown in green) in the experts’ assessments of probability and severity, as well as concerns about potential technology risks (shown in purple).

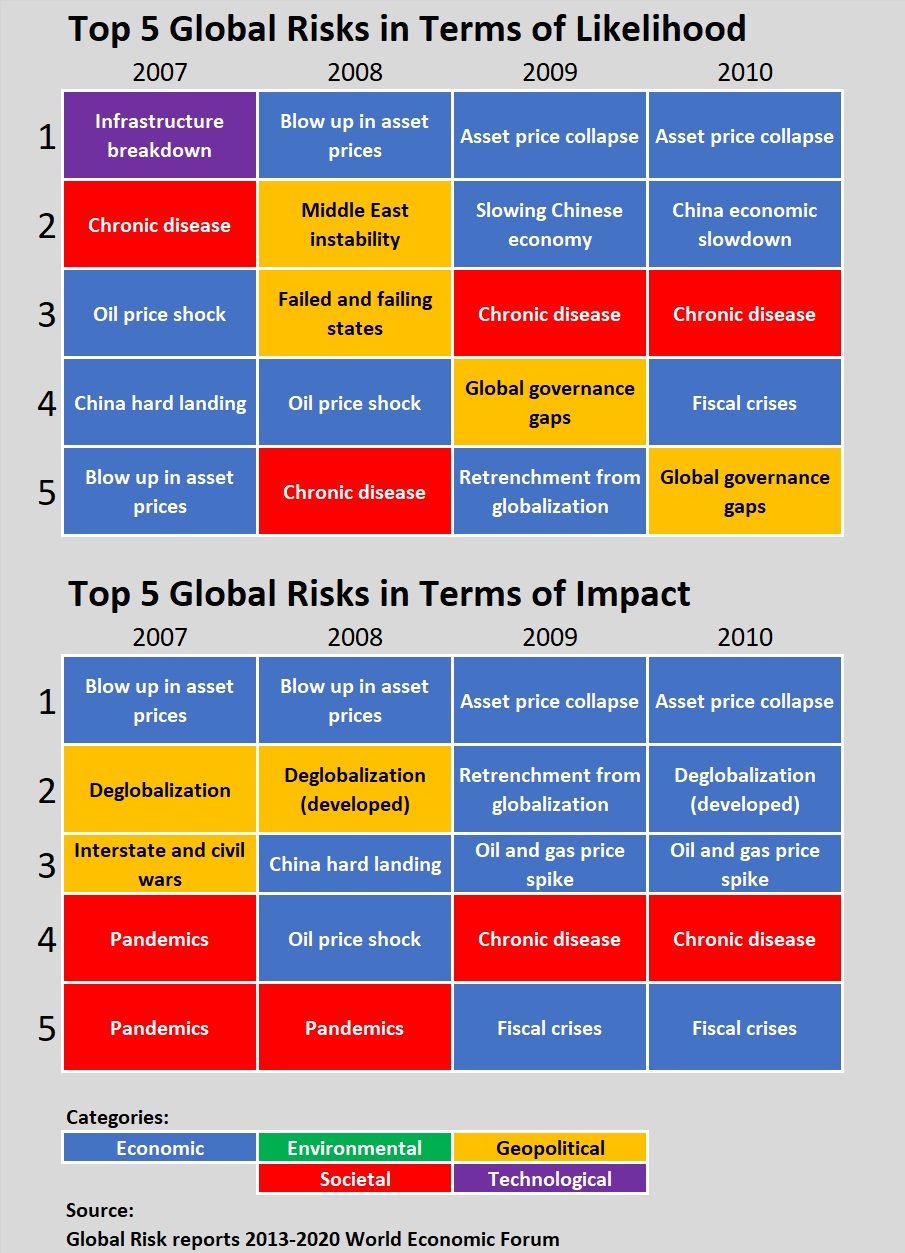

In contrast, during a similar four-year period a decade earlier, around the time of the global financial crisis, risks to economy were ranked highest (shown in blue).

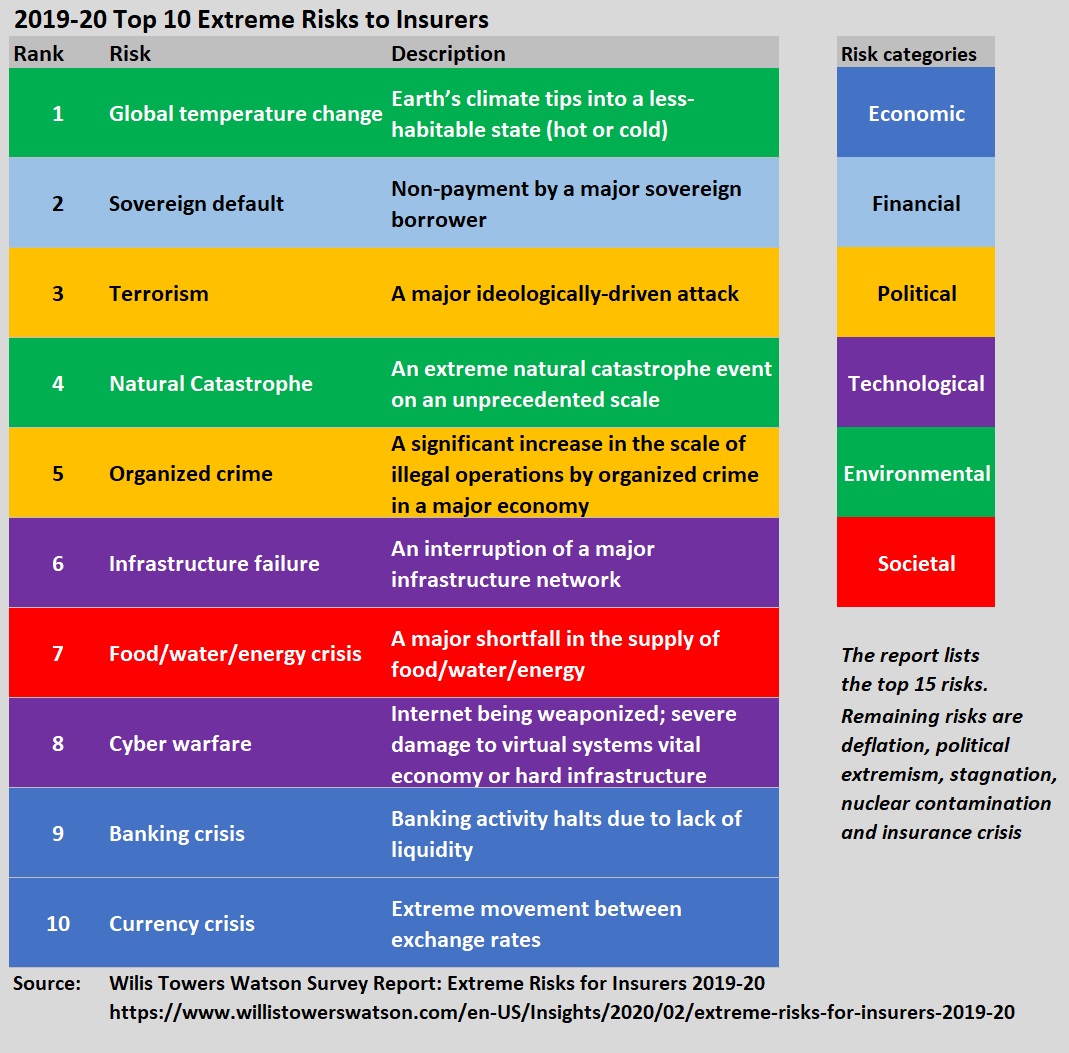

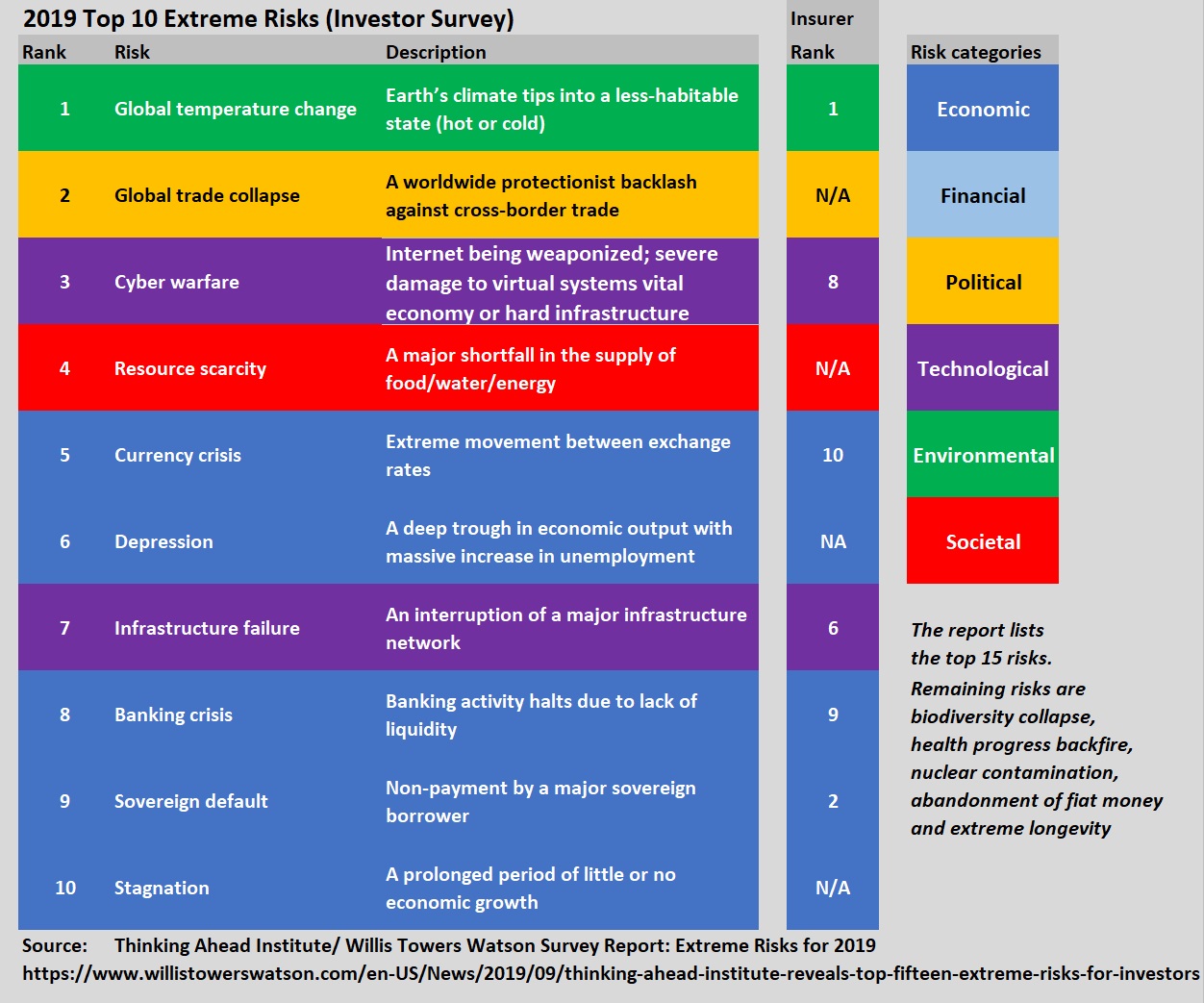

In February of this year, in addition to the Dangerous Risks report, Willis Towers Watson published a second survey report, “Extreme Risks for Insurers 2019-20.” That report ranks “potential events that are unlikely to occur but that could have a significant impact on economic growth and asset returns should they happen.” Global temperature change, sovereign default and terrorism topped the list based on assessments of insurance industry executives from around the globe.

To develop the list, Willis Towers Watson asked over 100 representatives of insurers to score 30 individual extreme risks based on their likelihood, intensity, scope and certainty. Risks that are more likely, have greater intensity and larger scope risks command higher scores, which Willis Towers Watson combined into a single ranking to reflect the importance of each extreme risk.

A similar report from 2013 puts the risks two societal risks—pandemics and scarcity of food, water or energy—at the top.

The more recent 2019-2020 survey builds on Willis Towers Watson Thinking Ahead Institute’s long-running analysis of how extreme risks may impact investment. Like the insurers, respondents assessing the importance of the same 30 extreme risks to investors ranked global temperature change as the top risk, but global trade collapse and cyber warfare replaced sovereign default and terrorism as the second- and third-ranked risks for the broader group.

The risk of a pandemic was presented to both groups, and both scored the risk the same in terms of likelihood (one-to-100 years), intensity (crushing), scope (global). The insurers, however, judged the pandemic risk as less uncertain, assessing it to have a medium degree of uncertainty, while the investor group judged it be highly uncertain.

Assessing the top-ranked extreme risk, global temperature change, both groups said the risk has a low degree of uncertainty and crushing impact. But while insurers put the likelihood in a one-to-20-year time frame, investors gave said one-to-100 years. Insurers also scored the risk larger in scope, describing it as “pan-generational” (impacting all future generations) rather than “trans-generational” (impacting one future generation).

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists